Fannie Mae 2003 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2003 Fannie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10 FANNIE MAE 2003 ANNUAL REPORT

payment mortgages were considered too risky. But then we

helped to standardize the 3 to 5 percent down payment loan,

brought it to global capital markets, and made it available

to lenders and communities nationwide. Now low-down

payment loans are commonplace. And we just adopted a new

variance in our underwriting standards that will make the

$500 down payment loan widely available as well.

Our market leadership in mortgage technology also brings

real benefit to the consumer. For example, by standardizing

our automated underwriting technology and making it

available to lenders nationwide, we have cut the typical loan

application approval process down to a few minutes and

cut approximately $1,000 off the loan origination cost. That

$1,000 savings is equivalent to a huge down payment assistance

program. This technology also helps smaller lenders to offer

big-bank mortgage services without the big-bank overhead,

expanding competition in the mortgage industry.

Bringing capital to where it would not go by itself

One of the greatest benefits of America’s secondary mortgage

market is its ability to pull housing capital into underserved

communities. By working with a wide range of lenders

and housing partners, Fannie Mae helps bring low-cost,

consumer-friendly financing to people and places where it

would not go by itself.

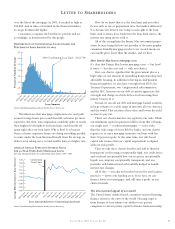

In 1994, we pledged to provide $1 trillion in capital to ten

million underserved families by the end of 2000. Thanks to

our housing and industry partners, we met that goal early.

Then in 2000, we launched our American Dream

Commitment, a pledge to provide $2 trillion in capital to

18 million underserved families by the year 2010, including

$400 billion targeted specifically for minority families (later

raised to $700 billion in response to President Bush’s

Minority Homeownership Initiative).

After four of the strongest years in housing and mortgage

finance history, we’ve already surpassed the top-line goals of

this commitment. But our work is far from complete.

So in January 2004, we announced our Expanded American

Dream Commitment and pledged significant new resources

to tackle America’s toughest housing challenges. Our new

commitment has three main goals.

First, we will expand access to homeownership for six

million first-time home buyers in the next ten years, including

1.8 million minority first-time home buyers. We also will

help raise the national minority homeownership rate from

49 percent to 55 percent, with the ultimate goal of closing

it entirely.

Second, we will help new and long-term homeowners

stay in their homes through a series of initiatives, and

commit $15 billion to preserve affordable rental housing and

$1.5 billion to support the revitalization of public housing

communities.

Third, we will increase the supply of affordable housing

and support community development activities in at least

1,000 neighborhoods across the country through our

American Communities Fund, and through targeted investments

like Low-Income Housing Tax Credits that help finance

affordable rental housing.

It is because of initiatives like our Trillion Dollar

Commitment and our American Dream Commitment that

we have exceeded our HUD affordable housing goals for ten

consecutive years. And we have increased our financing of

mortgages to African Americans by over 400 percent and to

Hispanic Americans by 470 percent in the past ten years,

compared with a 205 percent increase in overall financing.

Our Expanded American Dream Commitment will help us

do even more.

That leads to the last question in this discussion: “Why is

what Fannie Mae does still important?”

Principle V: As the American Dream grows, so do we

Some economists have questioned whether the American Dream

needs to grow anymore. They suggest that our nation is over-

invested in housing. And they ask whether Fannie Mae’s role

in expanding homeownership is needed anymore.

The fact is, the demand for housing capital continues to

grow because this country continues to grow. Based on census

data, we project there will be 30 million more Americans by

the end of the decade, both immigrants and native-born.

Applying headship rates — that is, the rate at which population

creates households — those 30 million Americans will create

13 to 15 million new households that will need a place to

LETTER TO SHAREHOLDERS

Fannie Mae’s disciplined growth approach brings the interests of our shareholders

and the interests of home buyers into perfect alignment. By growing our earnings and

providing you with a good return, we can grow our capital — which allows us to grow

our business and bring the benefits of the secondary market to more families.