Fannie Mae 2003 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2003 Fannie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SHAREHOLDER VALUE

13

FANNIE MAE 2003 ANNUAL REPORT

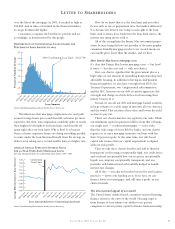

Our core net interest income has grown at an annualized rate

of 15.3 percent during the past decade. In 2003, core net

interest income grew by almost 20 percent to $10.5 billion.

This increase was driven by a five basis point increase in

Fannie Mae’s net interest margin to 1.20 percent and a rise in

the company’s average net investment balance.

The Drivers of Our Core Business Earnings*

Our guaranty fee income has grown at an annualized rate of

9.6 percent during the past decade. In 2003, guaranty fee

income rose 32.8 percent to $2.4 billion. The increase was

driven by a rise in the average effective guaranty rate and

significant growth in average outstanding MBS. In 2003,

Fannie Mae’s average effective guaranty fee rate was

20.2 basis points.

Credit-related losses remained at historically low levels in 2003,

as interest rates remained low and U.S. economic growth

improved. Losses in 2003 totaled $123 million, nearly

one-half the total 10 years earlier thanks to the strength of

the housing market, our efficient loss mitigation process,

and extensive use of credit enhancements to share credit risk.

As a percentage of the average mortgage credit book of

business, credit-related losses were 0.6 basis points in 2003.

*Our core business measures are non-GAAP (generally accepted accounting principles) financial measures

we use to evaluate our performance. See “Management’s Discussion and Analysis of Financial Condition

and Results of Operations — Core Business Earnings and Business Segment Results” in the Form 10-K

included in this report for more information about these measures.