Fannie Mae 2003 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2003 Fannie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

THOMAS E. DONILON

Executive Vice President –

Law and Policy and Secretary

to the Board of Directors

DANIEL H. MUDD

Vice Chairman and

Chief Operating Officer

TIMOTHY HOWARD

Vice Chairman and

Chief Financial Officer

can be found in how the company responds when it makes a

mistake. In late 2003, we discovered a series of computational

errors in our application of new accounting rules for mortgage

purchase commitments found in our October quarterly earnings

press release. Once we discovered the mistake, we promptly

announced and corrected it. We are certainly not happy that

the errors occurred, but I am proud of the way we handled the

situation. Fannie Mae strives to make our accounting systems

100 percent error free and we continuously review and

update our processes and procedures so that we can meet and

exceed the high standards of transparency and accuracy that

our investors expect and deserve.

❋ ❋ ❋

So that’s who we are: a private company with a public

mission of expanding opportunities for homeownership and

affordable housing — one that takes our mission and high

standards of integrity very seriously. Which leads to the second

question to be addressed: What does Fannie Mae do?

Principle II: Fannie Mae creates a market-based

housing finance system

The second principle of Fannie Mae is that we help create a

market-based, consumer-oriented housing finance system. This

system arose as an alternative to the bank-based system that

existed before our creation, and which still exists in most

countries around the world.

Some historical background is in order.

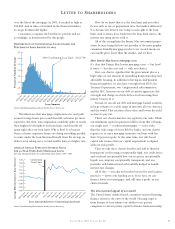

Why the secondary mortgage market was created

In the mortgage market of the 1930s, most families borrowed

from their local savings and loan to buy their homes. Lending

institutions relied on bank deposits to fund mortgage lending.

Loan terms were less than ten years and at the end of

the term, a big balloon payment would come due that included

the entire remaining principal owed. When the Great

Depression hit, more than 1.5 million families lost their

homes — even though many never missed a mortgage payment.

LETTER TO SHAREHOLDERS