Fannie Mae 2003 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2003 Fannie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9

FANNIE MAE 2003 ANNUAL REPORT

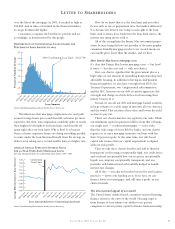

Those pre-tax core business earnings go to three places.

In 2003, for example, about 25 percent went to taxes. Over

56 percent went to increase our capital base. And the remaining

18 percent went to shareholders as dividends.

Some people look at our books and say our business

and results are much more complicated than that.

But it is not the business and the results that are

complicated. It is the accounting that is complicated.

Under new financial accounting standards such as Financial

Accounting Standard (“FAS”) No. 133 and Financial

Accounting Standard No. 149, we have to assign a mark-to-

market value to certain aspects of our business, but not oth-

ers. This leads to large unrealized gains and losses in reported

GAAP results.

The result as you can see above is to add unrealized

volatility to our reported earnings. But that volatility still

averages out over time to equal our core business earnings.

Disciplined growth

Fannie Mae places a high premium on strong and consistent

financial performance under all market conditions. The fact

that we have been able to deliver strong results in both of

the past two years, despite a soft economy and historic levels

of interest rate volatility is a testament to our disciplined

growth model.

Fannie Mae’s disciplined growth approach brings the

interests of our shareholders and the interests of home buyers

into perfect alignment. By growing our earnings and providing

you with a good return, we can grow our capital — which

allows us to grow our business and bring the benefits of the

secondary market to more families.

Our disciplined approach to growth also means that we

respond to market conditions. When mortgages are attractively

priced, we speed up our portfolio acquisitions, either buying

whole loans or MBS. When the market does not offer the

return we seek — such as when high investor demand drives

up mortgage prices — we may slow our portfolio growth.

However, slower portfolio growth means faster growth in our

outstanding MBS owned by others. This, too, delivers a steady

flow of funds to the primary mortgage market and contributes

to the growth of our overall book of business.

To strengthen our financial discipline even more, in July

2003 we announced a new series of objectives. They are:

(1) to maintain a stand-alone “risk-to-the-government” credit

rating from Standard & Poor’s of at least AA-, and a

stand-alone “bank financial strength” credit rating from

Moody’s of at least A-, on a scale in which A is the highest;

(2) to sufficiently capitalize and hedge our mortgage portfolio

and credit guaranty business so that each is able to

withstand internal or external “stress tests” set to at least

AA/Aa standard; and,

(3) to keep our mortgage prepayment and credit risk low

enough that over time our core business earnings are less

variable than the median of all AA/Aa and AAA/Aaa

companies in the S&P 500.

In addition, in our portfolio investment business, we

established a tighter portfolio duration gap policy between our

assets and liabilities of plus or minus six months substantially

all of the time (previously, it was two-thirds of the time). During

one of the most volatile interest rate movements in history,

our portfolio’s duration gap remained within the target

range throughout the year.

Principle IV: We lead the market in our mission

and our business

Having explained who we are, what we do, and how we do it,

it is fair to ask, “What are the end results of our efforts?”

We expect you, our investors, to receive a fair — and in

most years very attractive — return for entrusting us with

your capital.

The individual homeowner receives lower mortgage costs

(as discussed earlier) but also more consumer-friendly

mortgage choices.

Ten years ago, for example, the typical conforming mortgage

required a down payment of 10 to 20 percent, and low-down

LETTER TO SHAREHOLDERS

*Excludes certain effects of FAS 133.See “Management’s Discussion and Analysis of Financial Condition

and Results of Operations — Core Business Earnings and Business Segment Results” in the Form 10-K

included in this report.