Family Dollar 2012 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2012 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

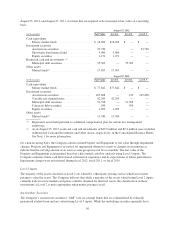

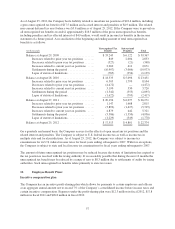

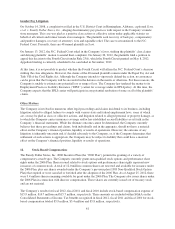

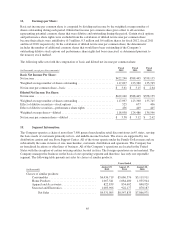

As of August 25, 2012, the Company had a liability related to uncertain tax positions of $22.4 million, including

a gross unrecognized tax benefit of $17.5 million and accrued interest and penalties of $4.9 million. The related

non-current deferred tax asset balance was $5.8 million as of August 25, 2012. If the Company were to prevail on

all unrecognized tax benefits recorded, approximately $16.5 million of the gross unrecognized tax benefits,

including penalties and tax effected interest of $4.9 million, would result in income tax benefits in the income

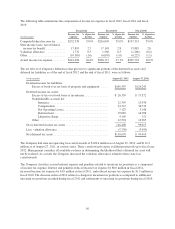

statement of a future period. A reconciliation of the beginning and ending amount of total unrecognized tax

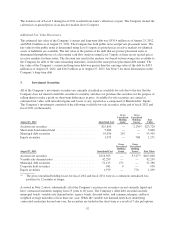

benefits is as follows:

(in thousands)

Unrecognized Tax

Benefit

Interest and

Penalties Total

Balance at August 29, 2009 ........................ $33,245 $ 6,122 $ 39,367

Increases related to prior year tax positions ....... 849 2,004 2,853

Decreases related to prior year tax positions ....... (327) (21) (348)

Increases related to current year tax positions ..... 2,260 411 2,671

Settlements during the period .................. (16,907) (3,066) (19,973)

Lapse of statute of limitations .................. (785) (354) (1,139)

Balance at August 28, 2010 ........................ $18,335 $ 5,096 $ 23,431

Increases related to prior year tax positions ....... 6,305 1,799 8,104

Decreases related to prior year tax positions ....... (4,472) — (4,472)

Increases related to current year tax positions ..... 3,190 530 3,720

Settlements during the period .................. (1,542) (553) (2,095)

Lapse of statute of limitations .................. (1,622) (795) (2,417)

Balance at August 27, 2011 ........................ $20,194 $ 6,077 $ 26,271

Increases related to prior year tax positions ....... 1,147 1,668 2,815

Decreases related to prior year tax positions ....... (3,892) (1,427) (5,319)

Increases related to current year tax positions ..... 4,879 442 5,321

Settlements during the period .................. (3,586) (1,350) (4,936)

Lapse of statute of limitations .................. (1,229) (549) (1,778)

Balance at August 25, 2012 ........................ $17,513 $ 4,861 $ 22,374

On a quarterly and annual basis, the Company accrues for the effects of open uncertain tax positions and the

related interest and penalties. The Company is subject to U.S. federal income tax as well as income tax in

multiple state and local jurisdictions. As of August 25, 2012, the Company was subject to income tax

examinations for its U.S. federal income taxes for fiscal years ending subsequent to 2007. With few exceptions,

the Company is subject to state and local income tax examinations for fiscal years ending subsequent to 2007.

The amount of future unrecognized tax positions may be reduced because the statute of limitations has expired or

the tax position is resolved with the taxing authority. It is reasonably possible that during the next 12 months the

unrecognized tax benefit may be reduced by a range of zero to $8.3 million due to settlements of audits by taxing

authorities. Such unrecognized tax benefits relate primarily to state tax issues.

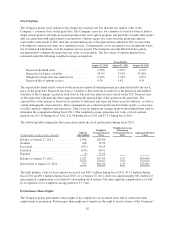

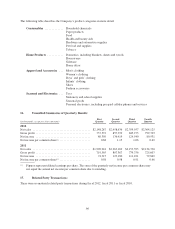

10. Employee Benefit Plans:

Incentive compensation plan

The Company has an incentive profit-sharing plan which allows for payments to certain employees and officers

at an aggregate annual amount not to exceed 7% of the Company’s consolidated income before income taxes and

certain incentive compensation. Expenses under the profit-sharing plan were $12.3 million in fiscal 2012, $17.8

million in fiscal 2011 and $28.8 million in fiscal 2010.

57