Dow Chemical 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Dow Chemical annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Buig Vue.

Deg Gr.

2012 Annual Report

Table of contents

-

Page 1

Bui De g V g Gr ue. . 2012 Annual Report -

Page 2

... Dow well to accelerate the Company's performance and deliver growth for another 115 years and beyond. Contents 1 2 6 8 10 12 14 16 18 20 22 24 Financial Highlights Chairman's Letter to Stockholders 2012 Achievements Executive Committee, Functional Executives, Corporate Officers, Board of Directors... -

Page 3

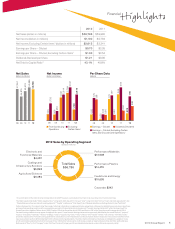

... 2012 Sales by Operating Segment (dollars in millions) Electronic and Functional Materials $4,481 Coatings and Infrastructure Solutions $6,898 Agricultural Sciences $6,382 Performance Materials $13,608 Total Sales $56,786 Performance Plastics $14,479 Feedstocks and Energy $10,695 Corporate... -

Page 4

...I. Ungerleider, Executive Vice President; Joe E. Harlan, Executive Vice President; James R. Fitterling, Executive Vice President; Andrew N. Liveris, President, Chief Executive Officer and Chairman; William H. Weideman, Chief Financial Officer and Executive Vice President 2 The Dow Chemical Company -

Page 5

... prioritizing growth investments. Although we course-correcteb aggressively anb remaineb ï¬rmly on strategy, our results in the calenbar year were clearly not where we wanteb them to be. The substantial cost anb cash savings we beployeb in 2012 bib not make up for a bramatic becline in price power... -

Page 6

... insect trait technology. These growth projects, and others like them, harvest Dow's unique strengths and position us well to capture the beneï¬t of increased earnings and higher margins as market conditions improve. Our major investments on the U.S. Gulf Coast and in the Middle East will continue... -

Page 7

... our downstream businesses. 2009 Price / Equity Earnings Cost Measures $5.5 Margin / Growth Ethylene Cycle $7.5 $8.4 $7.5 Innovation 2010 2011 2012 Near Term Advancing a New Era of Growth Without question, the world is undergoing real and wrenching change. As new market paradigms are... -

Page 8

... including Midland, Michigan, and Freeport, Texas, enables production of its proprietary 2,4-D choline, which is a key component in the new Enlist DuoTM herbicide with Colex-DTM Technology. 2 Quarter Dow Automotive Systems and Ford Motor Company sign a joint development agreement to research the... -

Page 9

... time to the Dow Jones Sustainability World Index as one of the top performers in the global chemical industry. In addition to improving its rating from last year, Dow achieved the highest score in the sector for Environmental Policy Management System. Dow restarts our St. Charles Olefins 2 Plant... -

Page 10

... M. Freiwald, Chief Human Resources Officer and Executive Vice President; Carol A. Williams, Executive Vice President, Manufacturing and Engineering, Supply Chain and Environmental Health and Safety (EH&S) Operations; Heinz Haller, Chief Commercial Officer, President of Dow Europe, Middle East and... -

Page 11

... Financial Reporting, as required by Section 404. The certiï¬cations were ï¬led as exhibits to the Company's Annual Report on Form 10-K for the year ended December 31, 2012, and copies are included herein. In addition, Mr. Liveris certiï¬ed to the New York Stock Exchange (NYSE) on May 17, 2012... -

Page 12

.... In 2012, our strong focus on applying material science expertise and translating customer needs into new, innovative solutions netted 42 new products in Performance Packaging ...a run rate of nearly one new product per week. 10 The Dow Chemical Company -

Page 13

... and the Dow-Mitsui manufacturing joint venture at our operations in Freeport, Texas. These partnerships allow us to develop highly competitive, world-scale production facilities at lower cost and with less capital. In coming years, our investments in the U.S. Gulf Coast and the Middle East will... -

Page 14

... micpobial contpol • Pepfopmance-enhancing solutions fop phapmaceutical, food, enepgy and pepsonal cape end-mapkets 2012 Sales by Business $4,481 Dow Electronic Materials Functional Materials 47% 53% 1 12 The Dow Chemical Company 2 Adjusted EBITDA margin is defined as EBITDA excluding the... -

Page 15

... manufacturing position 2012 Sales by Business $14,479 Dow Performance Packaging 74% Other 2% Agricultural Sciences Normalized Revenue Growth Target EBITDA Margin Target 2012 Adjusted EBITDA Margins1 ROTC2 Value Driver Overview: • Crop protection pipeline ï¬lled with high-value solutions... -

Page 16

... businesses with cost-advantaged feedstocks. Performance Materials Normalized Revenue Growth Target EBITDA Margin Target 2012 Adjusted EBITDA Margins ROTC Value Driver Overview: • Leading industry positions with global reach and access to large, attractive end-markets • Diverse products... -

Page 17

... building products and insulation technologies Dow Building and Construction 26% 38% 14% 22% 2 1 1.5X GDP ~25% 14% Improve 2012 Sales by Business $6,898 Dow Coating Materials Dow Water and Process Solutions Performance Monomers Feedstocks and Energy Normalized Revenue Growth Target EBITDA Margin... -

Page 18

... businesses and industries. • Strong customer orientation: We work closely with stakeholders across the value chain to bring solutions to market that address industry challenges. In 2012, Dow began a long-term alliance with Bend Research Inc., a leading drug formulation and manufacturing company... -

Page 19

... ADVANCEDTM powered by SmartStax® sales accelerate in U.S. corn • Enabling better quality in electronic displays and general lighting - Dow acquires LED phosphor maker Lightscape Materials, Inc. to help customers incorporate advanced phosphors into LED light-based systems 2012 Annual Report 17 -

Page 20

...example, in Performance Plastics, advantaged feedstocks from the U.S. Gulf Coast are expected to contribute approximately $1 billion in additional annual EBITDA by 2017. Industry Operating Rates PRICING POWER 92% 90% 88% 86% 84% 82% 2008 2009 2010 2011 2012 2013 2014 2015 2016 Sonsitivity Factors... -

Page 21

... and Infrastructure Solutions segments. Dow's new, world-scale ethylene production plant at our Dow Texas Operations in Freeport remains on track for a 2017 start-up. Sadara: Positioned to Serve High-Growth Regions and Sectors Progress for Sadara Chemical Company, a joint venture between Dow and... -

Page 22

... Discretionary Spending Reduction $100MM EBITDA Impact $500MM 2013 Target Cash Savings Adjust CapEx Investment to Reflect Near-Term Market Prioritize Projects with Shorter Paybacks Align Capacity Expansions with Global Growth Capital Expenditure Savings $500 $600MM 20 The Dow Chemical Company -

Page 23

... Execute Cost Reduction Program $750MM Accelerate Efficiency for Growth Continuing to focus on operational excellence $0 2012 1H 2013 2H 2013 20142 Cost Measures (Run Rate) Cash Measures (Cumulative) Total Target Market Impact: $1.75B 34% Increase in dividends declared per share in 2012 versus... -

Page 24

.... Injury and Illness Rate (recordable incidents per 200,000 work hours) 2.57 u U.S. Responsible Care® Chemical Company Rate: 0.85 94 05 06 07 08 09 10 11 12 13 14 15 Sustainable Chemistry Goal: Increase percentage of sales to 10 percent for products that are highly advantaged by sustainable... -

Page 25

... how companies can assess, incorporate and invest in nature and the benefits it provides, such as fresh water, clean air and flood protection. In 2012, we completed work at our first pilot site in Freeport, Texas, and published our second annual progress report on dow.com. 2012 Annual Report 23 -

Page 26

... chemical company in the world Mission › To passionately innovate what is essential to human progress by providing sustainable solutions to our customers Corporate Strategy › Preferentially invest in a portfolio of technology-integrated, market-driven performance businesses that create value... -

Page 27

... the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes No The aggregate market value of voting common stock held by non-affiliates as of June 30, 2012 (based upon the closing price of $31.50 per common share as quoted on the New York Stock Exchange), was approximately $37... -

Page 28

..., and Director Independence. Principal Accounting Fees and Services. 144 144 144 144 144 Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. Selected Financial Data. Management's Discussion and Analysis of Financial Condition and Results of... -

Page 29

The Dow Chemical Company and Subsidiaries FORWARD-LOOKING STATEMENTS Certain statements in this report, other than purely historical information, including estimates, projections, statements relating to business plans, objectives, and expected operating results, and the assumptions upon which those ... -

Page 30

...specialty chemicals, advanced materials, agrosciences and plastics businesses delivers a broad range of technology-based products and solutions to customers in approximately 160 countries and in high growth sectors such as electronics, water, energy, coatings and agriculture. In 2012, Dow had annual... -

Page 31

... PRODUCTS ELECTRONIC AND FUNCTIONAL MATERIALS Electronic and Functional Materials develops and markets customized materials using advanced technology and unique chemistries for specialty applications ranging from semiconductors and liquid crystal displays to microbial protection for the oil and gas... -

Page 32

...-Etsu Chemical. Joint Ventures Electronic and Functional Materials includes a portion of the Company's share of the results of Dow Corning Corporation, a joint venture that manufactures silicone and silicone products, which is owned 50 percent by the Company. COATINGS AND INFRASTRUCTURE SOLUTIONS... -

Page 33

... plants; traffic paints and road markings; metal and wood coatings Providing the right, cost effective separation technology for water treatment and filtration; energy (power, oil and gas); pharmaceutical; food and beverage; chemical processing Dow Water and Process Solutions Performance Monomers... -

Page 34

... crop protection and plant biotechnology products, urban pest management solutions and healthy oils. The business invents, develops, manufactures and markets products for use in agriculture, industrial and commercial pest management, and food service. The segment has broad global reach with sales... -

Page 35

... of the year, also consistent with the peak sales period. PERFORMANCE MATERIALS The Performance Materials segment is comprised of eleven market-focused, technology-driven, customer-centric businesses that are advantaged through integration and driven by innovative technology and solutions. Products... -

Page 36

diverse product line that serves customers in a large number of industries, including automotive, consumer, construction, infrastructure, oil and gas, appliance and electronics. Details on Performance Materials' 2012 sales, by business and geographic area, are as follows: Products Major products by... -

Page 37

...as well as chemical divisions of major national and international oil companies. Performance Materials back-integration into feedstocks supports a low-cost manufacturing base and consistent, reliable product supply. Dow is a full-service supplier with a global technical service network located close... -

Page 38

... infrastructure Medical end-use, personal care products Adhesives, flexible packaging for food and beverages; rigid packaging for food, household goods and industrial products; sealants; unitization films; and water, natural gas and irrigation pipe Dow Electrical and Wire and cable... -

Page 39

...-integration into feedstocks. Dow's global scale and feedstock flexibility creates a cost-advantaged foundation for the Company's downstream, marketdriven businesses. In North America, new shale gas opportunities - and the resulting increased supplies and stabilized raw material prices - have made... -

Page 40

...in FLNG. This investment was made in 2004 when the cost of developing oil and gas reserves in the United States was sufficiently high that LNG was a competitive alternative for securing natural gas, an essential raw material and energy source for Dow's operations. Current market conditions favor the... -

Page 41

... 2012, and expects to continue to have adequate supplies of raw materials in 2013. RESEARCH AND DEVELOPMENT The Company is engaged in a continuous program of basic and applied research to develop new products and processes, to improve and refine existing products and processes, and to develop new... -

Page 42

... percent - a development-stage Saudi Arabian company that will manufacture chlorine, ethylene and propylene for internal consumption and will produce and market high-value added chemical products and performance plastics. • The SCG-Dow Group consists of Siam Polyethylene Company Limited - owned 50... -

Page 43

... 1A. Risk Factors; Part II, Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations; and Notes 1 and 14 to the Consolidated Financial Statements. In addition, detailed information on Dow's performance regarding environmental matters and goals can be found online... -

Page 44

... Plastics and Chemicals 2007-2009. Executive Vice President, Health, Agriculture and Infrastructure Group February 2009 to May 2009. Executive Vice President, Performance Systems May 2009 to August 2010. Executive Vice President and Chief Commercial Officer August 2010 to September 2012. Present... -

Page 45

...of financial markets could limit customers' ability to obtain adequate financing to maintain operations, which could result in a decrease in sales volume and have a negative impact on Dow's results of operations. The Company's global business operations also give rise to market risk exposure related... -

Page 46

... the security and safety of chemical production and distribution. These concerns could have a negative impact on the Company's results of operations. Local, state and federal governments continue to propose new regulations related to the security of chemical plant locations and the transportation... -

Page 47

...and a number of other countries. The assets of the Company's funded plans are primarily invested in fixed income and equity securities of U.S. and foreign issuers. Changes in the market value of plan assets, investment returns, discount rates, mortality rates, regulations and the rate of increase in... -

Page 48

PART I, Item 1B. Unresolved Staff Comments. UNRESOLVED STAFF COMMENTS None. The Dow Chemical Company and Subsidiaries 22 -

Page 49

... the major production sites, the Company has plants and holdings in the following geographic areas: United States: Canada: Europe, Middle East and Africa: Latin America: Asia Pacific: 58 manufacturing locations in 22 states. 5 manufacturing locations in 3 provinces. 53 manufacturing locations in... -

Page 50

... and Analysis of Financial Condition and Results of Operations, and Note 14 to the Consolidated Financial Statements. Environmental Matters Following a 2008 Risk Management Program ("RMP") inspection by the Environmental Protection Agency ("EPA") at the Company's Freeport, Texas manufacturing... -

Page 51

PART I, Item 4. Mine Safety Disclosures. MINE SAFETY DISCLOSURES Not applicable. The Dow Chemical Company and Subsidiaries 25 -

Page 52

..., Item 11. Executive Compensation for information relating to the Company's equity compensation plans. There were no purchases of the Company's common stock by the Company during the three months ended December 31, 2012. On February 13, 2013, the Board of Directors approved a share buy-back program... -

Page 53

... dividends declared per share of common stock Book value per share of common stock Year-end Financial Position Total assets Long-term debt Financial Ratios Research and development expenses as percent of net sales Income from continuing operations before income taxes as percent of net sales Return... -

Page 54

...specialty chemicals, advanced materials, agrosciences and plastics businesses delivers a broad range of technology-based products and solutions to customers in approximately 160 countries and in high growth sectors such as electronics, water, energy, coatings and agriculture. In 2012, Dow had annual... -

Page 55

...and a new, world-scale ethylene production facility in Freeport, Texas. Dow's other major feedstock investment - Sadara Chemical Company ("Sadara"), the Company's joint venture with Saudi Arabian Oil Company in the Middle East, also remains on track. Great strides were made during 2012, as front-end... -

Page 56

... financial flexibility in 2012 and enhanced its investment grade ratings. In the fourth quarter of 2012, Moody's upgraded Dow's long-term and short-term debt to Baa2 and P-2 and the Company successfully issued $2.5 billion of new debt with 10- and 30-year tenor at historical low coupons. The Company... -

Page 57

... and Infrastructure Solutions). See Environmental Matters in Management's Discussion and Analysis of Financial Condition and Results of Operations; and Notes 11 and 14 to the Consolidated Financial Statements for additional information concerning these matters. In 2010, gross margin was reduced... -

Page 58

... by $21 million of implementation costs related to the Company's restructuring programs. In 2011, SG&A expenses increased 7 percent from 2010, as selling expenses increased in Electronic and Functional Materials and Agricultural Sciences to support new product launches and commercial activities. 32 -

Page 59

...Financial Statements. Production Costs and Operating Expenses Cost components as a percent of total Hydrocarbon feedstocks and energy Salaries, wages and employee benefits Maintenance Depreciation Restructuring charges Supplies, services and other raw materials Total 2012 37% 13 4 4 3 39 100% 2011... -

Page 60

...near term, resulting in a write-down of assets to fair value. If an asset impairment is recorded at Dow Corning related to the polycrystalline silicon asset group, the potential after tax impact to Dow is estimated to be approximately $700 million. In 2011, equity earnings increased to a new Company... -

Page 61

... Management's Discussion and Analysis of Financial Condition and Results of Operations for additional information regarding debt financing activity. The provision for income taxes was $565 million in 2012, compared with $817 million in 2011 and $481 million in 2010. The Company's effective tax rate... -

Page 62

..., 2011 and 2010. These dividends related to the Company's Cumulative Convertible Perpetual Preferred Stock, Series A ("Series A"). See Note 21 to the Consolidated Financial Statements for additional information. Net income available for common stockholders was $842 million ($0.70 per share) in 2012... -

Page 63

...of certain items recorded in 2012, 2011 and 2010: Certain Items Impacting Results In millions, except per share amounts Cost of sales: Labor-related litigation matter Asset impairments and related costs Warranty accrual adjustment of exited business Restructuring program implementation costs Selling... -

Page 64

... an $8 million charge related to Dow Corning's restructuring and asset abandonment. See Notes 3 and 8 to the Consolidated Financial Statements for additional information on these charges. Dow Electronic Materials sales in 2012 were down 3 percent from 2011, with price down 2 percent and volume... -

Page 65

..., resulting in a write-down of assets to fair value. If an asset impairment is recorded at Dow Corning related to the polycrystalline silicon asset group, the potential after tax impact to Dow is estimated to be approximately $700 million. 2011 Versus 2010 Electronic and Functional Materials sales... -

Page 66

...: Dow Building and Construction, Dow Coating Materials, Dow Water and Process Solutions, and Performance Monomers; and includes a portion of the Company's share of the results of Dow Corning Corporation, a joint venture of the Company. Coatings and Infrastructure Solutions In millions Sales Price... -

Page 67

...exchange resins used in ultrapure water applications and reverse osmosis membranes used in industrial water desalination projects. Performance Monomers sales are also expected to increase driven by improved end-market conditions, especially in coatings and adhesives. Equity earnings from Dow Corning... -

Page 68

... Olefins Company Limited and a portion of the results of Sadara Chemical Company, both joint ventures of the Company. On June 17, 2010, Dow sold Styron to an affiliate of Bain Capital Partners. Businesses and products sold within the Performance Materials segment included Emulsion Polymers (styrene... -

Page 69

... of asset impairment charges and related costs in the Polyurethanes business and a $42 million loss on the sale of a contract manufacturing business. See Notes 3, 5, 9 and 11 to the Consolidated Financial Statements for additional information on these charges. 2011 Versus 2010 Performance Materials... -

Page 70

... Technologies, LLC, as well as a portion of the results of EQUATE Petrochemical Company K.S.C., The Kuwait Olefins Company K.S.C., The SCG-Dow Group and Sadara Chemical Company, all joint ventures of the Company. On June 17, 2010, Dow sold Styron to an affiliate of Bain Capital Partners. Businesses... -

Page 71

... SCG-Dow Group. EBITDA for 2010 included a $7 million net gain related to the divestiture of Styron. See Note 5 to the Consolidated Financial Statements for additional information on this divestiture. Performance Plastics Outlook for 2013 In North America, the increasing supply of U.S. shale gas and... -

Page 72

...merchant sales driven by market conditions and sales to customers located on Dow manufacturing sites. In 2012, Energy business sales declined 23 percent compared with 2011. Volume was down 20 percent with declines in all geographic areas, primarily due to decreased sales of industrial gas. Price was... -

Page 73

...business are primarily opportunistic merchant sales driven by market conditions and sales to customers located on Dow manufacturing sites. The Company uses derivatives of crude oil and natural gas as feedstock in its ethylene facilities. The Company's cost of purchased feedstock and energy increased... -

Page 74

... • Venture Capital; • gains and losses on sales of financial assets; • stock-based compensation expense and severance costs; • asbestos-related defense and resolution costs; • foreign exchange results; • non-business aligned technology licensing and catalyst activities; • environmental... -

Page 75

... plans. Sales Price and Volume by Operating Segment and Geographic Area Pro Forma Comparison 2012 Percent change from prior year Volume Price Total Volume Operating Segments: Electronic and Functional Materials (1)% (2)% (3)% 3% Coatings and Infrastructure 2 (6) (4) (4) Solutions Agricultural... -

Page 76

... Cash provided by (used in): Operating activities Investing activities Financing activities Effect of exchange rate changes on cash Cash assumed in initial consolidation of variable interest entities Net change in cash and cash equivalents $ Cash provided by operating activities increased in 2012... -

Page 77

...plan was $397 million. The Company expects to incur additional costs in the future related to its 1Q12 and 4Q12 restructuring activities, as the Company continually looks for ways to enhance the efficiency and cost effectiveness of its operations, and to ensure competitiveness across its businesses... -

Page 78

... plans. Total equity was also negatively impacted by the Company's restructuring programs and 34 percent increase in dividends declared in 2012. Total Debt at December 31 In millions Notes payable Long-term debt due within one year Long-term debt Gross debt Cash and cash equivalents Marketable... -

Page 79

... consolidated statements of income and reflected in Corporate. During 2012, the Company issued $281 million aggregate principal amount of InterNotes with varying maturities in 2017, 2019 and 2022, and at various interest rates averaging 2.95 percent; and approximately $367 million of long-term debt... -

Page 80

... plant and associated infrastructure in Thailand; and enhancements and capacity increases to phenoxy assets, in support of the ENLISTâ„¢ Weed Control System, in Midland, Michigan. Because the Company designs and builds many of its capital projects in-house, it had no material capital commitments... -

Page 81

...Company's debt and equity securities uses multiple industry-recognized vendors for pricing information and established processes for validation and verification to assist the Company in its process for determining and validating fair values for these assets. For the Company's interests held in trade... -

Page 82

... Preferred Stock, Series A will accrue at the rate of $85 million per quarter, and are payable quarterly subject to Board of Directors' approval. OUTLOOK Dow enters 2013 squarely focused on driving earnings growth, increasing cash flow and rewarding shareholders. The Company's business plans... -

Page 83

... year, Analysis, Research and Planning Corporation ("ARPC") performs a review for Union Carbide based upon historical asbestos claims and resolution activity. Union Carbide compares current asbestos claim and resolution activity to the results of the most recent ARPC study at each balance sheet date... -

Page 84

... assessed at the Company level include, but are not limited to, GDP growth rates, long-term hydrocarbon and energy prices, equity and credit market activity, discount rates, foreign exchange rates and overall financial performance. Qualitative factors assessed at the reporting unit level include... -

Page 85

...in the discounted cash flow analysis for these 9 reporting units included: projected currency exchange rates for 73 currencies; forecasted long-term hydrocarbon and energy prices, by geographic area and by year, which included the Company's key feedstocks as well as natural gas and crude oil (due to... -

Page 86

... and losses is presented in the following table: Increase in Market-Related Asset Value Due to Recognition of Prior Gains and Losses In millions 2013 2014 2015 2016 Total $ $ 321 146 50 135 652 Based on the 2013 pension assumptions, the Company expects net periodic benefit costs to increase by... -

Page 87

... basis point change in the long-term return and discount rate assumptions would have an immaterial impact on the other postretirement benefit expense for 2013. Income Taxes Deferred tax assets and liabilities are determined based on temporary differences between the financial reporting and tax bases... -

Page 88

... with suppliers, customers and joint venture partners. Dow's EH&S policies helped the Company achieve excellent EH&S performance in 2012. Dow's injury/illness rates and process safety performance were excellent in 2012, and the Company is favorably positioned to achieve its 2015 sustainability goals... -

Page 89

... solar power plants, with a total capacity of over 700 megawatts. These plants will provide power for the equivalent of approximately 415,000 homes and save 1.6 million metric tons of GHG emissions per year. Through corporate energy efficiency programs and focused GHG management efforts, the Company... -

Page 90

...Midland site. On April 1, 2009, the Company acquired Rohm and Haas' Philadelphia Plant, which has been an industrial site since the early 1700s, and since the 1920s used by Rohm and Haas for the manufacture of a wide range of chemical products. Chemical disposal practices in the early years resulted... -

Page 91

...'s management, however, that the possibility is remote that costs in excess of the range disclosed will have a material impact on the Company's results of operations, financial condition and cash flows. The amounts charged to income on a pretax basis related to environmental remediation totaled... -

Page 92

...Consolidated Financial Statements. Matters Involving the Formation of K-Dow Petrochemicals Introduction On December 13, 2007, the Company and Petrochemical Industries Company (K.S.C.) ("PIC") of Kuwait, a wholly owned subsidiary of Kuwait Petroleum Corporation, announced plans to form a 50:50 global... -

Page 93

... additional exposures is not material to the Company's results. The global nature of Dow's business requires active participation in the foreign exchange markets. As a result of investments, production facilities and other operations on a global basis, the Company has assets, liabilities and cash... -

Page 94

... such consolidated financial statements present fairly, in all material respects, the financial position of The Dow Chemical Company and subsidiaries as of December 31, 2012 and 2011, and the results of their operations and their cash flows for each of the three years in the period ended December 31... -

Page 95

The Dow Chemical Company and Subsidiaries Consolidated Statements of Income (In millions, except per share amounts) For the years ended December 31 Net Sales Cost of sales Research and development expenses Selling, general and administrative expenses Amortization of intangibles Goodwill ... -

Page 96

Consolidated Statements of Comprehensive Income (Loss) (In millions) For the years ended December 31 The Dow Chemical Company and Subsidiaries Net Income Other Comprehensive Loss, Net of Tax (tax amounts shown below for 2012, 2011, 2010) Unrealized gains (losses) on investments: Unrealized holding... -

Page 97

... other comprehensive loss Unearned ESOP shares Treasury stock at cost (2012: zero shares; 2011: zero shares) The Dow Chemical Company's stockholders' equity Noncontrolling interests Total equity Total Liabilities and Equity See Notes to the Consolidated Financial Statements. $ $ $ $ $ 71 -

Page 98

... Cash used in financing activities Effect of Exchange Rate Changes on Cash Cash Assumed in Initial Consolidation of Variable Interest Entities Summary Increase (Decrease) in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year 2012... -

Page 99

... Dow Chemical Company and Subsidiaries Consolidated Statements of Equity See Notes to the Consolidated Financial Statements. Preferred Stock Balance at beginning of year and end of year Common Stock Balance at beginning of year Common stock issued Balance at end of year Additional Paid-in Capital... -

Page 100

... Affiliates and Related Company Transactions Goodwill and Other Intangible Assets Financial Instruments Fair Value Measurements Supplementary Information Earnings Per Share Calculations Commitments and Contingent Liabilities Transfers of Financial Assets Notes Payable, Long-Term Debt and Available... -

Page 101

.... The Company utilizes derivatives to manage exposures to currency exchange rates, commodity prices and interest rate risk. The fair values of all derivatives are recognized as assets or liabilities at the balance sheet date. Changes in the fair value of these instruments are reported in income or... -

Page 102

... life of the assets. Goodwill and Other Intangible Assets The Company records goodwill when the purchase price of a business acquisition exceeds the estimated fair value of net identified tangible and intangible assets acquired. Goodwill is tested for impairment at the reporting unit level annually... -

Page 103

... and transparency of financial reporting and increases the prominence of items reported in other comprehensive income. See the Consolidated Statements of Comprehensive Income and Note 23 for additional information. On January 1, 2012, the Company adopted ASU 2011-04, "Fair Value Measurement (Topic... -

Page 104

... their financial statements on the basis of IFRS. In January 2013, the FASB issued ASU 2013-01, "Balance Sheet (Topic 210): Clarifying the Scope of Disclosures about Offsetting Asset and Liabilities," which clarifies the scope of the offsetting disclosures of ASU 2011-11. Both ASUs are effective for... -

Page 105

... Impairment of Long-Lived Assets, Other Assets and Equity Method Investments $ 43 16 178 19 7 313 $ 576 In millions Electronic and Functional Materials Coatings and Infrastructure Solutions Performance Materials Performance Plastics Feedstocks and Energy Corporate Total Costs Associated with Exit... -

Page 106

... the Performance Plastics segment. Certain Building and Construction manufacturing assets in Midland, Michigan were shut down in the fourth quarter of 2012. As a result, an asset write-down of $9 million was recorded against the Coatings and Infrastructure Solutions segment. Formulated Systems... -

Page 107

... statements of income and reflected in the Company's segment results as shown in the following table. 1Q12 Restructuring Charges by Operating Segment In millions Electronic and Functional Materials Coatings and Infrastructure Solutions Performance Materials Corporate Total 1Q12 Restructuring... -

Page 108

... incur additional employee-related costs, including involuntary termination benefits, related to its other optimization activities. These costs cannot be reasonably estimated at this time. 2010 Adjustments to 2009 and 2008 Restructuring Plans In 2010, the Company recorded additional charges related... -

Page 109

... as "Cost of sales" in the consolidated statements of income and was reflected in Corporate. Severance payments of $7 million were made in the first half of 2011, bringing the program to a close. Restructuring Reserve Assumed from Rohm and Haas In millions Reserve balance at December 31, 2009 Cash... -

Page 110

..., recorded in "Sundry income (expense) - net" in the consolidated statements of income and reflected in Corporate. The Company continued to hold a 6.5 percent equity interest at December 31, 2012. Divestitures Required as a Condition to the Acquisition of Rohm and Haas On July 31, 2009, the Company... -

Page 111

...016 million in 2011 and $668 million in 2010. At December 31, 2012 and December 31, 2011, the Company's investment in Dow Corning was $227 million less than the Company's proportionate share of Dow Corning's underlying net assets. This amount is considered a permanent difference related to the other... -

Page 112

... to increase their share capital. Pursuant to this approval, Dow's $905 million of development costs related to Sadara, which were previously classified as "Noncurrent receivables" in the Company's consolidated balance sheets, were converted to equity and are now classified as "Investments in... -

Page 113

... charges. The summarized financial information that follows represents the combined accounts (at 100 percent) of the principal nonconsolidated affiliates. Summarized Balance Sheet Information at December 31 In millions 2012 (1) Current assets $ 8,841 Noncurrent assets 20,109 Total assets $ 28,950... -

Page 114

... for the years ended December 31, 2012 and 2011, by operating segment: Goodwill In millions Gross goodwill at Jan 1, 2011 Accumulated impairments at Jan 1, 2011 Net goodwill at Jan 1, 2011 Acquisition of seed company Sale of a Dow Automotive Systems product line Electronic and Functional Materials... -

Page 115

... assessed for the Company included, but were not limited to, GDP growth rates, long-term hydrocarbon and energy prices, equity and credit market activity, discount rates, foreign exchange rates and overall financial performance. Qualitative factors assessed for each of the reporting units included... -

Page 116

... Expense for Next Five Years In millions 2013 2014 2015 2016 2017 $ $ $ $ $ 533 511 493 483 449 NOTE 10 - FINANCIAL INSTRUMENTS Investments The Company's investments in marketable securities are primarily classified as available-for-sale securities. Investing Results In millions Proceeds from... -

Page 117

...). Due to the nature of these investments, the fair market value is not readily determinable. These investments are reviewed quarterly for impairment indicators. The Company's impairment analysis resulted in a $3 million reduction in the cost basis of these investments for the year ended December 31... -

Page 118

...with risk management activities are not expected to be material in 2013. The Company revises its strategies as market conditions dictate and management reviews its overall financial strategies and the impacts from using derivatives in its risk management program with the Company's Board of Directors... -

Page 119

... based on changes in the fair value of open contracts at the end of each reporting period. The Company anticipates volatility in AOCI and net income from its cash flow hedges. The amount of volatility varies with the level of derivative activities and market conditions during any period. Gains and... -

Page 120

... of debt discount" in the consolidated statements of income. The short-cut method is used when the criteria are met. At December 31, 2012 and 2011, the Company had no open interest rate swaps designated as fair value hedges of underlying fixed rate debt obligations. Net Foreign Investment Hedges... -

Page 121

... the fair value and gross balance sheet classification of derivative instruments at December 31, 2012 and 2011: Fair Value of Derivative Instruments In millions Balance Sheet Classification Other current assets Other current assets Accounts and notes receivable - Other Other current assets Accounts... -

Page 122

...consolidated balance sheets and held at amortized cost, which approximates fair value. (3) Included in "Accounts and notes receivable - Other" in the consolidated balance sheets. See Note 15 for additional information on transfers of financial assets. (4) The Company's investments in equity and debt... -

Page 123

... using quoted prices in active markets), total fair value is either the price of the most recent trade at the time of the market close or the official close price, as defined by the exchange on which the asset is most actively traded on the last trading day of the period, multiplied by the number of... -

Page 124

... balance sheets in 2012: Basis of Fair Value Measurements on a Nonrecurring Basis In millions 2012 Assets at fair value: Long-lived assets, other assets and equity method Goodwill 2011 Assets at fair value: Long-lived assets, other assets and equity method investments 2010 Assets at fair value... -

Page 125

... Systems reporting unit (part of the Performance Materials segment), which was included in "Goodwill impairment loss" in the consolidated statements of income. See Note 9 for additional information. 2011 Fair Value Measurements on a Nonrecurring Basis After evaluating expected future investments... -

Page 126

... of a joint venture Dividend income Other-net Total sundry income (expense) - net $ $ 2012 - $ 8 81 (123) - - (51) - 1 57 (27) $ 2011 - $ (36) 119 (482) - 33 (53) 21 25 57 (316) $ 2010 27 - 166 (46) (47) - (6) - - 31 125 (1) The 2011 loss on the sale of a contract manufacturing business also... -

Page 127

... the earnings per share calculations for the years ended December 31, 2012 and 2011: Net Income In millions Net income Net (income) loss attributable to noncontrolling interests Net income attributable to The Dow Chemical Company Preferred stock dividends Net income attributable to participating... -

Page 128

... share calculations for the year ended December 31, 2010: Net Income In millions Net income Net income attributable to noncontrolling interests Net income attributable to The Dow Chemical Company Preferred stock dividends Net income available for common stockholders Earnings Per Share Calculations... -

Page 129

... to income on a pretax basis related to environmental remediation totaled $197 million in 2012, $261 million in 2011 and $158 million in 2010. Capital expenditures for environmental protection were $145 million in 2012, $170 million in 2011 and $173 million in 2010. Midland Off-Site Environmental... -

Page 130

... in the total accrued obligation of $733 million). Environmental Matters Summary It is the opinion of the Company's management that the possibility is remote that costs in excess of those disclosed will have a material impact on the Company's results of operations, financial condition or cash flows... -

Page 131

... completed by Analysis, Research & Planning Corporation ("ARPC") in January 2003, Union Carbide increased its December 31, 2002 asbestos-related liability for pending and future claims for the 15-year period ending in 2017 to $2.2 billion, excluding future defense and processing costs. Since then... -

Page 132

.... Summary The amounts recorded by Union Carbide for the asbestos-related liability and related insurance receivable described above were based upon current, known facts. However, future events, such as the number of new claims to be filed and/or received each year, the average cost of disposing of... -

Page 133

...Union Carbide disposing of its asbestos-related claims, including future defense costs, could have a material impact on the Company's results of operations and cash flows for a particular period and on the consolidated financial position of the Company. Synthetic Rubber Industry Matters In 2003, the... -

Page 134

...material adverse impact on the results of operations, financial condition and cash flows of the Company. Purchase Commitments The Company has numerous agreements for the purchase of ethylene-related products globally. The purchase prices are determined primarily on a cost-plus basis. Total purchases... -

Page 135

...(1) The Company recorded a $60 million charge in the fourth quarter of 2011 related to an exited business, included in "Cost of sales" in the consolidated statements of income and reflected in Coatings and Infrastructure Solutions. Asset Retirement Obligations Dow has 188 manufacturing sites in 36... -

Page 136

... no plans or expectations of plans to exit the sites. It is the opinion of the Company's management that the possibility is remote that such conditional asset retirement obligations, when estimable, will have a material impact on the Company's consolidated financial statements based on current costs... -

Page 137

... ended December 31, 2010), which is included in "Interest expense and amortization of debt discount" in the consolidated statements of income. The Company's interests in the conduits are carried at fair value and included in "Accounts and notes receivable - Other" in the consolidated balance sheets... -

Page 138

...$ $ 2012 57 25,828 2,650 $ $ $ 2011 16 $ 28,609 $ 1,737 $ 2010 818 22,866 1,038 (1) Presented in "Operating Activities" in the consolidated statements of cash flows. Following is additional information related to the sale of receivables under these facilities: Trade Accounts Receivable Sold at... -

Page 139

... sold at December 31, 2012 or December 31, 2011. NOTE 16 - NOTES PAYABLE, LONG-TERM DEBT AND AVAILABLE CREDIT FACILITIES Notes Payable at December 31 In millions Notes payable to banks Notes payable to related companies Notes payable trade Total notes payable Year-end average interest rates... -

Page 140

... consolidated statements of income and reflected in Corporate. During 2012, the Company issued $281 million aggregate principal amount of InterNotes with varying maturities in 2017, 2019 and 2022, at various interest rates averaging 2.95 percent; and approximately $367 million of long-term debt was... -

Page 141

...a LIBOR-plus rate or Base Rate as defined in the agreement. At December 31, 2012, the full $170 million credit facility was available to the Company. Financing Activities Related to the Acquisition of Rohm and Haas The fair value of debt assumed from Rohm and Haas on April 1, 2009 was $2,576 million... -

Page 142

... of return for assets held in the Company's other postretirement benefit plan trusts. The discount rates utilized to measure the pension and other postretirement obligations of the U.S. qualified plans are based on the yield on high-quality fixed income investments at the measurement date. Future... -

Page 143

... Assumptions for Other Postretirement Benefits Discount rate Expected long-term rate of return on plan assets Initial health care cost trend rate Ultimate health care cost trend rate Year ultimate trend rate to be reached Benefit Obligations at December 31 2012 2011 3.67% 4.66% - - 7.84% 8.28% 5.00... -

Page 144

...Future Benefit Payments The estimated future benefit payments, reflecting expected future service, as appropriate, are presented in the following table: Estimated Future Benefit Payments at December 31, 2012 In millions 2013 2014 2015 2016 2017 2018 through 2022 Total Defined Benefit Pension Plans... -

Page 145

...and fixed income securities of U.S. and foreign issuers, and may include alternative investments such as real estate, private equity and absolute return strategies. At December 31, 2012, plan assets totaled $17.7 billion and included no Company common stock. At December 31, 2011, plan assets totaled... -

Page 146

...fixed income funds Fixed income derivatives Total fixed income securities Alternative investments: Real estate Private equity Absolute return Total alternative investments Other investments Total pension plan assets at fair value (1) Includes no Company common stock. Quoted Prices in Active Markets... -

Page 147

... stock. For pension or other postretirement benefit plan assets classified as Level 1 measurements (measured using quoted prices in active markets), total fair value is either the price of the most recent trade at the time of the market close or the official close price, as defined by the exchange... -

Page 148

...at fair value for the years ended December 31, 2012 and 2011: Basis of Fair Value Measurements of Other Postretirement Benefit Plan Assets at December 31, 2012 In millions Cash and cash equivalents Equity securities Fixed income securities Total assets at fair value Quoted Prices in Active Markets... -

Page 149

... consolidated balance sheets and "Conversion of note payable to preferred shares of a subsidiary" in the consolidated statements of equity. A fourth joint venture will construct, own and operate a membrane chlor-alkali facility to be located at the Company's Freeport, Texas integrated manufacturing... -

Page 150

... the partners. Terms of the equity option require the Company to purchase the partner's equity investment at a fixed price, after a specified period of time if the partner elects to sell its equity investment. The joint venture provides seed production services to the Company. The Company also holds... -

Page 151

... Risk-free interest rate Expected life of stock options granted during period (years) Life of Employees' Stock Purchase Plan (months) The dividend yield assumption for 2012 was based on a 10 percent/90 percent blend of the Company's current declared dividend as a percentage of the stock price on... -

Page 152

... the market price at exercise and the price paid by the employee to exercise the purchase rights. On February 9, 2012, the Board of Directors authorized The Dow Chemical Company 2012 Employee Stock Purchase Plan (the "2012 ESPP"), which was approved by stockholders at the Company's annual meeting... -

Page 153

...for deferred stock awards Related tax benefit $ $ $ $ $ 2012 33.81 $ 252 $ 93 $ 129 $ 48 $ 2011 37.60 $ 123 $ 46 $ 124 $ 46 $ 2010 27.89 38 14 123 46 (1) Includes the fair value of shares vested in prior years and delivered in the reporting year. Total unrecognized compensation cost related to... -

Page 154

... 31, 2014 January 1, 2011 - December 31, 2013 January 1, 2010 - December 31, 2012 Target Shares Granted (2) 1,205 1,109 875 Grant Date Fair Value (3) $ 34.00 $ 38.07 $ 27.79 (1) No shares were granted under the 2012 Plan during 2012. (2) At the end of the performance period, the actual number of... -

Page 155

... for purchases under the Employees' Stock Purchase Plan, for options exercised and for the release of deferred and restricted stock. The number of new common stock shares issued to employees and non-employee directors under the Company's stock-based compensation programs was 18.7 million in 2012, 12... -

Page 156

... the ratio of the current year's debt service to the sum of the principal and interest payments over the life of the loan. The shares are allocated to Plan participants in accordance with the terms of the Plan. Compensation expense for allocated shares is recorded at the fair value of the shares on... -

Page 157

...quarter of 2011. The valuation allowance was recorded against the deferred tax assets of two Dow entities in Brazil. As a result of the global recession in 2008-2009, coupled with rapidly deteriorating isocyanate industry conditions and increasing local costs, these two entities were in a three-year... -

Page 158

... reinvestment assertions of certain subsidiaries located in Europe and Asia Pacific. It is not practicable to calculate the unrecognized deferred tax liability on undistributed earnings. Total Gross Unrecognized Tax Benefits In millions Balance at January 1 Increases related to positions taken on... -

Page 159

...Examination by Major Tax Jurisdiction at December 31 Jurisdiction Argentina Brazil Canada France Germany Italy The Netherlands Spain Switzerland United Kingdom United States: Federal income tax State and local income tax Earliest Open Year 2012 2011 2006 2005 2008 2007 2008 2008 2010 2009 2006 2002... -

Page 160

...specialty chemicals, advanced materials, agrosciences and plastics businesses delivers a broad range of technology-based products and solutions to customers in approximately 160 countries and in high growth sectors such as electronics, water, energy, coatings and agriculture. In 2012, Dow had annual... -

Page 161

... solutions and healthy oils. The business invents, develops, manufactures and markets products for use in agriculture, industrial and commercial pest management, and food service. Agricultural Sciences consists of two businesses - Crop Protection and Seeds, Traits and Oils. Performance Materials... -

Page 162

...and pursuing new commercial opportunities); Venture Capital; gains and losses on sales of financial assets; stock-based compensation expense and severance costs; asbestos-related defense and resolution costs; foreign exchange results; non-business aligned technology licensing and catalyst activities... -

Page 163

... at market-based prices. Other transfers of products between operating segments are generally valued at cost. See Note 9 for information regarding the goodwill impairment loss. See Note 3 for information regarding restructuring charges. A reconciliation of EBITDA to "Income Before Income Taxes" is... -

Page 164

...amortization of debt discount Income Before Income Taxes $ $ 2012 5,591 2,698 41 1,269 1,665 $ $ 2011 7,785 2,883 40 1,341 3,601 $ $ 2010 7,200 2,962 37 1,473 2,802 The Company operates 188 manufacturing sites in 36 countries. The United States is home to 58 of these sites, representing 50... -

Page 165

... Dow Chemical Company and Subsidiaries Selected Quarterly Financial Data In millions, except per share amounts (Unaudited) 2012 Net sales Cost of sales Gross margin Goodwill impairment loss Restructuring charges Net income (loss) available for common stockholders Earnings (loss) per common share... -

Page 166

The Dow Chemical Company and Subsidiaries PART II ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE. Not applicable. 140 -

Page 167

... of the Company's Disclosure Committee and the Company's management, including the Chief Executive Officer and the Chief Financial Officer, of the effectiveness of the design and operation of the Company's disclosure controls and procedures pursuant to paragraph (b) of Exchange Act Rules... -

Page 168

... opinion. A company's internal control over financial reporting is a process designed by, or under the supervision of, the company's principal executive and principal financial officers, or persons performing similar functions, and effected by the company's board of directors, management, and other... -

Page 169

The Dow Chemical Company and Subsidiaries PART II ITEM 9B. OTHER INFORMATION. None. 143 -

Page 170

...'s Annual Report on Form 10-K for the year ended December 31, 2003. ITEM 11. EXECUTIVE COMPENSATION. Information relating to executive compensation and the Company's equity compensation plans is contained in the definitive Proxy Statement for the Annual Meeting of Stockholders of The Dow Chemical... -

Page 171

...not deemed incorporated by reference into this report. (c) The consolidated financial statements of Dow Corning Corporation and Subsidiaries for the period ended December 31, 2012, were filed with the Company's Annual Report on Form 10-K for the year ended December 31, 2012, pursuant to Rule 3-09 of... -

Page 172

... to fair value the Company's interests held in trade accounts receivable conduits. See Notes 11 and 15 to the Consolidated Financial Statements for further information. 2012 (2) Deductions represent: Notes and accounts receivable written off Reclassification of reserve for cash discounts and returns... -

Page 173

..., thereunto duly authorized. THE DOW CHEMICAL COMPANY By Date /S/ R. C. EDMONDS R. C. Edmonds, Vice President and Controller February 14, 2013 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant... -

Page 174

... report: AGROMEN The following registered service mark of American Chemistry Council appears in this report: Responsible Care The following registered trademark of Monsanto Technology LLC appears in this report: SmartStax, POWERCORE. SmartStax and POWERCORE multi-event technology developed by Dow... -

Page 175

... Statement on Form S-4, File No. 333-88443, filed October 5, 1999. Agreement and Plan of Merger, dated as of July 10, 2008, among The Dow Chemical Company, Ramses Acquisition Corp. and Rohm and Haas Company, incorporated by reference to Exhibit 2.1 to The Dow Chemical Company Current Report... -

Page 176

... for the quarter ended March 31, 2009. The Dow Chemical Company Voluntary Deferred Compensation Plan for Outside Directors (for deferrals made through December 31, 2004), as amended effective as of July 1, 1994, incorporated by reference to Exhibit 10(f) to The Dow Chemical Company Annual Report on... -

Page 177

... Performance Plan, as amended and restated on December 10, 2008, effective as of January 1, 2009, incorporated by reference to Exhibit 10(h) to The Dow Chemical Company Annual Report on Form 10-K for the year ended December 31, 2008. The Dow Chemical Company 1994 Non-Employee Directors' Stock Plan... -

Page 178

...filed on February 14, 2013. Amended and Restated 2003 Non-Employee Directors' Stock Incentive Plan, adopted by the Board of Directors of The Dow Chemical Company on December 10, 2007, incorporated by reference to Exhibit 10(u) to The Dow Chemical Company Annual Report on Form 10-K for the year ended... -

Page 179

... Deferred Compensation Plan for Non-Employee Directors, effective for deferrals after January 1, 2005, as amended and restated on December 10, 2008, effective as of January 1, 2009, incorporated by reference to Exhibit 10(cc) to The Dow Chemical Company Annual Report on Form 10-K for the year ended... -

Page 180

... reference to Exhibit 10.2 to The Dow Chemical Company Current Report on Form 8-K filed on October 27, 2008. Intentionally left blank. Commitment to Close, dated March 9, 2009, among The Dow Chemical Company, Ramses Acquisition Corp. and Rohm and Haas Company, incorporated by reference to Exhibit 10... -

Page 181

... to Exhibit 14 to The Dow Chemical Company Annual Report on Form 10-K for the year ended December 31, 2003. Subsidiaries of The Dow Chemical Company. Consent of Independent Registered Public Accounting Firm. Analysis, Research & Planning Corporation's Consent. Consent of Independent Registered... -

Page 182

... Chemical Company and Subsidiaries Exhibit Index DESCRIPTION EXHIBIT NO. 99.4 99.5 101.INS 101.SCH 101.CAL 101.DEF 101.LAB 101.PRE Guarantee relating to the 6.00% Notes of Rohm and Haas Company, incorporated by reference to Exhibit 99.5 to The Dow Chemical Company Current Report on Form 8-K filed... -

Page 183

The Dow Chemical Company and Subsidiaries EXHIBIT 12.1 Computation of Ratio of Earnings to Fixed Charges and Combined Fixed Charges and Preferred Stock Dividend Requirements For the Years Ended December 31 2011 2010 2009 3,601 $ (1,223) 1,016 (90) 100 - 3,404 $ 1,341 $ 90 - 112 1,543 $ 4,947 $ 3.2... -

Page 184

... with respect to the period covered by this report; 3. Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for... -

Page 185

... with respect to the period covered by this report; 3. Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for... -

Page 186

... Exchange Act of 1934; and 2. the information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. /s/ ANDREW N. LIVERIS Andrew N. Liveris President, Chief Executive Officer and Chairman of the Board February 15, 2013... -

Page 187

... Exchange Act of 1934; and 2. the information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. /s/ WILLIAM H. WEIDEMAN William H. Weideman Executive Vice President and Chief Financial Officer February 15, 2013... -

Page 188

(THIS PAGE INTENTIONALLY LEFT BLANK) 162 -

Page 189

(THIS PAGE INTENTIONALLY LEFT BLANK) 163 -

Page 190

(THIS PAGE INTENTIONALLY LEFT BLANK) 164 -

Page 191

(THIS PAGE INTENTIONALLY LEFT BLANK) 165 -

Page 192

(THIS PAGE INTENTIONALLY LEFT BLANK) 166 -

Page 193

(THIS PAGE INTENTIONALLY LEFT BLANK) 167 -

Page 194

... 150 100 50 50 07 08 09 10 11 12 02 03 04 05 06 07 08 09 10 11 12 Dow Chemical S&P 500 S&P 500 Chemicals Five-Year Cumulative Total Return in $ December 31, 2007 2008 2009 2010 2011 2012 Dow Chemical 100.00 40.80 77.61 97.95 85.08 99.36 S&P 500 100.00 63.06 79.70 91... -

Page 195

... in additional Dow shares. For more information on the Plan, please contact Dow's transfer agent, Computershare (see Transfer Agent and Stockholder Services). Investor Relations The Dow Chemical Company 2030 Dow Center Midland, MI 48674 U.S.A. Telephone: (800) 422 8193 (United States and Canada... -

Page 196

...® SmartStax is a registered trademark of Monsanto Technology LLC. The SmartStax multi-event technology is developed by Dow AgroSciences LLC and Monsanto The Dow Chemical Company Midland, MI 48674 U.S.A. Investor Relations (800) 422 8193 (989) 636 1463 [email protected] www.dow.com/financial Form No. 161...