Dow Chemical 2010 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2010 Dow Chemical annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010 Annual Report 13

STRATEGY-IN-ACTION

Plastics: A Portfolio with Focus

We have executed changes to our Plastics segment that

have resulted in a tighter market focus and superior

financial returns.

We have streamlined our portfolio, moving away from high-

cost commodities toward higher-margin specialties. Our focus

is on high-value-added polymers, such as linear low density

polyethylene (LLDPE), which serve market segments such as

flexible food and specialty packaging, and health and

hygiene. These specialty market segments demand and

reward new technology innovation. And we are bringing

our solutions to regions that are growing rapidly – as

evidenced by a joint venture’s start-up of its Solution

Linear Low Density Polyethylene II train in Thailand.

Strengthening Our Feedstock Advantage

At the same time, we plan to boost our ethane

cracking capability in the United States by up to

30 percent over the next three years, capitalizing on

the region’s affordable and stable natural gas prices.

In addition, we are reviewing joint venture options for

building a natural gas liquids fractionator. Both actions

will further strengthen the competitive advantage of

our higher-margin specialty plastics, Performance and

Advanced Materials segments.

We continue to bolster our integration strength in

cost-effective ways. In December, Dow finalized a joint

venture agreement with Mitsui to construct and operate

a new chlor-alkali facility at Dow’s Freeport, Texas, site.

The 50:50 joint venture will result in a world-scale chlor-

alkali plant that will supply critical building blocks to Dow’s

downstream businesses – at lower cost and with less capital.

Relationships: Partnering for Growth

Overall, our joint ventures delivered $1.1 billion in EBITDA to

Dow in 2010, representing a 54 percent increase from 2009,

excluding certain items.1 An integral part of our business

model, our joint venture activities have risen markedly in

recent years. For example:

•DowCorning’sequityearningshavegrownbynearly20percent

a year since 2004. This growth is expected to continue as new

silicone capacity comes online in China and as Dow Corning

increases its ability to support key industries such as electronics

and solar through its Hemlock Semiconductor joint venture.

•EQUATEPetrochemicalCompany,whichproducespolyethylene

and ethylene glycol for customers throughout Europe, Middle

East and Asia, is benefiting from recent expansions that nearly

doubled production capacity.

•DowKokambrokegroundonitsMidlandBatteryParkfacility

in June 2010. The plant, which will manufacture 600,000

watt-hours of advanced lithium ion batteries for the growing

plug-in hybrid and electrical vehicle business, is on target for

start-up in first quarter 2012. Already revenue positive, the joint

venture also began commercial production at a new facility

in France, to produce battery systems to power 15,000 fully

electric vehicles annually.

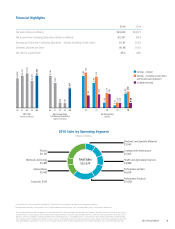

2010 Dow Proportionate Share of All Principal JV Sales* by Geography

North America

24%

Europe, Middle East

and Africa

28%

Asia Pacific

41%

Latin America

7%

Equity Earnings from Nonconsolidated Affiliates

($ in millions)

05

$964

06

$959

07

$1,122

08

$787

09

$630

10

$1,112

+

1 See supplemental information on www.dow.com/financial for a description of these items.

* Adjusted Net Sales is equal to Net Sales for these joint ventures less sales to Dow and/or

to other Dow joint ventures.