Dow Chemical 2010 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2010 Dow Chemical annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278

|

|

The Dow Chemical Company

12

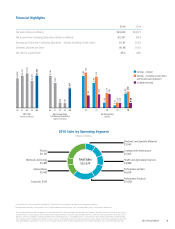

Reshaped: More Technology-Rich Businesses

Dow’s new portfolio is preferentially tilted toward specialty

chemical, advanced material and agroscience businesses. These

technology-rich platforms are already delivering higher margins

and earnings growth. Since 2009, Dow’s gross margin has

improved from 13 percent to approximately 15 percent. In

addition, the Company more than doubled its annual EBITDA

run-rate performance since the first quarter of 2009 to nearly

$2 billion in the fourth quarter of 2010.

Advanced Materials and Health and Agricultural Sciences,

which serve customers in electronics, health care, agriculture,

infrastructure and other fast-growing end-markets, are leading

Dow’s growth. Growth in the Performance division is driven by

our systems-and-solutions approach to customers, an improving

economy and strong sales in fast-growing end-markets such as

wind energy applications. Together, these segments accounted

for sales of $33 billion in 2010.

Meanwhile, our Chemicals and Energy segment continues to

bolster its integration strength, fueling downstream growth in

our market-driven and performance businesses. And our Plastics

segment – prized for strong back-integration into feedstocks,

economies of scale, as well as technology and brand leadership –

represents the strongest franchise in the industry.

Reinvigorated: Delivering on Our Commitments

We have actively reshaped Dow through aggressive portfolio

management. In less than two years, we have divested more

than $5 billion in non-strategic businesses – exceeding our

2009 –2010 targets. In 2010, we:

•Surpassedourgoalofdivesting$2billioninnon-strategic

assets, fueled in large part by our sale of Styron to Bain Capital

for $1.6 billion. These actions allowed us to reduce debt

while freeing capital for investment in our higher-growth,

higher-margin businesses.

•Maintainedanaggressivefocustodeliveragainstrestructuring

and acquisition-related synergy targets, delivering $2.4 billion

in cost savings… ahead of schedule.

•Continuedtomanageourbalancesheet,evidencedbythefact

that our net debt to total capital ratio reached 42.6 percent by

year-end. This was driven in part by more than $4 billion of cash

from operating activities.

THE RIGHT PORTFOLIO

Dow has reshaped and repositioned its portfolio to take on the complex realities

of today and tomorrow. We have reorganized our businesses around customers

and global market needs. We have preferentially invested in higher-growth and

technology-rich businesses, while preserving our unique integration advantage.

And we have exited businesses that no longer meet our strategic vision. As a result,

we have a diverse portfolio of leading businesses that are capable of creating

growth for our customers and long-term value for our stockholders.

Through cross-selling opportunities, new business and

new solutions, we have captured significant growth

synergies since our 2009 acquisition of Rohm and Haas.

Already, we have realized more than $1 billion revenue in

growth synergies on an annual run-rate basis, exceeding our

2010 target by more than $500 million – and we are rapidly

accelerating toward our 2012 target of $2 billion.

+