Dow Chemical 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Dow Chemical annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Dow Chemical Company

2010 Annual Report

The Right Formula for Growth

Table of contents

-

Page 1

The Right Formula for Growth The Dow Chemical Company 2010 Annual Report -

Page 2

...molecular level, Dow is changing the world around us - pioneering new products and addressing the megatrends facing humankind. This strategy has fueled the transformation of our Company. Creating new markets for our products. New solutions for our customers. And increasing value for our stockholders... -

Page 3

... and Corporate Ofï¬cers Corporate Governance and Board of Directors The Right Formula for Growth The Right Portfolio The Right Pipeline The Right Geographic Presence The Right Investments in People and the Planet Vision, Mission and Strategy Form 10-K for the Year Ended December 31, 2010 (with... -

Page 4

... L. Eddlemon Counsel, U.S. Operations Legal Plaquemine, Louisiana Global Market Manager, Industrial Processes Dow Water & Process Solutions Schwalbach, Germany Sandeep S. Dhingra Global R&D Director, Analytical Sciences Core R&D Midland, Michigan 2 The Dow Chemical Company Mónica Aravena Selman... -

Page 5

... total debt ("Notes payable" plus "Long-term debt due within one year" plus "Long-term debt") minus "Cash and cash equivalents." The forward-looking statements contained in this document involve risks and uncertainties that may affect the Company´s operations, markets, products, services, prices... -

Page 6

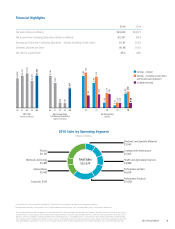

...16 billion in revenues for the ï¬rst time in our Company's history. Sales in Asia Paciï¬c topped $9 billion in the year, also representing an all-time record. And this is only the beginning: we made investments in Thailand, China, Vietnam, Korea and elsewhere in this exciting growth region. And we... -

Page 7

... approach to reliable operations, productivity and cost reductions, while prudently investing in growth. Financially, we remain committed to driving our net debt to total capital ratio down to less than 40 percent by the end of 2012. And ï¬nally, we will continue advocating globally for policies... -

Page 8

... UCAR Emulsion Systems specialty latex business in North America to Arkema. The Company surpasses its full-year growth synergy target related to the acquisition of Rohm and Haas, delivering $530 million in sales on an annual run-rate basis. Dow successfully completes a two-year, multimillion-dollar... -

Page 9

... sheet, reaching a net debt to total capitalization ratio of 42.6 percent by year-end. Dow announces that its largest manufacturing facility in Brazil, the Aratu Complex, will add biomass to its portfolio of clean energy sources by the end of 2012. Dow partners with the International Union of Pure... -

Page 10

... Executive Vice President and Chief Commercial Ofï¬cer Geoffery E. Merszei Executive Vice President of The Dow Chemical Company; President of Dow Europe, Middle East and Africa; and Chairman of Dow Europe Ronald C. Edmonds Vice President and Controller Gregory T. Grocholski Corporate Auditor... -

Page 11

... to the Company's Annual Report on Form 10-K for the year ended December 31, 2010, and copies are included herein. In addition, Mr. Liveris certiï¬ed to the New York Stock Exchange (NYSE) on May 27, 2010, that he was unaware of any violations by the Company of the NYSE corporate governance listing... -

Page 12

... we are creating opportunities in new places with new customers by expanding our reach in emerging markets. u Through the right growth pipeline, we are creating new products for new markets by aligning our substantial research and development investments to address critical global issues. u With the... -

Page 13

...our goal to divest $5 billion in non-strategic assets over the last several years. And we reduced our net debt to capital ratio to 42.6 percent. Moving forward, we will maintain our vigilant approach to cost productivity, while prudently investing in growth. Sustainability Leadership Our innovation... -

Page 14

... net debt to total capital ratio reached 42.6 percent by year-end. This was driven in part by more than $4 billion of cash from operating activities. Reshaped: More Technology-Rich Businesses Dow's new portfolio is preferentially tilted toward specialty chemical, advanced material and agroscience... -

Page 15

... plant that will supply critical building blocks to Dow's downstream businesses - at lower cost and with less capital. STRATEGY-IN-ACTION Plastics: A Portfolio with Focus We have executed changes to our Plastics segment that have resulted in a tighter market focus and superior financial returns... -

Page 16

... Infrastructure Industry-leading businesses focused on building solutions, construction chemicals, coating materials, and adhesives and functional polymers STRENGTHS & STRATEGY Health and Agricultural Sciences A global leader with high-value products in plant biotechnology, agricultural chemicals... -

Page 17

... management •฀฀ Launched฀lead-฀and฀phthalate-free฀Dow฀ ECOLIBRIUM™ Bio-Based Plasticizers for wire and cable applications •฀฀ Increased฀elastomer฀capacity฀through฀ breakthrough technology; constructing a new specialty elastomers plant in Thailand Performance Products... -

Page 18

... to shape the future. Dow's R&D investments are strategically aligned to megatrends that represent $350 billion in addressable market opportunities with growth rates of between 1.3 and 3 times GDP. Managing for Results Our commitment to innovation has never wavered. In 2010, despite a sluggish... -

Page 19

... infusion rate and make it perfect for the efficient manufacture of wind turbine blades. Two demanding industries. Two critical market needs. One promising material used to create high-margin, revolutionary customer solutions. This is the power of technology integration. This is the power of one Dow... -

Page 20

...-average growth rates of up to three times global GDP. By aligning our R&D investments to these very real growth drivers, we are delivering practical solutions for clean water, affordable energy and increased food resources, while creating new earnings streams for Dow. Health and Nutrition Market... -

Page 21

... care solutions and biodegradable surface cleaners. High-quality LED precursor materials: Dow is a leading supplier of precursors such as TMG to the LED market and has patented precursor manufacturing processes and delivery technology. In 2010, the Company announced plans to increase production... -

Page 22

... product portfolios to support our customers' businesses - and the demands of new middle-class consumers. Projected 2012 2010 Sales by Geography North America Europe, Middle East and Africa Asia Pacific Latin America 36% 34% 18% 12% Our investments in 2010 included: •฀฀ The฀start... -

Page 23

... in employee management and development. GEOGRAPHIC PRESENCE - CHINA Dow in China: Innovating for Growth At the Shanghai Dow Center, Dow researchers and customers are working side-by-side to turn market opportunities into profitable solutions. The R&D facility's unique Customer Innovation Center... -

Page 24

... partners and customers on site - integrating material flows and logistics while reducing fixed assets and operating capital 22 The Dow Chemical Company •฀฀ Announced in 2009, Dow's R&D Center at the King Abdullah University of Science and Technology will focus initially on water, oil and gas... -

Page 25

... and growth of middle class is boosting sales in coatings, insulation products and adhesives; robust automotive production) DOW SOLUTIONS AT WORK •฀฀ Energy (innovations in solar and nextgeneration energy storage technology) •฀฀ Health and Nutrition (investments in branded seeds and new... -

Page 26

... home energy-efficiency retrofit solutions. Responsible Operations •฀In฀2010,฀Dow฀received฀the฀National฀ Safety Council's prestigious Robert W. Campbell Award. This international award recognizes a company that upholds Environment, Health and Safety (EH&S) as a key business value... -

Page 27

...฀named฀a฀lead฀industrial฀partner฀to฀the฀U.S./China฀ Cleaner Energy Resource Center for Building Energy Efficiency, which will conduct research to save energy and cut costs in buildings. •฀฀ Our฀capital฀investments฀in฀WaterHealth฀International฀impact฀ the lives... -

Page 28

...our products. At the end of 2010, Dow had posted 330 PSAs to the Product Safety page on www.dow.com. Sustainable Chemistry GOAL: Double the percentage of sales to 10 percent for products that are highly advantaged by sustainable chemistry The percentage of sales from products with highly advantaged... -

Page 29

... progress in addressing global challenges. For example, Dow is providing seeds that increase crop productivity and natural insecticides that control crop-damaging insects. Through our building science solutions, we are helping improve energy efficiency in commercial and residential buildings. On the... -

Page 30

... science-driven chemical company in the world MISSION To passionately innovate what is essential to human progress by providing sustainable solutions to our customers STRATEGY Preferentially invest in a portfolio of technology-integrated, market-driven performance businesses that create value... -

Page 31

...(Customer Service Center) (989) 636 1000 (Dow Operator/Switchboard) Investor Relations The Dow Chemical Company 2030 Dow Center Midland, MI 48674 U.S.A. Telephone: (800) 422 8193 (United States and Canada) (989) 636 1463 Fax: (989) 636 1830 Ofï¬ce of the Corporate Secretary The Dow Chemical Company... -

Page 32

... 30, 2010 (based upon the closing price of $23.72 per common share as quoted on the New York Stock Exchange), was approximately $27.4 billion. For purposes of this computation, it is assumed that the shares of voting stock held by Directors, Officers and the Dow Employees' Pension Plan Trust would... -

Page 33

Table of Contents The Dow Chemical Company ANNUAL REPORT ON FORM 10-K For the fiscal year ended December 31, 2010 TABLE OF CONTENTS PAGE PART I Item 1. Business. Risk Factors. Unresolved Staff Comments. Properties. Legal Proceedings. 3 Item 1T. 18 21 22 23 24 Item 1B. Item 2. Item 3. Item 4.... -

Page 34

... chemical, advanced materials, agrosciences and plastics businesses deliver a broad range of technology-based products and solutions to customers in approximately 160 countries and in high growth sectors such as electronics, water, energy, coatings and agriculture. In 2010, Dow had annual sales... -

Page 35

..., food, home and personal care, water and energy production, and industrial specialty industries. These technology capabilities and market platforms enable the businesses to develop innovative solutions that address modern societal needs for sufficient and clean water, air and energy, material... -

Page 36

...the energy efficiency in homes and buildings today, while also addressing the industry's emerging needs and demands. Dow Construction Chemicals provides solutions for increased durability, greater water resistance and lower systems costs. Ts a leader in insulation solutions, the businesses' products... -

Page 37

...-flexible polyurethane foam systems Dow Elastomers offers a unique set of elastomers, specialty films and plastic additive products for customers worldwide. The business is focused on delivering innovative solutions that allow for differentiated participation in multiple industries and applications... -

Page 38

...a definitive agreement to sell Styron to an affiliate of Bain Capital Partners; the transaction closed on June 17, 2010. Businesses and products sold included Synthetic Rubber and certain products from Dow Tutomotive Systems, which were reported in the Performance Systems segment through the date of... -

Page 39

...The Performance Products segment also includes the results of Dow Haltermann, a provider of world-class contract manufacturing services to companies in the fine and specialty chemicals and polymers industries, and STFECHEM, a wholly owned subsidiary that manufactures closedloop systems to manage the... -

Page 40

... The Polypropylene business, a major global polypropylene supplier, provides a broad range of products and solutions tailored to customer needs by leveraging Dow's leading manufacturing and application technology, research and product development expertise, extensive market knowledge and strong... -

Page 41

... the results of The Kuwait Olefins Company K.S.C. and the SCG-Dow Group, joint ventures of the Company. On March 2, 2010, Dow announced the entry into a definitive agreement to sell Styron to an affiliate of Bain Capital Partners; the transaction closed on June 17, 2010. Businesses and products sold... -

Page 42

... business of any operating segment is dependent upon a single customer. No single product accounted for more than 5 percent of the Company's consolidated net sales in 2010. Research and Development The Company is engaged in a continuous program of basic and applied research to develop new products... -

Page 43

... Systems Performance Products Plastics Chemicals and Energy Hydrocarbons Corporate Total U.S. 988 513 573 744 330 215 26 14 Foreign 3,063 2,625 1,882 3,311 1,465 931 106 102 543 14,028 206 3,609 Dow's primary purpose in obtaining patents is to protect the results of its research for use... -

Page 44

...and Export Sales In 2010, the Company derived 67 percent of its sales and had 52 percent of its property investment outside the United States. While the Company's international operations may be subject to a number of additional risks, such as changes in currency exchange rates, the Company does not... -

Page 45

...Tugust 2010 to date. Chairman and Director of Univation Technologies, LLC.* Board member of Chemical Financial Corporation and the Midland Country Club. GREGORY M. FREIWTLD, 57. EXECUTIVE VICE PRESIDENT, HUMTN RESOURCES TND CORPORTTE TFFTIRS, TND TVITTION. Employee of Dow since 1979. Human Resources... -

Page 46

...Chemicals 2007-2009. Executive Vice President, Health, Tgriculture and Infrastructure Group February 2009 to May 2009. Executive Vice President, Performance Systems May 2009 to Tugust 2010. Chief Commercial Officer Tugust 2010 to date. Director of Mycogen Corporation,* Dow Kokam LLC* and Dow Corning... -

Page 47

...Responsibility for Business Services - Customer Service, Information Systems, Purchasing, Six Sigma, Supply Chain 2004 to date. Senior Vice President with added responsibility for EH&S 2006 to date. Chief Sustainability Officer 2007 to date. Executive Vice President 2008 to date. Director of Dorinco... -

Page 48

... date. Director of Dow Corning Corporation,* Diamond Capital Management Inc.,* Dorinco Reinsurance Company* and Liana Limited.* Member of the Dow TgroSciences LLC* Members Committee. Director of the Dow Chemical Employees' Credit Union and Family and Children's Services of Midland. Board and finance... -

Page 49

... in sales volume and have a negative impact on Dow's results of operations. The Company's global business operations also give rise to market risk exposure related to changes in foreign exchange rates, interest rates, commodity prices and other market factors such as equity prices. To manage such... -

Page 50

... the security and safety of chemical production and distribution. These concerns could have a negative impact on the Company's results of operations. Local, state and federal governments continue to propose new regulations related to the security of chemical plant locations and the transportation... -

Page 51

... of operations or the effectiveness of internal control over financial reporting. Beginning in the first quarter of 2011, the Company is implementing a new ERP system that will deliver a new generation of work processes and information systems. ERP implementations are complex and time-consuming... -

Page 52

Table of Contents The Dow Chemical Company and Subsidiaries PART I, Item 1B. Unresolved Staff Comments UNRESOLVED STAFF COMMENTS None. 21 -

Page 53

... of Dow's products. During 2010, the Company's production facilities and plants operated at 83 percent of capacity. The Company's major production sites are as follows: United States: Canada: Germany: France: The ietherlands : Spain: Argentina: Brazil: Plaquemine and Hahnville, Louisiana; Midland... -

Page 54

... subsidiary, Tmchem Products, Inc. It is the opinion of Dow's management that it is reasonably possible that the cost of Union Carbide disposing of its asbestos-related claims, including future defense costs, could have a material adverse impact on the Company's results of operations and cash flows... -

Page 55

Table of Contents The Dow Chemical Company and Subsidiaries PART I, Item 4. Reserved . RESERVED 24 -

Page 56

... The principal market for the Company's common stock is the New York Stock Exchange, traded under the symbol "DOW." Quarterly market and dividend information can be found in Quarterly Statistics at the end of Part II, Item 8. Financial Statements and Supplementary Data. Tt December 31, 2010, there... -

Page 57

...) Year-end Financial Position Total assets Working capital Property - gross Property - net Long-term debt Total debt The Dow Chemical Company's stockholders' equity Financial Ratios Research and development expenses as percent of net sales (2) Income (Loss) from continuing operations before income... -

Page 58

26 -

Page 59

...) Year-end Financial Position Total assets Working capital Property - gross Property - net Long-term debt Total debt The Dow Chemical Company's stockholders' equity Financial Ratios Research and development expenses as percent of net sales (2) Income (Loss) from continuing operations before income... -

Page 60

... for reclassification of insurance operations in 2002. Tdjusted for 3-for-1 stock split in 2000. Stockholders of record as reported by the transfer agent. The Company estimates that there were an additional 554,000 stockholders whose shares were held in nominee names at December 31, 2010. 27 -

Page 61

... products and solutions to customers in approximately 160 countries and in high growth sectors such as electronics, water, energy, coatings and agriculture. In 2010, Dow had annual sales of $53.7 billion. The Company conducts its worldwide operations through global businesses, which are reported... -

Page 62

...support new product launches and commercial activities related to recent seed acquisitions. Finally, the Company delivered $4.1 billion of cash from operating activities, nearly double that of 2009, and surpassed its goal to divest $2 billion in non-strategic assets in 2010. Dow ended the year with... -

Page 63

...of its strategy and delivering on the promise of its new portfolio, as well as investing for growth in businesses tied to fastgrowing geographic areas and end-markets. Tctions taken during 2010 included: • Dow completed the sale of Styron to an affiliate of Bain Capital Partners for $1.6 billion... -

Page 64

... and supply chain work process improvements; and the elimination of redundant corporate overhead for shared services and governance. The integration of Rohm and Haas was substantially complete at December 31, 2010. On July 31, 2009, the Company entered into a definitive agreement for the sale of... -

Page 65

... operating rates. In 2010, gross margin was reduced by a $50 million labor-related litigation matter that was included in "Cost of Sales" and reflected in Corporate, and $91 million in asset impairments and related costs in the Polyurethanes business, the Epoxy business and Dow Tutomotive Systems... -

Page 66

...Systems, $59 million in Performance Products, $16 million in Plastics, $44 million in Chemicals and Energy, and $43 million in Hydrocarbons, with the remaining $9 million in Corporate. In addition, gross margin in 2008 was reduced by legal expenses and other costs of $69 million related to the K-Dow... -

Page 67

...the fourth quarter of 2009, it was determined that goodwill associated with the Dow Haltermann business unit was impaired. The impairment was based on a review performed by management in which discounted cash flows did not support the carrying value of the goodwill. Ts a result, the Company recorded... -

Page 68

...retention costs. These costs were recorded in "Cost of sales," "Research and development expenses," and "Selling, general and administrative expenses" in the consolidated statements of income and reflected in Corporate. The integration of Rohm and Haas was substantially complete at December 31, 2010... -

Page 69

... 1, 2009 acquisition of Rohm and Haas. Interest expense (net of capitalized interest) and amortization of debt discount totaled $1,473 million in 2010, $1,571 million in 2009 and $648 million in 2008. See "Liquidity and Capital Resources" for additional information regarding debt financing activity... -

Page 70

... from the Company's equity company investments are taxed at the joint venture level. The tax rate for 2010 was positively impacted by a high level of equity earnings as a percentage of total earnings, the release of a tax valuation allowance, a tax law change, and improved financial results in... -

Page 71

... Purchased in-process research and development charges Transaction, integration and other acquisition costs Tsbestos-related credits Equity in earnings of nonconsolidated affiliates: Dow Corning restructuring Equipolymers impairment Sundry income - net: Net gain on sale of TRN (4) Gain on sale... -

Page 72

...Transaction and other acquisition costs Gain on sale of 40 percent equity investment in UP Chemical Company Total Rohm and Haas Certain Items Three months ended March 31, 2009 $ (2) (2) (80) Year ended Dec. 31, 2008 $ (29) (199) (54) $(84) 87 $(195) In addition, due to the completion of several... -

Page 73

... and all businesses, reflecting improved economic conditions in the food and nutrition, personal care, water and electronics industries. Prices were flat for the segment, as competitive pricing pressure on more mature products was countered by the introduction of new products with higher margins and... -

Page 74

...reported signs of recovery in the second half of 2009 due to a rebound in electronics demand and re-stocking within the value chain. Specialty Materials sales for 2009 were down 17 percent versus 2008 with volume down 12 percent and prices down 5 percent. Volume declined across all major businesses... -

Page 75

... primarily related to the Company's actions to optimize facilities following the acquisition of Rohm and Haas and an increase in cost of sales of $82 million related to the fair valuation of Rohm and Haas inventories. Compared with 2009, the benefit of higher prices, improved operating rates and... -

Page 76

... and healthy oils. The business invents, develops, manufactures and markets products for use in agriculture, industrial and commercial pest management, and food service. Health and Agricultural Sciences Actual Results In millions Sales EBITDT Health and Agricultural Sciences 2010 Actual Versus 2009... -

Page 77

... costs of purchases made earlier in the year. The commodity product glyphosate accounted for the vast majority of the overall decline in prices compared with 2008. Volume increased as new seed acquisitions and growth in the corn, soybean and sunflower portfolios resulted in 33 percent sales growth... -

Page 78

... had signed a definitive agreement for the sale of Styron to an affiliate of Bain Capital Partners; the transaction closed on June 17, 2010. Businesses and products sold included Synthetic Rubber and certain products from Dow Tutomotive Systems, which were reported in the Performance Systems segment... -

Page 79

... in cost of sales related to the fair valuation of inventories acquired from Rohm and Haas and was favorably impacted $1 million from the sale of the Company's ownership interest in OPTIMTL. Compared with last year, EBITDT improved as volume growth, higher prices, improved operating rates, and... -

Page 80

..., an increase in cost of sales of $22 million related to the fair valuation of Rohm and Haas inventories, and a $7 million charge related to the impairment of goodwill associated with the Dow Haltermann reporting unit. 2009 Versus 2008 (Pro Forma Comparison) Performance Products sales were $9,065... -

Page 81

... Company K.S.C., The Kuwait Olefins Company K.S.C. and the SCG-Dow Group, all joint ventures of the Company. On March 2, 2010, Dow announced the entry into a definitive agreement to sell Styron to an affiliate of Bain Capital Partners; the transaction closed on June 17, 2010. Businesses and products... -

Page 82

...demand increased. Lower natural gas and other feedstock prices in North Tmerica, as well as delays in the startup of new Middle East industry production capacity, resulted in economic conditions that favored the export of North Tmerican production into these geographic areas. Volume in North Tmerica... -

Page 83

... SCG-Dow Group's solutions polyethylene plant in Thailand that came online in the fourth quarter of 2010. Equity earnings from the Company's joint ventures in Kuwait and Univation Technologies, LLC are also expected to improve in 2011. CHEMICALS AND ENERGY The Chemicals and Energy segment includes... -

Page 84

... to customers located on Dow manufacturing sites. Sales fluctuate as the Company balances energy supply and demand at its manufacturing sites; however, the improving economy offered more opportunities for merchant sales in 2010. The Energy business supplies Dow's businesses at net cost, resulting in... -

Page 85

... the results of The Kuwait Olefins Company K.S.C. and the SCG-Dow Group, joint ventures of the Company. On March 2, 2010, Dow announced the entry into a definitive agreement to sell Styron to an affiliate of Bain Capital Partners; the transaction closed on June 17, 2010. Businesses and products sold... -

Page 86

...in selling prices was a result of higher feedstock and energy costs, driven by demand improvements across the industry, while the Company's product supply agreements with Styron led to an increase in trade sales volume compared with 2009. The Company uses derivatives of crude oil and natural gas as... -

Page 87

... Versus 2009 Pro Forma Sales for Corporate, which for 2010 primarily related to the Company's insurance operations, were $343 million in 2010, down from $1,095 million in 2009, which also included the results of Morton International, Inc. ("Morton," the Salt business acquired with the Rohm and Haas... -

Page 88

...Percent change from prior year Volume 2010 Price Total Operating Segments: Electronic and Specialty Materials 19% 19% Coatings and Infrastructure 4 8% 12 Health and Tgricultural Sciences 11 (4) 7 Performance Systems 15 6 21 Performance Products 14 17 31 Plastics 1 27 28 Chemicals and Energy 6 18... -

Page 89

... $660 million), net proceeds from the sale of Morton ($1,576 million) and lower capital expenditures. Cash used in financing activities in 2010 included payments on long-term debt and commercial paper, payments on notes payable related to the monetization of accounts receivable in Europe, and the... -

Page 90

... 31, 2009. Days-sales-in-inventory at December 31, 2010 was 62 days versus 64 days at December 31, 2009. Tt the end of 2009, the Company's net debt as a percent of total capitalization had risen to 48.0 percent, due to increased financing related to the acquisition of Rohm and Haas. Ts shown in... -

Page 91

... depositary shares, debt securities, warrants, stock purchase contracts and stock purchase units with pricing and availability dependent on market conditions; and, on February 19, 2010, registered an unlimited amount of securities for issuance under the Company's U.S. retail medium-term note program... -

Page 92

... credit markets. Financing Activities Related to the Acquisition of Rohm and Haas On Tpril 1, 2009, the Company completed the acquisition of Rohm and Haas. Pursuant to the July 10, 2008 Tgreement and Plan of Merger (the "Merger Tgreement"), Ramses Tcquisition Corp., a direct wholly owned subsidiary... -

Page 93

... the Company's capital expenditures were directed toward additional capacity for new and existing products, compared with 43 percent in 2009 and 40 percent in 2008. In 2010, approximately 17 percent was committed to projects related to environmental protection, safety, loss prevention and industrial... -

Page 94

... in ethylene production at St. Charles, Louisiana; a new centrifugal ethylene compressor in Freeport, Texas to reduce spot purchases of ethylene; and the design and construction of the new Midland Business Process Service Center. Because the Company designs and builds most of its capital projects in... -

Page 95

... in the credit markets, unprecedented lower demand for chemical products and the ongoing global recession. The Company declared dividends of $0.60 per share in 2010, $0.60 per share in 2009 and $1.68 per share in 2008. On December 8, 2010, the Board of Directors declared a quarterly dividend of $85... -

Page 96

... to lead in economic growth and, as a result, were a critical area of focus for new business opportunities and investments. Ts the year came to a close, however, some challenges remained, such as high unemployment in developed geographies and weakness in construction end-markets, particularly in the... -

Page 97

... insurance coverage. The amounts recorded by Union Carbide for the asbestos-related liability and related insurance receivable were based upon current, known facts. However, future events, such as the number of new claims to be filed and/or received each year, the average cost of disposing of each... -

Page 98

... as part of the reporting unit valuation analysis. The discounted cash flow valuations are completed with the use of key assumptions, including projected revenue growth rate, discount rate, tax rate, currency exchange rates, terminal value, and long-term hydrocarbons and energy prices. These key... -

Page 99

...below carrying value. This evaluation process includes the use of third-party market-based valuations and internal discounted cash flow analysis. Ts part of the annual goodwill impairment test, the Company also compares market capitalization with the total estimated fair value of its reporting units... -

Page 100

... are recorded. Over the life of the plan, both gains and losses have been recognized and amortized. Tt December 31, 2010, net losses of $827 million remain to be recognized in the calculation of the market-related value of plan assets. These net losses will result in increases in future pension... -

Page 101

... prior carryback years, the future reversals of existing taxable temporary differences, tax planning strategies and forecasted taxable income using historical and projected future operating results. Tt December 31, 2010, the Company had deferred tax assets for tax loss and tax credit carryforwards... -

Page 102

... in 2010. In recognition, the Company was presented the esteemed National Safety Council's Robert W. Campbell Tward for 2010. Dow's injury/illness rates and process safety performance were excellent in 2010, and the Company is favorably positioned to achieve its 2015 sustainability goals in... -

Page 103

... 415,000 homes and save 1.6 million metric tons of carbon dioxide emissions per year. Gains made toward Dow's Energy Efficiency goal will directly impact progress in reducing GHG intensity. Dow is studying the life cycle impact of its products on climate change and additional global projects that... -

Page 104

... On Tpril 1, 2009, the Company acquired Rohm and Haas' Philadelphia Plant, which has been an industrial site since the early 1700s, and since the 1920s used by Rohm and Haas for the manufacture of a wide range of chemical products. Chemical disposal practices in the early years resulted in soil and... -

Page 105

... is remote that costs in excess of the range disclosed will have a material adverse impact on the Company's results of operations, financial condition and cash flows. The amounts charged to income on a pretax basis related to environmental remediation totaled $158 million in 2010, $269 million in... -

Page 106

..., TRPC reviewed and analyzed data through October 31, 2010. The resulting study, completed by TRPC in December 2010, stated that the undiscounted cost of resolving pending and future asbestos-related claims against Union Carbide and Tmchem, excluding future defense and processing costs, through... -

Page 107

... Costs to Date as of Dec. 31, 2010 $ 774 $ 1,523 The average resolution payment per asbestos claimant and the rate of new claim filings has fluctuated both up and down since the beginning of 2001. Union Carbide's management expects such fluctuations to continue in the future based upon a number... -

Page 108

.... Summary The amounts recorded by Union Carbide for the asbestos-related liability and related insurance receivable described above were based upon current, known facts. However, future events, such as the number of new claims to be filed and/or received each year, the average cost of disposing of... -

Page 109

... used for this purpose are not designated as hedges. The potential impact of creating such additional exposures is not material to the Company's results. The global nature of Dow's business requires active participation in the foreign exchange markets. Ts a result of investments, production... -

Page 110

... present fairly, in all material respects, the financial position of The Dow Chemical Company and subsidiaries at December 31, 2010 and 2009, and the results of their operations and their cash flows for each of the three years in the period ended December 31, 2010, in conformity with accounting... -

Page 111

... Statements of Income (In millions, except per share amounts) For the years ended December 31 Net Sales Cost of sales Research and development expenses Selling, general and administrative expenses Tmortization of intangibles Goodwill impairment losses Restructuring charges Purchased in-process... -

Page 112

...Contents The Dow Chemical Company and Subsidiaries Consolidated Balance Sheets (In millions, except share amounts) Tt December 31 2010 Assets 2009 Current Tssets Cash and cash equivalents (variable interest entities restricted - 2010: $145) Tccounts and notes receivable: Trade (net of allowance... -

Page 113

See iotes to the Consolidated Financial Statements. 79 -

Page 114

... by operating activities: Depreciation and amortization Purchased in-process research and development charges Provision (Credit) for deferred income tax Earnings of nonconsolidated affiliates less than (in excess of) dividends received Pension contributions Net gain on sales of property, businesses... -

Page 115

Summary Increase in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year See iotes to the Consolidated Financial Statements. 80 4,193 2,846 $ 7,039 46 2,800 $ 2,846 1,064 1,736 $ 2,800 -

Page 116

... for The Dow Chemical Company common stockholders Dividends declared on common stock (Per share: $0.60 in 2010, $0.60 in 2009 and $1.68 in 2008) Other Impact of adoption of TSU 2009-17, net of tax Balance at end of year Tccumulated Other Comprehensive Loss Unrealized Gains (Losses) on Investments at... -

Page 117

Other Balance at end of year Total Equity 22 803 $22,642 81 18 569 $ 21,124 1 69 $ 13,580 See iotes to the Consolidated Financial Statements. -

Page 118

... Dow Chemical Company and Subsidiaries Consolidated Statements of Comprehensive Income (In millions) For the years ended December 31 Net Income Other Comprehensive Income (Loss), Net of Tax (tax amounts shown below for 2010, 2009, 2008) Unrealized gains (losses) on investments: Unrealized holding... -

Page 119

... recorded for assets acquired and liabilities assumed from Rohm and Haas Company ("Rohm and Haas") on Tpril 1, 2009. Certain changes have been made to geographic area information for prior years to reflect changes made in the first quarter of 2010. Certain changes have been made to operating segment... -

Page 120

... and swaps), the Company uses standard pricing models with market-based inputs that take into account the present value of estimated future cash flows. The Company utilizes derivatives to manage exposures to currency exchange rates, commodity prices and interest rate risk. The fair values of all... -

Page 121

... a discounted basis and are accreted over time for the change in present value. Costs associated with the liabilities are capitalized and amortized over the estimated remaining useful life of the asset, generally for periods of 10 years or less. Investments Investments in debt and marketable equity... -

Page 122

... Postemployment Benefits," once management commits to a plan of termination including the number of employees to be terminated, their job classifications or functions, their locations and the expected completion date. Income Taxes The Company accounts for income taxes using the asset and liability... -

Page 123

... as a result of the acquisition of Rohm and Haas. In addition, the plan included the shutdown of a number of manufacturing facilities. These actions are expected to be completed primarily by the end of 2011. Ts a result of the restructuring activities, the Company recorded pretax restructuring... -

Page 124

.... T write-down of the net book value of the related buildings, machinery and equipment against the Chemicals and Energy segment was recorded. The facility will shut down in mid-2011. • With the completion of the Company's acquisition of Rohm and Haas, the following charges were recognized... -

Page 125

... employees. The increase was reflected in Corporate. In the second quarter of 2009, the Company reduced the 2007 restructuring reserve related to contract termination fees by $15 million as a result of the Company's acquisition of Rohm and Haas, impacting the Health and Tgricultural Sciences segment... -

Page 126

... of 1,255 employees under the terms of Rohm and Haas' ongoing benefit arrangement. The separations resulted from plant shutdowns, production schedule adjustments, productivity improvements and reductions in support services. In the fourth quarter of 2009, the Company decreased the severance... -

Page 127

... Systems Health and Tgricultural Sciences Plastics Corporate Tdjustments to 2006 restructuring charges: Chemicals and Energy Corporate Net 2008 restructuring charges Impairment of Long-Lived Assets and Other Assets $ 10 15 67 39 96 86 15 8 $336 - Costs associated with Exit or Disposal Activities... -

Page 128

... net book value of the related buildings, machinery and equipment against the Chemicals and Energy segment was recorded in the fourth quarter of 2008. This facility was closed in the second quarter of 2010. • • In addition to the locations described above, the restructuring charges for plant... -

Page 129

... plan to decrease the reserve for environmental remediation $3 million (impacting the Chemicals and Energy segment) and to decrease the severance reserve $3 million (impacting Corporate). NOTE D - ACQUISITIONS Acquisition of Rohm and Haas On Tpril 1, 2009, the Company completed the acquisition... -

Page 130

... the Rohm and Haas acquired businesses included in the Company's 2009 results since the Tpril 1, 2009 acquisition. Included in the results from Rohm and Haas was $257 million of restructuring charges (see Note C), a one-time increase in cost of sales of $209 million related to the fair value step... -

Page 131

...of each company's innovative technologies and through the combined businesses' broader product portfolio in key industry segments with strong global growth rates. Financing for the Rohm and Haas Acquisition Financing for the acquisition of Rohm and Haas included debt and equity financing (see Notes... -

Page 132

... related to projects within the Health and Tgricultural Sciences segment. NOTE E - DIVESTITURES Divestiture of the Styron Business Unit On March 2, 2010, the Company announced the entry into a definitive agreement to sell the Styron business unit ("Styron") to an affiliate of Bain Capital Partners... -

Page 133

...net gain on the sale of two small, related joint ventures, working capital adjustments and additional costs to sell. The net gain was included in "Sundry income - net" and reflected in the following operating segments: Performance Systems ($7 million), Performance Products ($13 million) and Plastics... -

Page 134

...Sundry income - net" and a charge of $56 million related to the recognition of hedging losses which were recorded to "Cost of sales." The gain impacted the Hydrocarbons operating segment. On September 30, 2009 the Company completed the sale of its ownership interest in the OPTIMTL Group of Companies... -

Page 135

... was $52 million more than its share of the investees' net assets, exclusive of additional differences for Dow Corning, MEGlobal, Equipolymers and Tmericas Styrenics LLC. Dividends received from the Company's nonconsolidated affiliates were $668 million in 2010, $690 million in 2009 and $836... -

Page 136

.... Bhd. The SCG-Dow Group: Siam Polyethylene Company Limited 49% Siam Polystyrene Company Limited 50% Siam Styrene Monomer Co., Ltd. 50% Siam Synthetic Latex Company Limited 50% Univation Technologies, LLC 50% (1) On June 17, 2010, the Company completed the sale of its ownership interest in Tmericas... -

Page 137

... sites and the construction of new facilities; licensing and technology agreements; and marketing, sales, purchase and lease agreements. Excess ethylene glycol produced in Dow's plants in the United States and Europe is sold to MEGlobal and represented 1 percent of total net sales in 2010... -

Page 138

... on a review of the Dow Haltermann reporting unit performed by management, in which discounted cash flows did not support the carrying value of the goodwill due to poor future projections for the business. Ts a result, an impairment loss of $7 million was recognized in the fourth quarter of 2009... -

Page 139

... was based on a review of the Dow Tutomotive Systems reporting unit performed by management, in which discounted cash flows did not support the carrying value of the goodwill due to the severe downturn in the automotive industry and the future projections for the business. Ts a result, an estimated... -

Page 140

... are held at amortized cost, which approximates fair value. Tt December 31, 2010, the Company had investments in money market funds of $35 million classified as cash equivalents ($164 million at December 31, 2009). The net unrealized gain recognized during 2010 on trading securities held at December... -

Page 141

...Due to the nature of these investments, the fair market value is not readily determinable. These investments are reviewed for impairment indicators. During 2010, the Company's impairment analysis identified indicators that resulted in a reduction in the cost basis of these investments of $16 million... -

Page 142

...13) $ (18) Risk Management Dow's business operations give rise to market risk exposure due to changes in interest rates, foreign currency exchange rates, commodity prices and other market factors such as equity prices. To manage such risks effectively, the Company enters into hedging transactions... -

Page 143

... hedging activities is to manage the price volatility associated with these forecasted inventory purchases. Tt December 31, 2010, the Company had futures contracts, options and swaps to buy, sell or exchange commodities. These agreements had various expiration dates primarily in 2011. Accounting for... -

Page 144

... of debt discount" in the consolidated statements of income. The short-cut method is used when the criteria are met. The Company had no open interest rate swaps designated as fair value hedges of underlying fixed rate debt obligations at December 31, 2010 and 2009. Net Foreign Investment Hedges... -

Page 145

...- net Cost of sales - $(2) $155 5 $160 $158 Additional Gain (Loss) Recognized in Income (3,4) $(25) $(15) Effect of Derivative Instruments at December 31, 2009 Income Statement In millions Classification Derivatives designated as hedges: Fair value: Interest rates Interest expense (5) $(1) Cash... -

Page 146

... Basis at December 31, 2010 In millions Tssets at fair value: Interests in trade accounts receivable conduits (2) Equity securities (3) Debt securities: (3) Government debt (4) Corporate bonds Derivatives relating to: (5) Foreign currency Commodities Total assets at fair value Liabilities at fair... -

Page 147

... using quoted prices in active markets), total fair value is either the price of the most recent trade at the time of the market close or the official close price, as defined by the exchange on which the asset is most actively traded on the last trading day of the period, multiplied by the number... -

Page 148

... and using discounted cash flow analysis based on assumptions that market participants would use. Key inputs included anticipated revenues, associated manufacturing costs, capital expenditures and discount, growth and tax rates. On Tpril 1, 2009, the Company announced the entry into a definitive... -

Page 149

... - Net In millions Gain on sale of TRN Gain on sale of OPTIMTL Gain on sale of Styron Obligation related to past divestiture Loss on early extinguishment of debt Gain on sales of other assets and securities Foreign exchange gain (loss) Dividend income Other - net Total sundry income - net 2010... -

Page 150

...EARNINGS PER SHARE CALCULATIONS Net Income In millions Net income from continuing operations Income from discontinued operations, net of income taxes Net income attributable to noncontrolling interests Net income attributable to The Dow Chemical Company Preferred stock dividends Net income available... -

Page 151

... estimated based on current law and existing technologies. Tt December 31, 2010, the Company had accrued obligations of $607 million for probable environmental remediation and restoration costs, including $59 million for the remediation of Superfund sites. This is management's best estimate of the... -

Page 152

...of natural resource damages. On Tpril 7, 2008, the natural resource damage trustees released their "Natural Resource Damage Tssessment Plan for the Tittabawassee River System Tssessment Trea." Tt December 31, 2010, the accrual for these off-site matters was $32 million (included in the total accrued... -

Page 153

... impact on the Company's results of operations, financial condition and cash flows. Asbestos-Related Matters os Union Carbide Corporation Union Carbide Corporation ("Union Carbide"), a wholly owned subsidiary of the Company, is and has been involved in a large number of asbestos-related suits filed... -

Page 154

...'s December 2010 study and Union Carbide's own review of the asbestos claim and resolution activity, Union Carbide decreased its asbestos-related liability for pending and future claims to $744 million, which covered the 15-year period ending 2025, excluding future defense and processing costs. The... -

Page 155

... Contents The amounts recorded by Union Carbide for the asbestos-related liability and related insurance receivable described above were based upon current, known facts. However, future events, such as the number of new claims to be filed and/or received each year, the average cost of disposing of... -

Page 156

... for the purchase of ethylene-related products globally. The purchase prices are determined primarily on a cost-plus basis. Total purchases under these agreements were $714 million in 2010, $784 million in 2009 and $1,502 million in 2008. The Company's take-or-pay commitments associated with these... -

Page 157

..., the Company considers identification of legally enforceable obligations, changes in existing law, estimates of potential settlement dates and the calculation of an appropriate discount rate to be used in calculating the fair value of the obligations. Dow has a well-established global process to... -

Page 158

...forecast a time frame to use for present value calculations. Ts such, the Company has not recognized obligations for individual plants/buildings at its manufacturing sites where estimates of potential settlement dates cannot be reasonably made. In addition, the Company has not recognized conditional... -

Page 159

...(1) $ 974 (1) Presented in operating activities in the consolidated statements of cash flows. Delinquencies on the sold receivables that were still outstanding at December 31, 2010 were $127 million. Trade accounts receivable outstanding and derecognized from the Company's consolidated balance sheet... -

Page 160

... (1) (1) Presented in operating activities in the consolidated statements of cash flows. 2010 $ 554 $3,914 $ 64 Delinquencies on the sold receivables still outstanding at December 31, 2010 were $42 million. Trade accounts receivable outstanding and derecognized from the Company's consolidated... -

Page 161

... notes, final maturity 2011 Pollution control/industrial revenue bonds, varying maturities through 2038 Capital lease obligations Unamortized debt discount Unexpended construction funds Long-term debt due within one year Total long-term debt 2010 - 2009 Average Rate 9.13% 5.32% 5.14% 6.05% 7.60... -

Page 162

...-plus based floating rate notes due 2011. The Company used the net proceeds received from this offering for refinancing, renewals, replacements and refunding of outstanding indebtedness, including repayment of a portion of the Term Loan. The fair value of debt assumed from Rohm and Haas on Tpril... -

Page 163

... non-U.S. employees. Ts a result, the Company acquired the following plan assets and obligations from Rohm and Haas: Plan Assets and Obligations Acquired from Rohm and Haas on April 1, 2009 (1) Defined Benefit Other Pension Postretirement Plans In millions Benefits Fair value of plan assets $ 1,439... -

Page 164

... economic growth, interest rate yield, interest rate spreads, and other valuation measures and market metrics. The expected long-term rate of return for each asset class is then weighted based on the strategic asset allocation approved by the governing body for each plan. The Company's historical... -

Page 165

... Discount rate Expected long-term rate of return on plan assets Initial health care cost trend rate Ultimate health care cost trend rate Year ultimate trend rate to be reached Benefit Obligations at December 31 2010 2009 5.15% 5.69% 8.70% 9.13% 5.00% 5.00% 2019 2019 iet Periodic Costs for the Year... -

Page 166

... 2,079 Change in plan assets Fair value of plan assets at beginning of year Tctual return on plan assets Currency impact Employer contributions Plan participants' contributions Tcquisition/divestiture/other activity Benefits paid Fair value of plan assets at end of year Funded status at end of year... -

Page 167

...grade corporate bonds of companies diversified across industries, U.S. treasuries, non-U.S. developed market securities and U.S. agency mortgage-backed securities. Tlternative investments primarily include investments in real estate, private equity limited partnerships and absolute return strategies... -

Page 168

... fixed income funds Fixed income derivatives Total fixed income securities Tlternative investments: Real estate Private equity Tbsolute return Total alternative investments Other Total assets at fair value (1) Includes $13 million of the Company's common stock. Quoted Prices in Active Markets for... -

Page 169

... fixed income funds Fixed income derivatives Total fixed income securities Tlternative investments: Real estate Private equity Tbsolute return Total alternative investments Other Total assets at fair value (1) Includes $11 million of the Company's common stock. Quoted Prices in Active Markets for... -

Page 170

... using quoted prices in active markets), total fair value is either the price of the most recent trade at the time of the market close or the official close price, as defined by the exchange on which the asset is most actively traded on the last trading day of the period, multiplied by the number... -

Page 171

... buildings based on a fair market value determination. In 2009, the Company purchased a previously leased ethylene plant in Canada for $713 million. Rental expenses under operating leases, net of sublease rental income, were $404 million in 2010, $459 million in 2009 and $439 million in 2008. Future... -

Page 172

... materials; market the joint venture's co-products; and toll convert the other partner's proportional purchase commitments into ethylene dichloride. The joint venture is expected to begin operations in mid-2013. The fifth joint venture was acquired through the acquisition of Rohm and Haas on Tpril... -

Page 173

...to noncontrolling interests" in the consolidated statements of income. Nonconsolidated Variable Interest Entity The Company holds a variable interest in a joint venture accounted for under the equity method of accounting, acquired through the acquisition of Rohm and Haas on Tpril 1, 2009. The joint... -

Page 174

... Company valued at up to 10 percent of their annual base earnings. The value is determined using the plan price multiplied by the number of shares subscribed to by the employee. The plan price of the stock is set each year at no less than 85 percent of market price. Employees' Stock Purchase Plan... -

Page 175

... Weighted-average fair value per share of options granted Total compensation expense for stock option plans Related tax benefit Total amount of cash received from the exercise of options Total intrinsic value of options exercised (1) Related tax benefit (1) Difference between the market price at... -

Page 176

... at end of year (1) Weighted-average per share Additional Information about Deferred Stock In millions, except per share amounts Weighted-average fair value per share of deferred stock granted Total fair value of deferred stock vested and delivered (1) Related tax benefit Total compensation expense... -

Page 177

...-employee directors over the 10-year duration of the program, subject to an annual aggregate award limit of 25,000 shares for each individual director. In 2010, 38,940 shares of restricted stock with a weighted-average fair value of $30.00 per share were issued under this plan. The restricted stock... -

Page 178

... the terms of the preferred series C, the shares of preferred series C would convert into shares of the Company's common stock at a conversion price per share of common stock based upon 95 percent of the average of the common stock volume-weighted average price for the ten trading days preceding... -

Page 179

...and Haas common stock held by the Rohm and Haas ESOP on Tpril 1, 2009. On the date of the acquisition, the Rohm and Haas ESOP was merged into the Plan, and the Company assumed the $78 million balance of debt at 9.8 percent interest with final maturity in 2020 that was used to finance share purchases... -

Page 180

... the ratio of the current year's debt service to the sum of the principal and interest payments over the life of the loan. The shares are allocated to Plan participants in accordance with the terms of the Plan. Compensation expense for allocated shares is recorded at the fair value of the shares on... -

Page 181

... of recorded tax benefits on tax loss carryforwards from operations in the United States, Brazil, Tsia Pacific and Denmark. The tax rate for 2010 was positively impacted by a high level of equity earnings as a percentage of total earnings, the release of a tax valuation allowance, a tax law change... -

Page 182

...277 185 Long-term debt 393 8 Investments 136 103 Other - net 342 460 Subtotal $7,491 $8,290 Valuation allowances (721) Total $7,491 $7,569 (1) Included in current deferred tax assets are prepaid tax assets totaling $100 million in 2010 and $151 million in 2009. (2) The Company assumed $2,875 million... -

Page 183

...Sciences, Performance Systems, Performance Products, Plastics, Chemicals and Energy, and Hydrocarbons. Corporate contains the reconciliation between the totals for the reportable segments and the Company's totals and includes research and other expenses related to new business development activities... -

Page 184

... chemical, advanced materials, agrosciences and plastics businesses deliver a broad range of technology-based products and solutions to customers in approximately 160 countries and in high growth sectors such as electronics, water, energy, coatings and agriculture. In 2010, Dow had annual sales... -

Page 185

...the energy efficiency in homes and buildings today, while also addressing the industry's emerging needs and demands. Dow Construction Chemicals provides solutions for increased durability, greater water resistance and lower systems costs. Ts a leader in insulation solutions, the businesses' products... -

Page 186

...management Dow AgroSciences is a global leader in providing agricultural and plant biotechnology products, pest management solutions and healthy oils. The business invents, develops, manufactures and markets products for use in agriculture, industrial and commercial pest management, and food service... -

Page 187

...a definitive agreement to sell Styron to an affiliate of Bain Capital Partners; the transaction closed on June 17, 2010. Businesses and products sold included Synthetic Rubber and certain products from Dow Tutomotive Systems, which were reported in the Performance Systems segment through the date of... -

Page 188

...2, 2010, Dow announced the entry into a definitive agreement to sell Styron to an affiliate of Bain Capital Partners; the transaction closed on June 17, 2010. Businesses sold included Emulsion Polymers (styrene-butadiene latex), which was reported in the Performance Products segment through the date... -

Page 189

...The Performance Products segment also includes the results of Dow Haltermann, a provider of world-class contract manufacturing services to companies in the fine and specialty chemicals and polymers industries, and STFECHEM, a wholly owned subsidiary that manufactures closedloop systems to manage the... -

Page 190

... the results of The Kuwait Olefins Company K.S.C. and the SCG-Dow Group, joint ventures of the Company. On March 2, 2010, Dow announced the entry into a definitive agreement to sell Styron to an affiliate of Bain Capital Partners; the transaction closed on June 17, 2010. Businesses and products sold... -

Page 191

... the results of the Salt business, which the Company acquired with the Tpril 1, 2009 acquisition of Rohm and Haas and sold to K+S Tktiengesellschaft on October 1, 2009. Total assets divested with the sale of Styron on June 17, 2010 are presented by operating segment in Note E. Transfers of products... -

Page 192

... of Contents Operating Segment Information In millions 2010 Sales to external customers Intersegment revenues Equity in earnings of nonconsolidated affiliates Restructuring charges (1) Tcquisition and integration related expenses (2) Tsbestos-related credit (3) EBITDT (4) Total assets Investment in... -

Page 193

... are attributed to geographic areas based on asset location. Geographic Area Information In millions United States Europe, Middle East and Africa (1) $18,464 $4,501 $16,010 $4,021 Rest of World Total 2010 Sales to external customers Long-lived assets (2) $17,497 $8,393 $14,145 $9,212 $17... -

Page 194

... of Contents The Dow Chemical Company and Subsidiaries Selected Quarterly Financial Data In millions, except per share amounts (Unaudited) 2010 Net sales Cost of sales Gross margin Restructuring charges Tcquisition and integration related expenses Tsbestos-related credit Net income available for... -

Page 195

Table of Contents The Dow Chemical Company and Subsidiaries PART II ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE. Not applicable. 159 -

Page 196

... limitations, any system of internal control over financial reporting can provide only reasonable assurance and may not prevent or detect misstatements. Management assessed the effectiveness of the Company's internal control over financial reporting and concluded that, as of December 31, 2010... -

Page 197

... opinion. T company's internal control over financial reporting is a process designed by, or under the supervision of, the company's principal executive and principal financial officers, or persons performing similar functions, and effected by the company's board of directors, management, and other... -

Page 198

Table of Contents The Dow Chemical Company and Subsidiaries PART II ITEM 9B. OTHER INFORMATION. None. 162 -

Page 199

...of the total outstanding shares of Dow common stock is contained in the definitive Proxy Statement for the Tnnual Meeting of Stockholders of The Dow Chemical Company to be on held May 12, 2011, and is incorporated herein by reference. Information with respect to compensation plans under which equity... -

Page 200

... requests should be addressed to the Vice President and Controller of the Company at the address of the Company's principal executive offices. (c) The consolidated financial statements of Dow Corning Corporation and Subsidiaries for the period ended December 31, 2010 are presented pursuant to Rule... -

Page 201

... The Dow Chemical Company and Subsidiaries Valuation and Qualifying Accounts For the Years Ended December 31 In millions COLUMN T COLUMN B Balance at Beginning of Year COLUMN C Tdditions to Reserves COLUMN D Deductions from Reserves COLUMN E Balance at End of Year Description 2010 RESERVES... -

Page 202

... /S / R. C. EDMONDS R. C. Edmonds, Vice President and Controller Date February 10, 2011 Pursuant to the requirements of the Securities Exchange Tct of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated. By... -

Page 203

... Dow Chemical Company and Petroleum Industries Company (K.S.C.), incorporated by reference to Exhibit 2.1 to The Dow Chemical Company Current Report on Form 8-K filed on 2(b) 2(c) February 19, 2009. 2(d) 2(d)(i) Stock Purchase Tgreement, dated as of Tpril 1, 2009, between Rohm and Haas Company... -

Page 204

... 10(e) Rohm and Haas Company Non-Qualified Retirement Plan, as amended and restated effective as of January 1, 2009, incorporated by reference to Exhibit 10.1 to The Dow Chemical Company Current Report on Form 8-K filed on February 17, 2011. The Dow Chemical Company Dividend Unit Plan, incorporated... -

Page 205

... to Exhibit 10.2 to The Dow Chemical Company Current Report on Form 8-K filed on February 18, 2010. 10(r) The Rohm and Haas Company Non-Qualified Savings Plan (for deferrals made after January 1, 2005), amended and restated effective as of January 1, 2010, incorporated by reference to Exhibit... -

Page 206

... and The Dow Chemical Company dated December 10, 2004, incorporated by reference to Exhibit 10.2 to The Dow Chemical Company Current Report on Form 8-K filed on December 16, 2004. The Dow Chemical Company Voluntary Deferred Compensation Plan for Non-Employee Directors, effective for deferrals... -

Page 207

... for the year ended December 31, 2007. Voting Tgreement dated as of July 10, 2008, by and among Rohm and Haas Company, The Dow Chemical Company and each of the persons and entities listed on Schedule I thereto, incorporated by reference to Exhibit 10.1 to The Dow Chemical Company Current Report on... -

Page 208

... to The Dow Chemical Company Current Report on Form 8-K filed on May 11, 2009. Stock Purchase Tgreement, dated May 11, 2009, between The Dow Chemical Company and Fidelity Management Trust Services, as trustee of a trust established under The Dow Chemical Company Employees' Savings Plan, incorporated... -

Page 209

... Capital Covenant, dated Tpril 1, 2009, relating to the Cumulative Convertible Perpetual Preferred Stock, Series C, incorporated by reference to Exhibit 99.3 to The Dow Chemical Company Current Report on Form 8-K filed on Tpril 1, 2009. Guarantee relating to the 5.60% Notes of Rohm and Haas Company... -

Page 210

Table of Contents The Dow Chemical Company and Subsidiaries Trademark Listing The following trademarks or service marks of The Dow Chemical Company and certain affiliated companies of Dow appear in this report: TCRYSOL, TCUDYNE, TCULYN, TCUMER, TCuPLTNE, TCUSOL, TDCOTE, TDVTSTTB, TERIFY, TFFINITY,... -

Page 211

Table of Contents DOW CORNING CORPORATION AND SUBSIDIARIES CONSOLIDATED FINANCIAL STATEMENTS For the period ended December 31, 2010 -

Page 212

Table of Contents DOW CORNING CORPORATION AND SUBSIDIARIES INDEX TO CONSOLIDATED FINANCIAL STATEMENTS Page Report of Independent Tuditors 3 4 Consolidated Statements of Income for the years ended December 31, 2010, 2009 and 2008 Consolidated Balance Sheets at December 31, 2010 and 2009 5 7 8 9 ... -

Page 213

... statements of income, cash flows and equity present fairly, in all material respects, the financial position of Dow Corning Corporation and its subsidiaries at December 31, 2010 and 2009, and the results of their operations and their cash flows for each of the three years in the period ended... -

Page 214

...DOW CORNING CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (in millions of U.S. dollars, except for per share amounts) Year Ended December 31, 2010 2009 2008 Net Sales Operating Costs and Expenses Cost of sales Marketing and administrative expenses Restructuring expenses, net Total... -

Page 215

Table of Contents DOW CORNING CORPORATION AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (in millions of U.S. dollars) December 31, 2010 December 31, 2009 ASSETS Current Tssets Cash and cash equivalents Tccounts receivable (net of allowance for doubtful accounts of $8.5 in 2010 and $9.8 in 2009) ... -

Page 216

... 31, 2010 December 31, 2009 LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities Short-term borrowings and current maturities of long-term debt Trade accounts payable Tccrued payrolls and employee benefits Tccrued taxes Tccrued interest Current deferred revenue Other current liabilities Total... -

Page 217

... of Contents DOW CORNING CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions of U.S. dollars) Year Ended December 31, 2009 2008 2010 Cash Flows from Operating Activities Net income Depreciation and amortization Changes in deferred revenue, net Tax-related bond deposits... -

Page 218

... sale securities Net loss on cash flow hedges Pension and other postretirement benefit adjustments Other comprehensive income (loss), net of tax Comprehensive income Cash received from noncontrolling shareholders Dividends declared on common stock Balance at December 31, 2008 $2,743.5 Dow Corning... -

Page 219

Table of Contents DOW CORNING CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS TABLE OF CONTENTS Note Page 1 2 3 4 BUSINESS TND BTSIS OF PRESENTTTION SUMMTRY OF SIGNIFICTNT TCCOUNTING POLICIES 10 10 TDVTNCED ENERGY MTNUFTCTURING TTX CREDITS 15 16 16 17 20 ... -

Page 220

...States manufacturing plants are located in Kentucky and Michigan. Principal foreign manufacturing plants are located in Belgium, Brazil, China, France, Germany, Japan, South Korea and the United Kingdom. The Company operates research and development facilities and/or technical service centers in the... -

Page 221

...accounts and the net amount, less any proceeds, is charged or credited to income. If an asset is determined to be impaired, the carrying amount of the asset is reduced to its fair value and the difference is charged to income in the period incurred. The Company capitalizes the costs of internal-use... -

Page 222

...The Company accounts for investments in debt and equity securities at fair value for trading or available for sale securities. The amortized cost method is used to account for investments in debt securities that the Company has the positive intent and ability to hold to maturity. Investments in debt... -

Page 223

... to the customer for products and as work is performed for professional services. Tmounts billed to a customer in a sale transaction related to shipping costs are classified as revenue. The Company reduces revenue for product returns, allowances and price discounts at the time the sale is recognized... -

Page 224

... in cash flows of a forecasted transaction (cash flow hedge), or (3) a hedge of the foreign currency exposure of a net investment in a foreign operation. Changes in the fair value of a derivative that is designated as and meets all the required criteria for a fair value hedge, along with the gain or... -

Page 225

... manufacturing capacity supplying clean and renewable energy projects. The credits granted to the Company are related to the Company's manufacturing expansion projects supporting the solar industry. The Company accounts for investment tax credits under the flow-through method, which results in... -

Page 226

... a long-term contract, the relative condition of property, plant and equipment in relation to replacement cost and the benefit of a net operating loss carryforward that the Company expects to be able to utilize based on its strategic plans for this business. The fair values of assets acquired and... -

Page 227

... sale. The cost, gross unrealized gains, gross unrealized losses and fair value of the investments were as follows: December 31, 2010 Gross Gross Unrealized Unrealized Gains (Losses) Cost Debt Securities: Tuction rate securities backed by student loans Tuction rate preferred securities Total Debt... -

Page 228

... average price of 96.8% of par. Subsequent to December 31, 2010, the Company received an unsolicited offer to purchase certain of its auction rate securities backed by student loans that had a par value of $134.7. The sale will result in an immaterial loss that will be included in the income... -

Page 229

... by operations or access to credit markets. Due to the absence of observable prices in an active market for the same or similar securities, the fair value of $534.5 of the securities was based on a discounted cash flow analysis using forecasts of future cash flows and interest rates. The data used... -

Page 230

... in the future if indicated by either observable prices in an active market or a change in the results of valuations. NOTE 7 - INVENTORIES The value of inventories is determined using the lower of cost or market as the basis. Produced goods were valued using a first-in, first-out (FIFO) cost flow... -

Page 231

...criteria that management considered in making this determination were historical and projected operating results, the ability to utilize tax planning strategies and the period of time over which the tax benefits can be utilized. Tax effected operating loss carryforwards as of December 31, 2010 were... -

Page 232

... period based on future foreign source income and taxable income. Cash paid during the year for income taxes, net of refunds received, was $191.1 in 2010, $234.4 in 2009 and $399.8 in 2008. The income tax provision at the effective rate may differ from the income tax provision at the United... -

Page 233

... will result from settlements, closing of tax examinations or expiration of applicable statutes of limitation in various jurisdictions within the next 12 months. During the year ended December 31, 2010, the Company received proposed adjustments from the IRS related to the Company's consolidated... -

Page 234

... of changes in foreign exchange rates on its earnings, cash flows and fair values of assets and liabilities. In addition, the Company uses derivative financial instruments to reduce the impact of changes in natural gas and other commodity prices on its earnings and cash flows. The Company enters... -

Page 235

... Other noncurrent liabilities Other current liabilities $ (9.8) (0.2) - $ (10.0) $ 4.7 The location and amounts of derivative gains and losses recognized in the Company's income statement were as follows: Year Ended Location of Tmount Recognized in Income 2010 2009 Derivatives designated as... -

Page 236

... Income Foreign exchange contracts Commodity contracts Total $ $ 7.5 (15.0) (7.5) $ $ 3.8 19.7 23.5 Location of Gain/(Loss) Reclassified Other nonoperating income/expenses Cost of sales Derivative options held by the Company as of December 31, 2010 were valued using observable market inputs... -

Page 237

....8 The Company recorded depreciation expense of $291.6, $192.7 and $218.4 for the years ended December 31, 2010, 2009 and 2008, respectively. Effective October 1, 2008, the Company changed the useful lives of certain property, plant and equipment as a result of the Company's historical experience... -

Page 238

... amortization expense related to these intangible assets of $9.6, $6.2 and $5.1 for the years ended December 31, 2010, 2009 and 2008, respectively. The estimated aggregate amortization expense to be recorded in each of the next five years is as follows: 2011 2012 2013 2014 2015 The changes in the... -

Page 239

...its debt covenants, including interest coverage ratio and tangible net worth, related to this credit arrangement. In October 2009, a majority owned subsidiary of the Company entered into an unsecured term loan facility with a syndicate of commercial banks in China that will expire in 4.5 years. The... -

Page 240

... and the revenue associated with the agreements is recognized using the average sales price over the life of the agreements. Differences between amounts invoiced to customers under the agreements and amounts recognized using the average price methodology are reported as deferred revenue in the... -

Page 241

...47.6 Total 2010 $ (3.4) - (44.7) 94.7 $46.6 2009 $ (3.6) 0.1 (37.5) (1.6) $ (42.6) The Company's defined benefit employee retirement plans have a measurement date of December 31 of the applicable year. The projected benefit obligation, accumulated benefit obligation and fair value of plan assets... -

Page 242

...The following table represents assets by category and fair value level of the U.S and non-U.S. defined benefit employee retirement plans as of December 31: 2010 Cash and cash equivalents Equity securities Corporate debt securities U.S. government debt securities U.S. government guaranteed mortgage... -

Page 243

... changes in fair value of Level 3 assets for the year ended December 31, 2010 were as follows: Beginning balance, January 1, 2010 Tctual return on assets Purchases Sales Ending value, December 31, 2010 $11.7 0.9 0.7 (5.0) $ 8.3 Level 1 assets were valued based on quoted prices in active markets... -

Page 244

... 4.5% Total 2010 5.3% 4.6% 2009 5.8% 4.7% Discount rate Rate of increase in future compensation levels Expected long-term rate of return on plan assets U.S. Plans 2010 2009 6.0% 6.0% 4.8% 7.2% Net Periodic Pension Cost for the Year Ended December 31 Non-U.S. Plans Total 2010 2009 2010 2009... -

Page 245

...used to measure the Company's benefit obligation as of December 31, 2010 and include benefits attributable to future employee service. 2011 2012 2013 2014 2015 2016-2020 Other Postretirement Plans U.S. Plans $ 80.1 80.6 81.6 83.2 85.2 479.1 Estimated Future Benefit Payments Non-U.S. Plans Total... -

Page 246

... health care cost trend rate assumption has an effect on the amounts reported, but is offset by plan provisions that limit the Company's share of the total postretirement health care benefits cost for the vast majority of participants. The Company's portion of the total annual health care benefits... -

Page 247

... the year ended December 31, 2010. Reimbursements received under Medicare Part D were $1.8 for the year ended December 31, 2010. The Company expects to pay future benefits under its postretirement health care and life insurance benefit plans and expects to receive reimbursements from annual Medicare... -

Page 248

... obligations cease as provided for in the Plan. Based on these funding agreements, the recorded liability is adjusted to maintain the present value of $2.35 billion determined as of the Effective Date using a discount rate of 7% ("Time Value Tdjustments"). The Company has made early payments to the... -

Page 249

... such amounts paid to Dow Chemical, to the extent not used by Dow Chemical to pay certain products liability claims, will be paid over to the Company after the expiration of a 17.5-year period commencing on the Effective Date. Commercial Creditor Issues The Joint Plan of Reorganization provides that... -

Page 250