Dish Network 2013 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2013 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-41

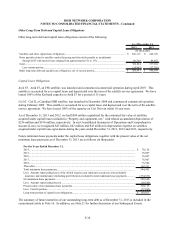

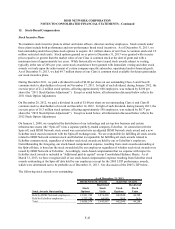

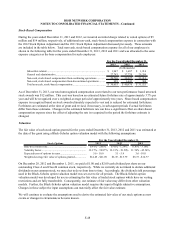

A reconciliation of the beginning and ending amount of unrecognized tax benefits included in “Long-term deferred

revenue, distribution and carriage payments and other long-term liabilities” on our Consolidated Balance Sheets was

as follows:

Unrecogni zed tax b enefit 2013 2 01 2 201 1

Balance as of beginning of period..................................................................................... $ 328,951 $ 235,067 $ 193,320

Additions based on tax positions related to the current year.............................................. 12,736 110,435 12,721

Additions based on tax positions related to prior years..................................................... 66,307 - 34,762

Reductions based on tax positions related to prior years...................................................

(

104,796

)

(

5,477

)

(

1,169

)

Reductions based on tax positions related to settlements with taxing authorities..............

(

139,022

)

(

1,739

)

(

1,185

)

Reductions based on tax positions related to the lapse of the statute of limi tations .......... (12,823) (9,335) (3,382)

Balance as of end of period............................................................................................... 151,353$ 328,951$ 235,067$

For the Years Ended December 31,

(In thousands)

We have $149 million in unrecognized tax benefits that, if recognized, could favorably affect our effective tax rate. We

do not expect any portion of this amount to be paid or settled within the next twelve months. In 2013, we reversed

$102 million of an uncertain tax position that was resolved during the third quarter 2013, reflected in the table

above.

Accrued interest and penalties on uncertain tax positions are recorded as a component of “Other, net” on our

Consolidated Statements of Operations and Comprehensive Income (Loss). During the years ended December 31,

2013, 2012 and 2011, we recorded $4 million, less than $1 million and $4 million in interest and penalty expense to

earnings, respectively. Accrued interest and penalties were $13 million and $17 million at December 31, 2013 and

2012, respectively. The above table excludes these amounts.

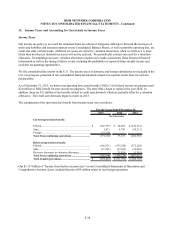

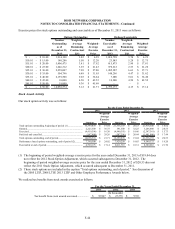

13. Stockholders’ Equity (Deficit)

Capital Stock and Additional Paid-In Capital

Our certificate of incorporation authorizes the following capital stock: (i) 1,600,000,000 shares of Class A common

stock, par value $0.01 per share; (ii) 800,000,000 shares of Class B common stock, par value $0.01 per share; (iii)

800,000,000 shares of Class C common stock, par value $0.01 per share; and (iv) 20,000,000 shares of preferred stock,

par value $0.01 per share. As of December 31, 2013 and 2012, there were no outstanding shares of Class C common

stock or preferred stock.

The Class A, Class B and Class C common stock are equivalent except for voting rights. Holders of Class A and Class

C common stock are entitled to one vote per share and holders of Class B common stock are entitled to 10 votes per

share. Each share of Class B and Class C common stock is convertible, at the option of the holder, into one share of

Class A common stock. Our Class A common stock is publicly traded on the NASDAQ Global Select Market under

the symbol “DISH.” Upon a change in control of DISH Network, each holder of outstanding shares of Class C

common stock is entitled to 10 votes for each share of Class C common stock held. Our principal stockholder owns the

majority of all outstanding Class B common stock. Together with all other stockholders, he also owns outstanding

Class A common stock.

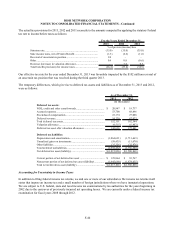

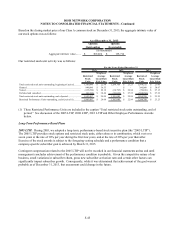

Common Stock Repurchase Program

Our Board of Directors previously authorized the repurchase of up to $1.0 billion of our Class A common stock.

On November 5, 2013, our Board of Directors extended this authorization such that we are currently authorized to

repurchase up to $1.0 billion of outstanding shares of our Class A common stock through and including December

31, 2014. As of December 31, 2013, we may repurchase up to $1.0 billion under this plan. During the years ended

December 31, 2013, 2012 and 2011, there were no repurchases of our Class A common stock.