Dish Network 2013 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2013 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-37

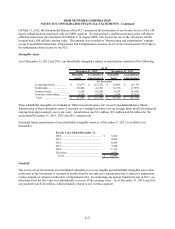

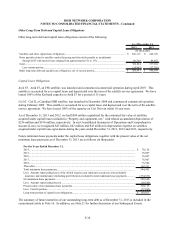

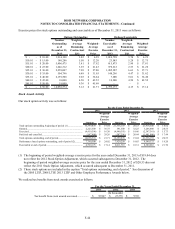

Interest on Long-Term Debt

Annual

Semi-Annual Debt Service

Payment Dates Requirements

(In thousands)

6 5/8% Senior Notes due 2014................... April 1 and October 1 66,250$

7 3/4% Senior Notes due 2015................... May 31 and November 30 58,125$

7 1/8% Senior Notes due 2016................... February 1 and August 1 106,875$

4 5/8% Senior Notes due 2017................... January 15 and July 15 41,625$

4 1/4% Senior Notes due 2018................... April 1 and October 1 51,000$

7 7/8% Senior Notes due 2019................... March 1 and September 1 110,250$

5 1/8% Senior Notes due 2020................... May 1 and November 1 56,375$

6 3/4% Senior Notes due 2021................... June 1 and December 1 135,000$

5 7/8% Senior Notes due 2022................... January 15 and July 15 117,500$

5 % Senior Notes due 2023........................ March 15 and September 15 75,000$

Our ability to meet our debt service requirements will depend on, among other factors, the successful execution of

our business strategy, which is subject to uncertainties and contingencies beyond our control.

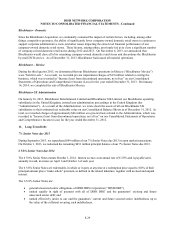

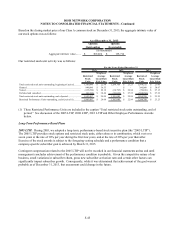

Fair Value of our Long-Term Debt

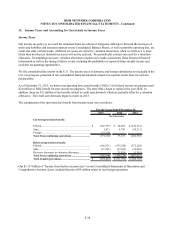

The following table summarizes the carrying and fair values of our debt facilities as of December 31, 2013 and 2012:

Carrying

Value Fair Value

Carrying

Value Fair Value

7 % Senior Notes due 2013 (1)................................ $ - $ - $ 500,000 $ 521,875

6 5/8% Senior Notes due 2014 (2).......................... 1,000,000 1,040,200 1,000,000 1,078,500

7 3/4% Senior Notes due 2015................................ 750,000 813,750 750,000 844,725

7 1/8% Senior Notes due 2016................................ 1,500,000 1,657,500 1,500,000 1,683,750

4 5/8% Senior Notes due 2017................................ 900,000 946,962 900,000 940,500

4 1/4% Senior Notes due 2018................................ 1,200,000 1,221,792 - -

7 7/8% Senior Notes due 2019................................ 1,400,000 1,603,000 1,400,000 1,669,500

5 1/8% Senior Notes due 2020................................ 1,100,000 1,104,950 - -

6 3/4% Senior Notes due 2021................................ 2,000,000 2,122,500 2,000,000 2,280,000

5 7/8% Senior Notes due 2022................................ 2,000,000 1,997,500 2,000,000 2,150,000

5 % Senior Notes due 2023..................................... 1,500,000 1,458,090 1,500,000 1,548,750

Mortgages and other notes payable......................... 80,769 80,769 88,955 88,955

Subtotal.................................................................... 13,430,769 14,047,013$ 11,638,955 12,806,555$

Capital lease obligations (3).................................... 220,115 NA 248,729 NA

Total long-term debt and capital

lease obligations (including current portion)........ 13,650,884$ 11,887,684$

2013 2012

(In thousands)

As of December 31,

(1) During September 2013, we repurchased $49 million of our 7% Senior Notes due 2013 in open market

transactions. On October 1, 2013, we redeemed the remaining $451 million principal balance of our 7% Senior

Notes due 2013.

(2) Our 6 5/8% Senior Notes with an aggregate principal balance of $1.0 billion mature on October 1, 2014 and have

been reclassified to “Current portion of long-term debt and capital lease obligations” on our Consolidated Balance

Sheets as of December 31, 2013.

(3) Disclosure regarding fair value of capital leases is not required.