Dish Network 2013 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2013 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

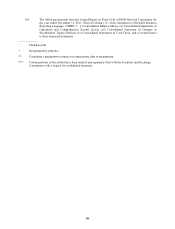

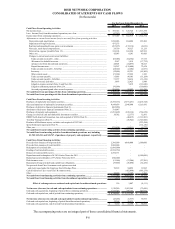

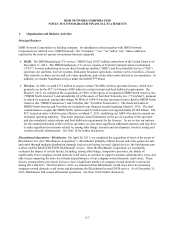

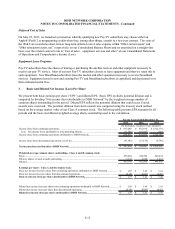

DISH NETWORK CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

The accompanying notes are an integral part of these consolidated financial statements.

F-6

2013 2012 2011

Cash Flows From Operating Activities:

Net income (loss)............................................................................................................................... 789,746$ 625,740$ 1,515,578$

Less: Income (loss) from discontinued operations, net of tax........................................................... (47,343) (37,179) (6,796)

Income (loss) from continuing operations.......................................................................................... 837,089$ 662,919$ 1,522,374$

Adjustments to reconcile net income (loss) to net cash flows from operating activities:

Depreciation and amortization...................................................................................................... 1,054,026 964,484 912,203

Impairment of long-lived assets.................................................................................................... 437,575 - -

Realized and unrealized losses (gains) on investments................................................................. (387,675) (172,314) (8,019)

Non-cash, stock-based compensation............................................................................................ 29,730 39,327 31,213

Deferred tax expense (benefit) (Note 12)...................................................................................... 126,194 369,224 607,813

Other, net...................................................................................................................................... 65,987 8,241 45,003

Changes in current assets and current liabilities:

Trade accounts receivable - other............................................................................................. (69,086) (64,364) 19,175

Allowance for doubtful accounts.............................................................................................. 2,147 1,919 (17,735)

Advances (to) from discontinued operations............................................................................. 48,803 (34,075) 94,013

Prepaid income taxes................................................................................................................ 26,397 (110,608) 72,638

Trade accounts receivable - EchoStar....................................................................................... (28,142) (2,284) (2,031)

Inventory................................................................................................................................... (12,654) 85,321 (61,809)

Other current assets................................................................................................................... (71,324) 27,222 1,241

Trade accounts payable............................................................................................................. 35,895 90,303 (31,204)

Trade accounts payable - EchoStar........................................................................................... 73,157 54,636 (16,136)

Deferred revenue and other....................................................................................................... 3,497 22,425 5,989

Litigation expense accrual (Note 16 and Note 20).................................................................... - 5,419 (316,949)

Litigation settlement payments (Note 20)................................................................................. (70,999) - (350,000)

Accrued programming and other accrued expenses.................................................................. 208,580 55,923 111,381

Net cash flows from operating activities from continuing operations......................................... 2,309,197 2,003,718 2,619,160

Net cash flows from operating activities from discontinued operations, net.............................. (36,732) 8,157 (45,282)

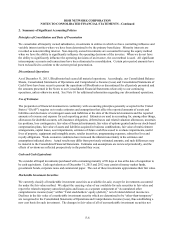

Cash Flows From Investing Activities:

Purchases of marketable investment securities................................................................................... (6,356,136) (3,971,451) (5,407,328)

Sales and maturities of marketable investment securities................................................................... 4,999,639 2,046,648 6,210,191

Purchases of derivative financial instruments (Note 2)...................................................................... (805,996) - -

Settlement of derivative financial instruments (Note 2)..................................................................... 718,847 - -

Purchases of property and equipment................................................................................................ (1,253,499) (945,334) (760,158)

Change in restricted cash and marketable investment securities........................................................ 38,782 (2,177) 12,831

DBSD North America Transaction, less cash acquired of $5,230 (Note 9)....................................... - (40,015) (1,139,201)

TerreStar Transaction (Note 9).......................................................................................................... - (36,942) (1,345,000)

Purchase of Blockbuster assets, excludes cash acquired of $107,061................................................ - - (233,584)

Sprint Settlement Agreement (Note 9)............................................................................................... - - (114,150)

Other, net........................................................................................................................................... (376,494) (54,811) (6,773)

Net cash flows from investing activities from continuing operations.......................................... (3,034,857) (3,004,082) (2,783,172)

Net cash flows from investing activities from discontinued operations, net, including

$1,782, $12,232, and $18,747 of purchases of property and equipment, respectively........... 13,773 (15,132) 87,844

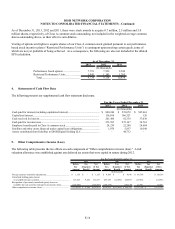

Cash Flows From Financing Activities:

Proceeds from issuance of long-term debt......................................................................................... 2,300,000 4,400,000 2,000,000

Proceeds from issuance of restricted debt.......................................................................................... 2,600,000 - -

Redemption of restricted debt............................................................................................................ (2,600,000) - -

Funding of restricted debt escrow...................................................................................................... (2,596,750) - -

Release of restricted debt escrow....................................................................................................... 2,596,771 - -

Repurchases and redemption of 6 3/8% Senior Notes due 2011........................................................ - - (1,000,000)

Repurchases and redemption of 7% Senior Notes due 2013.............................................................. (500,000) - -

Debt issuance costs............................................................................................................................ (11,146) (13,246) (27,261)

Repayment of long-term debt and capital lease obligations............................................................... (37,869) (36,090) (32,236)

Net proceeds from Class A common stock options exercised

and stock issued under the Employee Stock Purchase Plan............................................................ 76,512 94,852 39,995

Cash dividend on Class A and Class B common stock...................................................................... - (452,890) (893,278)

Other.................................................................................................................................................. 24,422 11,307 6,293

Net cash flows from financing activities from continuing operations.......................................... 1,851,940 4,003,933 93,513

Net cash flows from financing activities from discontinued operations, net............................... (435) (1,449) 484

Effect of exchange rates on cash and cash equivalents from discontinued operations.. 156 1,887 (4,111)

Net increase (decrease) in cash and cash equivalents from continuing operations.................... 1,126,280 3,003,569 (70,499)

Cash and cash equivalents, beginning of period from continuing operations..................................... 3,573,742 570,173 640,672

Cash and cash equivalents, end of period from continuing operations............................................... 4,700,022$ 3,573,742$ 570,173$

Net increase (decrease) in cash and cash equivalents from discontinued operations................. (23,238) (6,537) 38,935

Cash and cash equivalents, beginning of period from discontinued operations................................. 32,398 38,935 -

Cash and cash equivalents, end of period from discontinued operations........................................... 9,160$ 32,398$ 38,935$

For the Years Ended December 31,