Dish Network 2013 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2013 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-19

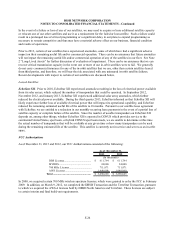

Fair Value Election. As of December 31, 2013, our ARS and other noncurrent marketable investment securities

portfolio of $134 million included $89 million of securities accounted for under the fair value method.

Other Investment Securities

We have strategic investments in certain debt and equity securities that are included in noncurrent “Marketable and

other investment securities” on our Consolidated Balance Sheets and accounted for using the cost, equity and/or fair

value methods of accounting.

Our ability to realize value from our strategic investments in companies that are not publicly traded depends on the

success of those companies’ businesses and their ability to obtain sufficient capital, on acceptable terms or at all,

and to execute their business plans. Because private markets are not as liquid as public markets, there is also

increased risk that we will not be able to sell these investments, or that when we desire to sell them we will not be

able to obtain fair value for them.

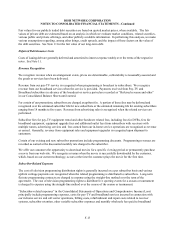

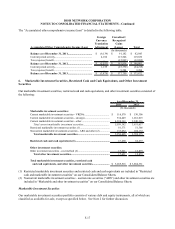

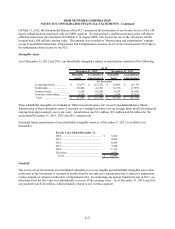

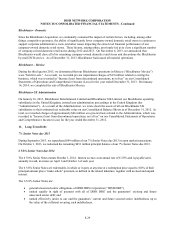

Unrealized Gains (Losses) on Marketable Investment Securities

As of December 31, 2013 and 2012, we had accumulated net unrealized gains of $181 million and $207 million,

respectively. These amounts, net of related tax effect, were $178 million and $194 million, respectively. All of these

amounts are included in “Accumulated other comprehensive income (loss)” within “Total stockholders’ equity

(deficit).” The components of our available-for-sale investments are summarized in the table below.

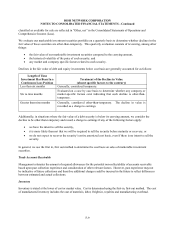

Marketable Marketable

Investment Investment

Securities Gains Losses Net Securities Gains Losses Net

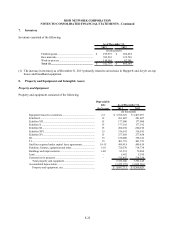

Debt securities:

VRDNs................................... 116,570$ -$ -$ -$ 130,306$ -$ -$ -$

ARS and other........................ 45,030 1,188 (5,138) (3,950) 43,921 1,375 (8,033) (6,658)

ARS fair value election.......... 88,622 - - - 62,251 - - -

Other (including restricted).... 4,668,532 83,363 (4,741) 78,622 3,287,317 208,208 (1,203) 207,005

Equity securities....................... 335,651 106,684 - 106,684 265,380 17,918 (11,537) 6,381

Total.......................................... 5,254,405$ 191,235$ (9,879)$ 181,356$ 3,789,175$ 227,501$ (20,773)$ 206,728$

As of December 31,

(In thousands)

Unrealized

2013

Unrealized

2012

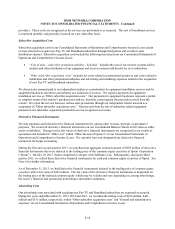

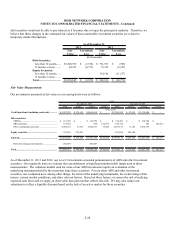

As of December 31, 2013, restricted and non-restricted marketable investment securities include debt securities of

$4.340 billion with contractual maturities within one year, $359 million with contractual maturities extending longer

than one year through and including five years, $2 million with contractual maturities extending longer than five

years through and including ten years and $218 million with contractual maturities longer than ten years. Actual

maturities may differ from contractual maturities as a result of our ability to sell these securities prior to maturity.

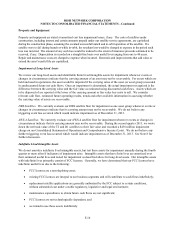

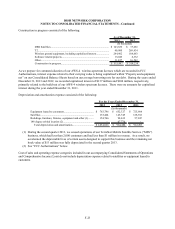

Marketable Investment Securities in a Loss Position

The following table reflects the length of time that the individual securities, accounted for as available-for-sale, have

been in an unrealized loss position, aggregated by investment category. As of December 31, 2012, the unrealized

losses on our investments in equity securities represented investments in broad-based indexes and companies in the

telecommunications and technology industries. We are not aware of any specific factors which indicate the

unrealized losses in these investments are due to anything other than temporary market fluctuations. As of

December 31, 2013 and 2012, the unrealized losses on our investments in debt securities primarily represented

investments in ARS and corporate bonds. We have the ability to hold and do not intend to sell our investments in

these debt securities before they recover or mature, and it is more likely than not that we will hold these investments

until that time. In addition, we are not aware of any specific factors indicating that the underlying issuers of these