Dish Network 2011 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2011 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

62

62

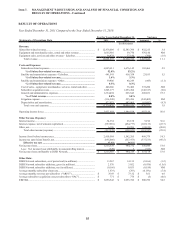

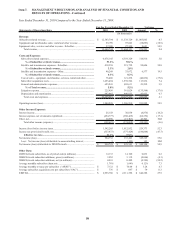

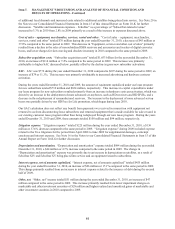

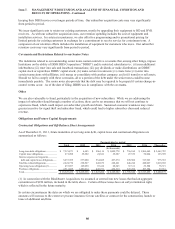

Earnings before interest, taxes, depreciation and amortization. EBITDA was $2.956 billion during the year ended

December 31, 2010, an increase of $644 million or 27.9% compared to the same period in 2009. The following table

reconciles EBITDA to the accompanying financial statements.

2010 2009

EBITDA.................................................................... 2,955,786$ 2,311,398$

Interest expense, net................................................. (429,619) (358,391)

Income tax (provision) benefit, net.......................... (557,473) (377,429)

Depreciation and amortization................................. (983,965) (940,033)

Net income (loss) attributable to DISH Network....... 984,729$ 635,545$

For the Years Ended

December 31,

(In thousands)

EBITDA is not a measure determined in accordance with GAAP, and should not be considered a substitute for

operating income, net income or any other measure determined in accordance with GAAP. EBITDA is used as a

measurement of operating efficiency and overall financial performance and we believe it to be a helpful measure for

those evaluating companies in the pay-TV industry. Conceptually, EBITDA measures the amount of income

generated each period that could be used to service debt, pay taxes and fund capital expenditures. EBITDA should

not be considered in isolation or as a substitute for measures of performance prepared in accordance with GAAP.

Income tax (provision) benefit, net. Our income tax provision was $557 million during the year ended December

31, 2010, an increase of $180 million compared to the same period in 2009. The increase in the provision was

primarily related to the increase in “Income (loss) before income taxes.”

Net income (loss) attributable to DISH Network. “Net income (loss) attributable to DISH Network” was $985

million during the year ended December 31, 2010, an increase of $349 million compared to $636 million for the

same period in 2009. The increase was primarily attributable to the changes in revenue and expenses discussed

above.

LIQUIDITY AND CAPITAL RESOURCES

Cash, Cash Equivalents and Current Marketable Investment Securities

We consider all liquid investments purchased within 90 days of their maturity to be cash equivalents. See “Item

7A. – Quantitative and Qualitative Disclosures About Market Risk” for further discussion regarding our

marketable investment securities. As of December 31, 2011, our cash, cash equivalents and current marketable

investment securities totaled $2.041 billion compared to $2.940 billion as of December 31, 2010, a decrease of

$899 million. This decrease in cash, cash equivalents and current marketable investment securities was primarily

related to our investment in DBSD North America of $1.139 billion, the TerreStar Transaction of $1.345 billion,

repurchases and redemptions of our 6 3/8% Senior Notes due 2011 totaling $1.0 billion, the $893 million dividend

paid in cash on our Class A and Class B common stock, capital expenditures of $779 million, the Blockbuster

Acquisition of $127 million, net of $107 million cash received, and the Sprint Settlement Agreement net payment

of approximately $114 million, which were partially offset by cash generated from operations of $2.574 billion

and the net proceeds of $1.973 billion related to the issuance of our 6 3/4% Senior Notes due 2021.

We have investments in various debt and equity instruments including corporate bonds, corporate equity securities,

government bonds and variable rate demand notes (“VRDNs”). VRDNs are long-term floating rate municipal bonds

with embedded put options that allow the bondholder to sell the security at par plus accrued interest. All of the put

options are secured by a pledged liquidity source. Our VRDN portfolio is comprised of investments in many

municipalities, which are backed by financial institutions or other highly rated companies that serve as the pledged

liquidity source. While they are classified as marketable investment securities, the put option allows VRDNs to be

liquidated generally on a same day or on a five business day settlement basis. As of December 31, 2011 and 2010,

we held VRDNs, within our current marketable investment securities portfolio, with fair values of $161 million and

$1.334 billion, respectively.