Dish Network 2011 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2011 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-37

As of December 31, 2011, we had benefits of foreign tax credits and net operating loss carryforwards of approximately $9

million, which are fully offset by a valuation allowance.

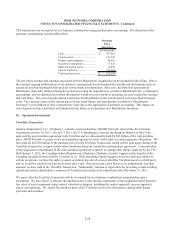

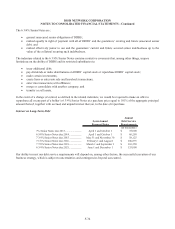

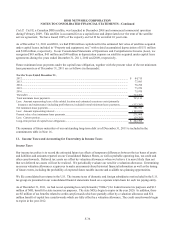

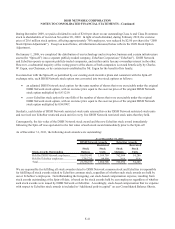

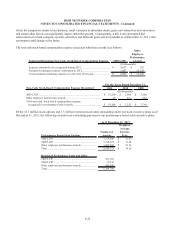

The components of the (provision for) benefit from income taxes are as follows:

2011 2010 2009

Current

(p

rovision

)

benefit:

Federal............................................................................. $ (235,357) $ (287,523) $ (335,958)

State................................................................................. (27,523) (68,550) (36,762)

Foreign............................................................................. (4,199) - (79)

(267,079) (356,073) (372,799)

Deferred

(p

rovision

)

benefit:

Federal............................................................................. (590,618) (227,024) 15,771

State................................................................................. (34,128) 16,341 (373)

Foreign............................................................................. (4,939) - -

Decrease (increase) in valuation allowance..................... 1,758 9,283 (20,028)

(627,927) (201,400) (4,630)

Total benefit (provision).................................................. (895,006)$ (557,473)$ (377,429)$

For the Years Ended December 31,

(In thousands)

Of our $2.411 billion of “Income (loss) before income taxes” on our Consolidated Statements of Operations and

Comprehensive Income (Loss), approximately $28 million relates to our foreign operations.

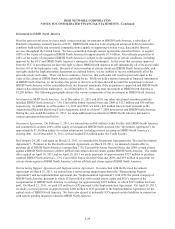

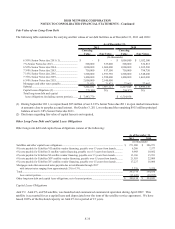

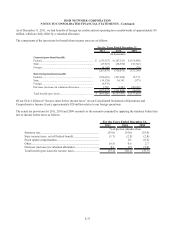

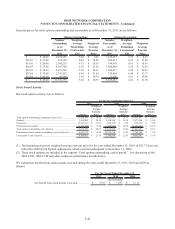

The actual tax provisions for 2011, 2010 and 2009 reconcile to the amounts computed by applying the statutory Federal tax

rate to income before taxes as follows:

2011 2010 2009

Statutory rate............................................................................... (35.0) (35.0) (35.0)

State income taxes, net of Federal benefit................................... (1.7) (2.5) (2.8)

Stock option compensation.......................................................... - 0.3 (0.2)

Other............................................................................................ (0.5) 0.6 2.7

Decrease (increase) in valuation allowance................................. 0.1 0.5 (2.0)

Total benefit (provision) for income taxes.................................. (37.1) (36.1) (37.3)

For the Years Ended December 31,

% of pre-tax (income)/loss