Dish Network 2011 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2011 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

45

PART II

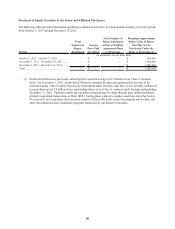

Item 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters

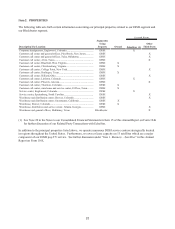

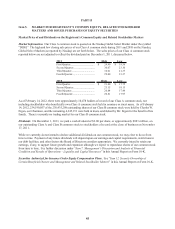

Market Information. Our Class A common stock is quoted on the Nasdaq Global Select Market under the symbol

“DISH.” The high and low closing sale prices of our Class A common stock during 2011 and 2010 on the Nasdaq

Global Select Market (as reported by Nasdaq) are set forth below. The sales prices of our Class A common stock

reported below are not adjusted to reflect the dividend paid on December 1, 2011, discussed below.

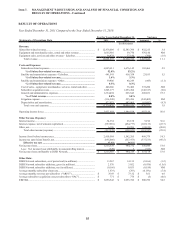

2011 High Low

First Quarter.................................... 24.40$ 19.56$

Second Quarter................................ 30.67 23.10

Third Quarter.................................. 32.01 21.37

Fourth Quarter................................. 29.00 23.27

2010 High Low

First Quarter.................................... 21.80$ 17.75$

Second Quarter................................ 23.15 18.15

Third Quarter.................................. 20.84 17.44

Fourth Quarter................................. 20.81 17.97

As of February 14, 2012, there were approximately 10,478 holders of record of our Class A common stock, not

including stockholders who beneficially own Class A common stock held in nominee or street name. As of February

14, 2012, 234,190,057 of the 238,435,208 outstanding shares of our Class B common stock were held by Charles W.

Ergen, our Chairman, and the remaining 4,245,151 were held in trusts established by Mr. Ergen for the benefit of his

family. There is currently no trading market for our Class B common stock.

Dividends. On December 1, 2011, we paid a cash dividend of $2.00 per share, or approximately $893 million, on

our outstanding Class A and Class B common stock to stockholders of record at the close of business on November

17, 2011.

While we currently do not intend to declare additional dividends on our common stock, we may elect to do so from

time to time. Payment of any future dividends will depend upon our earnings and capital requirements, restrictions in

our debt facilities, and other factors the Board of Directors considers appropriate. We currently intend to retain our

earnings, if any, to support future growth and expansion although we expect to repurchase shares of our common stock

from time to time. See further discussion under “Item 7. Management’s Discussion and Analysis of Financial

Condition and Results of Operations – Liquidity and Capital Resources” in this Annual Report on Form 10-K.

Securities Authorized for Issuance Under Equity Compensation Plans. See “Item 12. Security Ownership of

Certain Beneficial Owners and Management and Related Stockholder Matters” in this Annual Report on Form 10-K.