Dish Network 2011 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2011 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-46

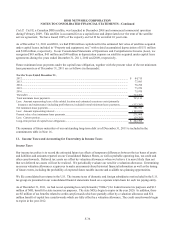

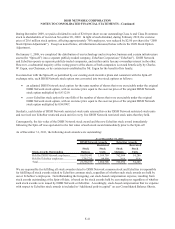

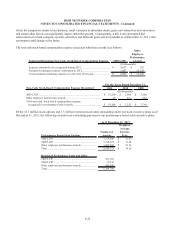

Stock-Based Compensation

During the year ended December 31, 2010, we incurred $3 million of additional non-cash, stock-based compensation

cost in connection with the 2009 Stock Option Adjustment discussed previously. This amount is included in the table

below. Total non-cash, stock-based compensation expense for all of our employees is shown in the following table for

the years ended December 31, 2011, 2010 and 2009 and was allocated to the same expense categories as the base

compensation for such employees:

2011 2010 2009

Subscriber-related................................................. 1,914$ 1,160$ 1,069$

General and administrative................................... 29,607 14,227 11,158

Total non-cash, stock-based compensation........... 31,521$ 15,387$ 12,227$

For the Years Ended December 31,

(In thousands)

As of December 31, 2011, our total unrecognized compensation cost related to our non-performance based unvested

stock awards was $25 million and includes compensation expense that we will recognize for EchoStar stock awards held

by our employees as a result of the Spin-off. This cost is based on an estimated future forfeiture rate of approximately

3.7% per year and will be recognized over a weighted-average period of approximately two years. Share-based

compensation expense is recognized based on stock awards ultimately expected to vest and is reduced for estimated

forfeitures. Forfeitures are estimated at the time of grant and revised, if necessary, in subsequent periods if actual

forfeitures differ from those estimates. Changes in the estimated forfeiture rate can have a significant effect on share-

based compensation expense since the effect of adjusting the rate is recognized in the period the forfeiture estimate is

changed.

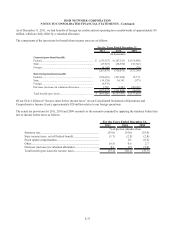

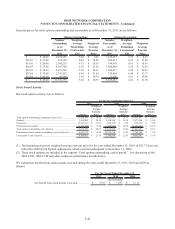

Valuation

The fair value of each stock option for the years ended December 31, 2011, 2010 and 2009 was estimated at the date of

the grant using a Black-Scholes option valuation model with the following assumptions:

Stock Options 2011 2010 2009

Risk-free interest rate.......................................................... 0.36% - 3.18% 1.50% - 2.89% 1.70% - 3.19%

Volatility factor................................................................... 31.74% - 45.56% 33.33% - 38.63% 29.72% - 45.97%

Expected term of options in years....................................... 3.6 - 10.0 5.2 - 7.5 3.0 - 7.3

Weighted-average fair value of options granted................. $8.73 - $14.77 $6.83 - $8.14 $3.86 - $8.29

For the Years Ended December 31,

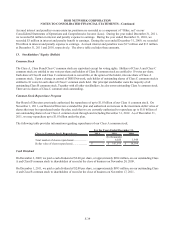

On December 2, 2009 and December 1, 2011, we paid a $2.00 cash dividend per share on our outstanding Class A and

Class B common stock. While we currently do not intend to declare additional dividends on our common stock, we may

elect to do so from time to time. Accordingly, the dividend yield percentage used in the Black-Scholes option valuation

model is set at zero for all periods. The Black-Scholes option valuation model was developed for use in estimating the

fair value of traded stock options which have no vesting restrictions and are fully transferable. Consequently, our

estimate of fair value may differ from other valuation models. Further, the Black-Scholes option valuation model

requires the input of highly subjective assumptions. Changes in the subjective input assumptions can materially affect

the fair value estimate.