Dish Network 2011 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2011 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

58

58

General and administrative expenses. “General and administrative expenses” totaled $1.234 billion during the year

ended December 31, 2011, a $609 million increase compared to the same period in 2010. This increase was primarily

due to an increase in personnel, building and maintenance and other administrative costs associated with our

Blockbuster operations which commenced April 26, 2011.

Litigation expense. “Litigation expense” totaled a negative $317 million during the year ended December 31, 2011,

a reduction in expense of $542 million compared to the same period in 2010. See Note 16 in the Notes to our

Consolidated Financial Statements in Item 15 of this Annual Report on Form 10-K for further discussion.

Depreciation and amortization. “Depreciation and amortization” expense totaled $922 million during the year ended

December 31, 2011, a $62 million or 6.3% decrease compared to the same period in 2010. This change in

“Depreciation and amortization” expense was primarily due to a decrease in depreciation on equipment leased to

subscribers principally related to less equipment capitalization during 2011 compared to the same period in 2010 and

less equipment write-offs from disconnecting subscribers. This decrease was partially offset by an increase in

depreciation on satellites as a result of EchoStar XIV and EchoStar XV being placed into service during the second and

third quarters 2010, respectively.

Interest expense, net of amounts capitalized. “Interest expense, net of amounts capitalized” totaled $558 million

during the year ended December 31, 2011, an increase of $103 million or 22.7% compared to the same period in 2010.

This change primarily resulted from an increase in interest expense related to the issuance of our 6 3/4% Senior

Notes due 2021 during the second quarter 2011 and a decrease in the amount of interest capitalized, partially offset

by a decrease in interest expense as a result of the repurchases and redemptions of our 6 3/8% Senior Notes due

2011.

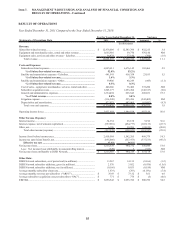

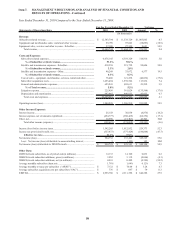

Earnings before interest, taxes, depreciation and amortization. EBITDA was $3.857 billion during the year ended

December 31, 2011, an increase of $901 million or 30.5% compared to the same period in 2010. The following table

reconciles EBITDA to the accompanying financial statements.

2011 2010

EBITDA.................................................................. 3,856,542$ 2,955,786$

Interest expense, net............................................... (523,556) (429,619)

Income tax (provision) benefit, net........................ (895,006) (557,473)

Depreciation and amortization............................... (922,073) (983,965)

Net income (loss) attributable to DISH Network..... 1,515,907$ 984,729$

For the Years Ended

December 31,

(In thousands)

EBITDA is not a measure determined in accordance with accounting principles generally accepted in the United

States (“GAAP”) and should not be considered a substitute for operating income, net income or any other measure

determined in accordance with GAAP. EBITDA is used as a measurement of operating efficiency and overall

financial performance and we believe it to be a helpful measure for those evaluating companies in the pay-TV

industry. Conceptually, EBITDA measures the amount of income generated each period that could be used to

service debt, pay taxes and fund capital expenditures. EBITDA should not be considered in isolation or as a substitute

for measures of performance prepared in accordance with GAAP.

Income tax (provision) benefit, net. Our income tax provision was $895 million during the year ended December

31, 2011, an increase of $338 million compared to the same period in 2010. The increase in the provision was

primarily related to the increase in “Income (loss) before income taxes.”

Net income (loss) attributable to DISH Network. “Net income (loss) attributable to DISH Network” was $1.516

billion during the year ended December 31, 2011, an increase of $531 million compared to $985 million for the

same period in 2010. The increase was primarily attributable to the changes in revenue and expenses discussed

above.