Dish Network 2004 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2004 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

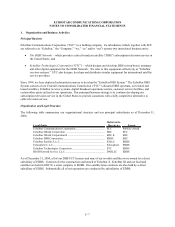

Income Taxes

We establish a provision for income taxes currently payable or receivable and for income tax amounts deferred to

future periods in accordance with Statement of Financial Accounting Standards No. 109, “Accounting for Income

Taxes” (“SFAS 109”). SFAS 109 requires that deferred tax assets or liabilities be recorded for the estimated future

tax effects of differences that exist between the book and tax bases of assets and liabilities. Deferred tax assets are

offset by valuation allowances in accordance with SFAS 109, because we believe it is more likely than not that such

net deferred tax assets will not be realized.

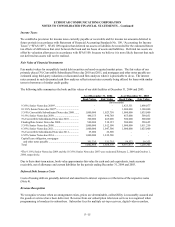

Fair Value of Financial Instruments

Fair market values for our publicly traded debt securities are based on quoted market prices. The fair values of our

privately placed 3% Convertible Subordinated Notes due 2010 and 2011, and mortgages and other notes payable are

estimated using third-party valuations or discounted cash flow analyses when it is practicable to do so. The interest

rates assumed in such discounted cash flow analyses reflect interest rates currently being offered for loans with similar

terms to borrowers of similar credit quality.

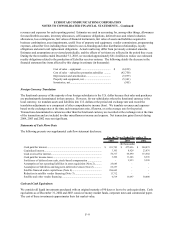

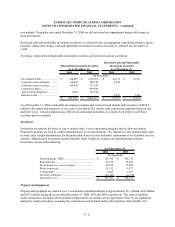

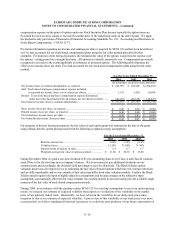

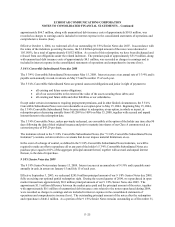

The following table summarizes the book and fair values of our debt facilities at December 31, 2004 and 2003:

As of December 31, 2004 As of December 31, 2003

Book Value Fair Value Book Value Fair Value

(In thousands)

9 3/8% Senior Notes due 2009*.................................... - - 1,423,351 1,498,077

10 3/8% Senior Notes due 2007*.................................. - - 1,000,000 1,100,000

5 3/4% Convertible Subordinated Notes due 2008 ....... 1,000,000 1,023,750 1,000,000 1,035,000

9 1/8% Senior Notes due 2009...................................... 446,153 490,768 455,000 509,031

3% Convertible Subordinated Note due 2010 .............. 500,000 465,000 500,000 500,000

Floating Rate Senior Notes due 2008............................ 500,000 518,125 500,000 520,625

5 3/4% Senior Notes due 2008...................................... 1,000,000 1,012,500 1,000,000 1,011,250

6 3/8% Senior Notes due 2011...................................... 1,000,000 1,047,500 1,000,000 1,025,000

3% Convertible Subordinated Note due 2011............... 25,000 22,500 - -

6 5/8% Senior Notes due 2014...................................... 1,000,000 1,012,500 - -

Capital lease obligation, mortgages

and other notes payable .............................................. 331,735 331,735 59,322 59,322

Total 5,802,888 5,924,378 6,937,673 7,258,305

*The 9 3/8% Senior Notes due 2009 and the 10 3/8% Senior Notes due 2007 were redeemed February 2, 2004 and October 1,

2004, respectively.

Due to their short-term nature, book value approximates fair value for cash and cash equivalents, trade accounts

receivable, net of allowance and current liabilities for the periods ending December 31, 2004 and 2003.

Deferred Debt Issuance Costs

Costs of issuing debt are generally deferred and amortized to interest expense over the terms of the respective notes

(Note 4).

Revenue Recognition

We recognize revenue when an arrangement exists, prices are determinable, collectibility is reasonably assured and

the goods or services have been delivered. Revenue from our subscription television services is recognized when

programming is broadcast to subscribers. Subscriber fees for multiple set-top receivers, digital video recorders,

F–15