Dish Network 2004 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2004 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

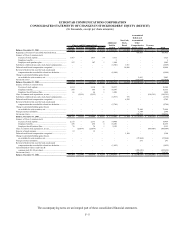

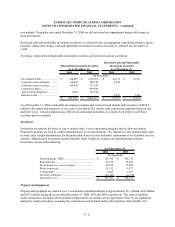

ECHOSTAR COMMUNICATIONS CORPORATION

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY (DEFICIT)

(In thousands, except per share amounts)

The accompanying notes are an integral part of these consolidated financial statements.

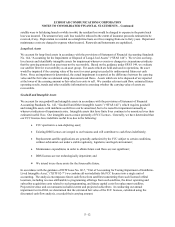

Accumulated

Deficit and

Non-Cash, Accumulated

Additional Stock- Other

Class A and B Common Stock Paid-In Based Comprehensive Treasury

Issued Treasury Outstanding Amount Capital Compensation Income (Loss) Stock Total

Balance, December 31, 2001 ........................................................ 479,451 - 479,451 4,794$ 1,709,797$ (25,456)$ (2,466,907)$ -$ (777,772)$

Repurchase of Series D Convertible Preferred Stock .................... - - - - - - 437,433 - 437,433

Issuance of Class A common stock:

Exercise of stock options .......................................................... 1,417 - 1,417 14 7,511 - - - 7,525

Employee benefits ..................................................................... - - - - 3 - - - 3

Employee stock purchase plan .................................................. 107 - 107 1 1,904 - - - 1,905

Forfeitures of deferred non-cash, stock-based compensation ......... - - - - (5,520) 1,911 - - (3,609)

Deferred stock-based compensation recognized ............................ - - - - - 14,888 - - 14,888

Reversal of deferred tax asset for book stock-based

compensation that exceeded the related tax deduction .............. - - - - (6,964) - - - (6,964)

Change in unrealized holding gains (losses)

on available-for-sale securities, net............................................ - - - - - - 2,603 - 2,603

Net income (loss) ........................................................................... - - - - - - (852,034) - (852,034)

Balance, December 31, 2002......................................................... 480,975 - 480,975 4,809$ 1,706,731$ (8,657)$ (2,878,905)$ -$ (1,176,022)$

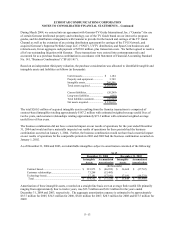

Issuance of Class A common stock:

Exercise of stock options .......................................................... 3,114 - 3,114 31 18,517 - - - 18,548

Employee benefits...................................................................... 566 - 566 6 16,347 - - - 16,353

Employee Stock Purchase Plan ................................................. 66 - 66 1 1,889 - - - 1,890

Class A common stock repurchases, at cost.................................... - (5,915) (5,915) - - - - (190,391) (190,391)

Forfeitures of deferred non-cash, stock-based compensation ......... - - - - (3,933) 775 - - (3,158)

Deferred stock-based compensation recognized ............................ - - - - - 6,702 - - 6,702

Reversal of deferred tax asset for book stock-based

compensation that exceeded the related tax deduction .............. - - - - (5,746) - - - (5,746)

Change in unrealized holding gains (losses)

on available-for-sale securities, net............................................ - - - - - - 73,446 - 73,446

Foreign currency translation........................................................... - - - - - - 1,348 - 1,348

Net income (loss)............................................................................ - - - - - - 224,506 - 224,506

Balance, December 31, 2003......................................................... 484,721 (5,915) 478,806 4,847$ 1,733,805$ (1,180)$ (2,579,605)$ (190,391)$ (1,032,524)$

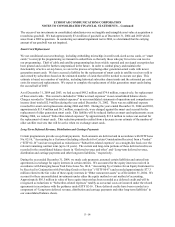

Issuance of Class A common stock:

Exercise of stock options .......................................................... 2,175 - 2,175 21 14,448 - - - 14,469

Employee benefits...................................................................... 478 - 478 5 16,250 - - - 16,255

Employee Stock Purchase Plan ................................................. 78 - 78 1 2,122 - - - 2,123

Class A common stock repurchases, at cost.................................... - (25,879) (25,879) - - - - (809,609) (809,609)

Exercise of stock warrants.............................................................. 12 - 12 - - - - - -

Deferred stock-based compensation recognized ............................ - - - - - 1,180 - - 1,180

Change in unrealized holding gains (losses)

on available-for-sale securities, net............................................ - - - - - - (27,864) - (27,864)

Foreign currency translation........................................................... - - - - - - 291 - 291

Reversal of deferred tax asset for book stock-based

compensation that exceeded the related tax deduction .............. - - - - (1,652) - - - (1,652)

Cash dividend on Class A and Class B

common stock ($1.00 per share)................................................ - - - - - - (455,650) - (455,650)

Net income (loss)............................................................................ - - - - - - 214,769 - 214,769

Balance, December 31, 2004......................................................... 487,464 (31,794) 455,670 4,874$ 1,764,973$ -$ (2,848,059)$ (1,000,000)$ (2,078,212)$

F–5