Dish Network 2004 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2004 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.5

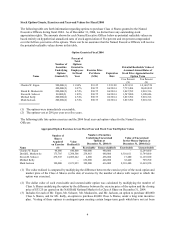

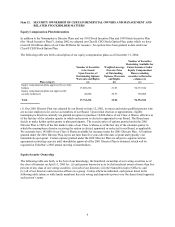

achieved. We cannot currently predict when or if those goals will be achieved or when or if the options granted

under the plan will become exercisable.

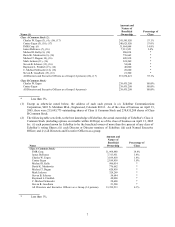

Director Compensation and Nonemployee Director Option Plans

Our employee directors are not compensated for their services as directors. Each nonemployee director receives an

annual retainer of $20,000 which is paid in equal quarterly installments on the last day of each calendar quarter,

provided such person is a member of the Board on the last day of the applicable calendar quarter. Our

nonemployee directors also receive $1,000 for each meeting attended in person and $500 for each meeting attended

by telephone. Additionally, the chairperson of each committee of the Board receives a $5,000 annual retainer,

which is paid in equal quarterly installments on the last day of each calendar quarter, provided such person is the

chairperson of the committee on the last day of the applicable calendar quarter. Furthermore, our nonemployee

directors receive reimbursement, in full, of travel expenses related to attendance at the annual meetings of the Board

and its committees, and the reimbursement, subject to an annual maximum reimbursement of $2,000 per

nonemployee director, of travel expenses related to attendance at other meetings of the Board and its committees.

During 2004, the Board agreed to reimburse Mr. Schroeder for all of his actual travel costs to attend Board and

committee meetings, in the amount of $3,949.

Our nonemployee directors are granted an option to acquire 10,000 Class A Shares upon election to the Board under

our 1995 Nonemployee Director Stock Option Plan (our “1995 Director Plan”) or our 2001 Nonemployee Director

Stock Option Plan (our “2001 Director Plan,” and together with the 1995 Director Plan, the “Nonemployee Director

Plans”). Options granted under our Nonemployee Director Plans are 100% vested upon issuance and have a term of

five years. We also currently grant each nonemployee director an option to acquire 5,000 Class A Shares every year

in exchange for their continuing services.

We have granted the following options to our directors under these plans: in December 1995, upon appointment to

the Board, Mr. Friedlob was granted an option to acquire 8,000 Class A Shares at an exercise price of $2.53125 per

share. This option was repriced to $2.1250 per share during July 1997. Mr. Friedlob was subsequently granted the

following additional options: 40,000 Class A Shares at an exercise price of $2.1250 per share in February 1997;

40,000 Class A Shares at an exercise price of $6.00 per share in February 1999; 10,000 Class A Shares at an

exercise price of $33.109 per share in June 2000; 5,000 Class A Shares at an exercise price of $34.62 per share in

June 2003; and 5,000 Class A Shares at an exercise price of $31.12 per share in September 2004.

In December 2002, upon appointment to the Board, Mr. Goodbarn was granted an option to acquire 10,000 Class A

Shares at an exercise price of $22.26. He was subsequently granted an option to purchase 5,000 Class A Shares at

an exercise price of $34.62 per share in June 2003 and an option to purchase 5,000 Class A Shares at an exercise

price of $31.12 in September 2004.

In December 2003, upon appointment to the Board, Mr. Schroeder was granted an option to acquire 10,000 Class A

Shares at an exercise price of $33.99. He was subsequently granted an option to purchase 5,000 Class A Shares at

an exercise price of $31.12 in September 2004.

Compensation Committee Interlocks and Insider Participation

The Compensation Committee is comprised solely of outside directors. The Compensation Committee members are

Mr. Friedlob, Mr. Goodbarn and Mr. Schroeder. None of these individuals was an officer or employee of EchoStar

at any time during the 2004 fiscal year or at any other time. No executive officer of EchoStar served on the board of

directors or compensation committee of another entity, or on any other committee of the board of directors of

another entity performing similar functions during the last fiscal year.