Dish Network 2004 Annual Report Download - page 94

Download and view the complete annual report

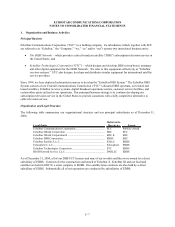

Please find page 94 of the 2004 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

The excess of our investments in consolidated subsidiaries over net tangible and intangible asset value at acquisition is

recorded as goodwill. We had approximately $3.4 million of goodwill as of December 31, 2004 and 2003 which

arose from a 2002 acquisition. In conducting our annual impairment test in 2004, we determined that the carrying

amount of our goodwill was not impaired.

Smart Card Replacement

We use conditional access technology, including embedding microchips in credit card-sized access cards, or “smart

cards,” to encrypt the programming we transmit to subscribers so that only those who pay for service can receive

our programming. Theft of cable and satellite programming has been widely reported and our signal encryption has

been pirated and could be further compromised in the future. In order to combat piracy and maintain the

functionality of active set-top boxes, we are in the process of replacing older generation smart cards with newer

generation smart cards. We have accrued a liability for the replacement of smart cards in satellite receivers sold to

and owned by subscribers based on the estimated number of cards that will be needed to execute our plan. This

estimate is based on a number of variables, including historical subscriber churn trends and the estimated per card

costs for smart card replacements. We expect to complete the replacement of older generation smart cards during

the second half of 2005.

As of December 31, 2004 and 2003, we had accrued $48.2 million and $74.6 million, respectively, for replacement

of these smart cards. This accrual is included in “Other accrued expenses” in our consolidated balance sheets.

Charges recorded to “Subscriber-related expenses” in our consolidated statements of operations and comprehensive

income (loss) totaled $2.9 million during the year ended December 31, 2002. There was no additional expense

recorded for smart card replacements during 2004 and 2003. During the years ended December 31, 2004 and 2003,

approximately $13.4 million and $6.2 million, respectively, were charged against the smart card accrual for the

replacement of older generation smart cards. This liability will be reduced further as smart card replacements occur.

During 2004, we reduced “Subscriber-related expenses” by approximately $13.0 million to reduce our accrual for

the replacement of smart cards. This reduction primarily resulted from a decrease in our estimate of the number of

older satellite receivers that will be active when we exchange smart cards.

Long-Term Deferred Revenue, Distribution and Carriage Payments

Certain programmers provide us up-front payments. Such amounts are deferred and in accordance with EITF Issue

No. 02-16, “Accounting by a Customer (Including a Reseller) for Certain Consideration Received from a Vendor”

(“EITF 02-16”) and are recognized as reductions to “Subscriber-related expenses” on a straight-line basis over the

relevant remaining contract term (up to 10 years). The current and long-term portions of these deferred credits are

recorded in the consolidated balance sheets in “Deferred revenue and other” and “Long-term deferred revenue,

distribution and carriage payments and other long-term liabilities,” respectively.

During the year ended December 31, 2004, we made cash payments, assumed certain liabilities and entered into

agreements in exchange for equity interests in certain entities. We accounted for the equity interests received in

accordance with Emerging Issues Task Force Issue No. 00-8, “Accounting by a Grantee for an Equity Instrument to

be Received in Conjunction with Providing Goods or Services” (“EITF 00-8”) and recorded approximately $77.3

million related to the fair value of these equity interests in “Other noncurrent assets” as of December 31, 2004. We

account for these unconsolidated investments under either the equity method or cost method of accounting.

Approximately $56.5 million in value of these equity interests has been recorded as a deferred credit and will be

recognized as reductions to “Subscriber-related expenses” ratably as our actual costs are incurred under the related

agreements in accordance with the guidance under EITF 02-16. These deferred credits have been recorded as a

component of “Long-term deferred revenue, distribution and carriage payments and other long-term liabilities” in

our consolidated balance sheets.

F–14