Dish Network 2004 Annual Report Download - page 47

Download and view the complete annual report

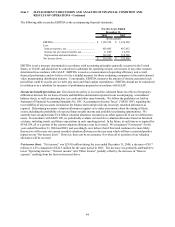

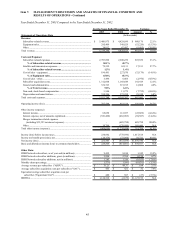

Please find page 47 of the 2004 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

39

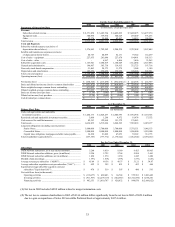

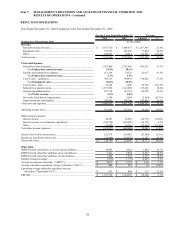

DISH Network subscribers. As of December 31, 2004, we had approximately 10.905 million DISH Network

subscribers compared to approximately 9.425 million at December 31, 2003, an increase of approximately 15.7%.

DISH Network added approximately 1.480 million net new subscribers for the year ended December 31, 2004

compared to approximately 1.245 million net new subscribers during the same period in 2003. We believe the

increase in net new subscribers resulted from a number of factors, including the commencement of sales under our

co-branding agreement with SBC and other distribution relationships and an increase in our distribution channels.

Temporary product shortages and installation delays during the second half of 2003 were substantially eliminated

during the first quarter of 2004 which also contributed to the current year increase.

A material portion of our new subscriber additions are derived from our relationship with SBC. However, SBC

recently announced that in 2005 it will begin deploying an advanced fiber network that will enable it to offer video

services directly. Our net new subscriber additions and certain of our other key operating metrics would be

adversely affected to the extent SBC de-emphasizes or discontinues its efforts to acquire DISH Network subscribers.

Additionally, as the size of our subscriber base continues to increase, if percentage subscriber churn remains

constant, increasing numbers of gross new subscribers are required to sustain net subscriber growth.

Subscriber-related revenue. DISH Network “Subscriber-related revenue” totaled $6.677 billion for the year ended

December 31, 2004, an increase of $1.267 billion or 23.4% compared to the same period in 2003. This increase was

directly attributable to continued DISH Network subscriber growth and the increase in “ARPU” discussed below.

ARPU. Monthly average revenue per subscriber was approximately $54.87 during the year ended December 31, 2004

and approximately $51.21 during the same period in 2003. The $3.66 or 7.1% increase in monthly average revenue

per DISH Network subscriber is primarily attributable to price increases of up to $2.00 in February 2004 and 2003

on some of our most popular packages, and from equipment sales, installation and other services related to our

relationship with SBC. This increase was also attributable to a reduction in the number of DISH Network subscribers

receiving subsidized programming through our free and discounted programming promotions, the increased

availability of local channels by satellite, increases in our advertising sales and increases in the number of DISH

Network subscribers with multiple set-top boxes and digital video recorders. We provided local channels by

satellite in 152 markets as of December 31, 2004 compared to 101 markets as of December 31, 2003.

Impacts from our litigation with the networks in Florida, FCC rules governing the delivery of superstations and other

factors could cause us to terminate delivery of network channels and superstations to a substantial number of our

subscribers, which could cause many of those customers to cancel their subscription to our other services. In the

event the Court of Appeals upholds the Miami District Court’s network litigation injunction, and if we do not reach

private settlement agreements with additional stations, we will attempt to assist subscribers in arranging alternative

means to receive network channels, including migration to local channels by satellite where available, and free off

air antenna offers in other markets. However, we cannot predict with any degree of certainty how many subscribers

might ultimately cancel their primary DISH Network programming as a result of termination of their distant network

channels. We could be required to terminate distant network programming to all subscribers in the event the

plaintiffs prevail on their cross-appeal and we are permanently enjoined from delivering all distant network

channels. Termination of distant network programming to subscribers would result in, among other things, a

reduction in average monthly revenue per subscriber and a temporary increase in subscriber churn.

In April 2002, the FCC concluded that our “must carry” implementation methods were not in compliance with the

“must carry” rules. If the FCC finds our subsequent remedial actions unsatisfactory, while we would attempt to

continue providing local network channels in all markets without interruption, we could be forced by capacity

constraints to reduce the number of markets in which we provide local channels. This could cause a temporary

increase in churn and a small reduction in average monthly revenue per subscriber.

Equipment sales. For the year ended December 31, 2004, “Equipment sales” totaled $373.3 million, an increase of

$77.8 million or 26.4% compared to the same period during 2003. This increase principally resulted from an increase

in sales of DBS accessories to retailers and other distributors of our equipment domestically and directly to DISH

Network subscribers.