Dish Network 2004 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2004 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

40

We currently have certain binding purchase orders and a minimum volume commitment with an international DBS

service provider through March 31, 2006 and we are actively trying to secure new orders from other potential

international customers. However, we cannot guarantee at this time that those negotiations will be successful. A

significant portion of our equipment revenue depends largely on sustaining substantial orders from this international

DBS service provider and other international operators, which in turn, depends on other factors, such as the level of

consumer acceptance of direct-to-home satellite TV products and the increasing intensity of competition for

international subscription television subscribers. We have recently decided to downsize and eliminate certain

product lines sold by our EchoStar International Corporation subsidiary and accordingly, we expect that future sales

of our non-DISH Network receivers and other accessories to international customers will decline as compared to

historical levels.

Other. “Other” sales totaled $100.6 million for the year ended December 31, 2004, an increase of $66.6 million

compared to the same period during 2003. This increase is primarily attributable to the subscription television service

revenues from C-band subscribers of the SNG business that we acquired in April 2004.

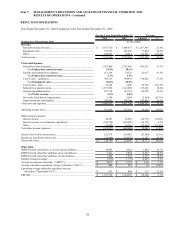

Subscriber-related expenses. “Subscriber-related expenses” totaled $3.567 billion during the year ended December

31, 2004, an increase of $859.5 million or 31.7% compared to the same period in 2003. The increase in “Subscriber-

related expenses” was primarily attributable to the increase in the number of DISH Network subscribers, which

resulted in increased expenses to support the DISH Network. “Subscriber-related expenses” represented 53.4% and

50.1% of “Subscriber-related revenue” during the years ended December 31, 2004 and 2003, respectively. The

increase in this expense to revenue ratio primarily resulted from increases in our programming and subscriber

retention costs, and costs associated with the expansion of our installation, in-home service and call center operations.

These increased operational costs, some of which are temporary, related to, among other things, more complicated

installations required by receivers with multiple tuners and a larger dish, or “SuperDISH” which is used to receive

programming from our FSS satellites. The increase also resulted from cost of sales and expenses from equipment

sales, installation and other services related to our relationship with SBC. Since margins related to our co-branded

subscribers are lower than for our traditional subscribers, we expect this relationship to continue to negatively impact

this ratio to the extent that we continue to add co-branded subscribers under our SBC agreement. The ratio of

“Subscriber-related expenses” to “Subscriber-related revenue” could also continue to increase if our programming and

retention costs increase at a greater rate than our “Subscriber-related revenue” and if we are unable to improve

efficiencies related to our installation, in-home service and call center operations.

We currently offer local broadcast channels in approximately 155 markets across the United States. In 38 of those

markets, two dishes are necessary to receive all local channels in the market. SHVERA now requires, among other

things, that all local broadcast channels delivered by satellite to any particular market be available from a single dish

within 18 months of the law’s December 8, 2004 effective date. Because we had planned to transition all local

channels in any particular market to the same dish by 2008 rather than in the shorter transition period mandated by

SHVERA, satellite capacity limitations may force us to move the local channels in as many as 30 markets to

different satellites, requiring subscribers in those markets to install a second or a different dish to continue receiving

their local network channels. We may be forced to stop offering local channels in some of those markets altogether.

The transition of all local channels to the same dish could result in disruptions of service for a substantial number of

our customers, and our ability to timely comply with this requirement without incurring significant additional costs

is dependent on, among other things, the successful launch and operation of one or more additional satellites. It is

possible that the costs of compliance with this requirement could exceed $100.0 million. To the extent some of

those costs are passed on to our subscribers, and because many subscribers may be unwilling to install a second dish

where one had been adequate, we expect that our subscriber churn could be negatively impacted.

In the normal course of business, we enter into various contracts with programmers to provide content. Our

programming contracts generally require us to make payments based on the number of subscribers to which the

respective content is provided. Consequently, our programming expenses will continue to increase to the extent we are

successful in growing our subscriber base. In addition, because programmers continue to raise the price of content,

there can be no assurance that our “Subscriber-related expenses” as a percentage of “Subscriber-related revenue” will

not materially increase absent corresponding price increases in our DISH Network programming packages.