Dish Network 2004 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2004 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

Subordinated Notes due 2010 and 2011 are not included in the diluted EPS calculation as the effect of the

conversion of the notes would be anti-dilutive. Of the options outstanding as of December 31, 2004, options to

purchase approximately 7.0 million shares were outstanding under a long term incentive plan. Vesting of these

options is contingent upon meeting certain longer-term goals which have not yet been achieved. As such, the long-

term incentive options are not included in the diluted EPS calculation.

New Accounting Pronouncements

In December 2004, the Financial Accounting Standards Board issued Statement of Financial Accounting Standards

No. 123 (Revised 2004), “Share Based Payment” (“SFAS 123(R)”) which (i) revises SFAS No. 123, “Accounting

for Stock-Based Compensation,” (“SFAS 123”) to eliminate the disclosure only provisions of that statement and the

alternative to follow the intrinsic value method of accounting under Accounting Principles Board Opinion No. 25,

“Accounting for Stock Issued to Employees” (“APB 25”) and its related implementation guidance, and (ii) requires

a public entity to measure the cost of employee services received in exchange for an award of equity instruments,

including grants of employee stock options, based on the grant-date fair value of the award and recognize that cost

in its results of operations over the period during which an employee is required to provide the requisite service in

exchange for that award. The statement is effective for financial statements as of the beginning of the first interim

period that begins after June 15, 2005. Companies may elect to apply this statement either prospectively, or on a

modified version of retrospective application under which financial statements for prior periods are adjusted on a

basis consistent with the pro forma disclosures required for those periods under SFAS 123. We are currently

evaluating which transitional provision and fair value methodology we will follow. However, we expect that any

expense associated with the adoption of the provisions of SFAS 123(R) will have a material negative impact on our

results of operations.

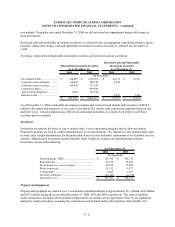

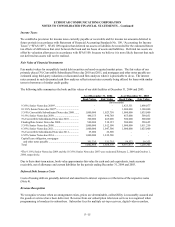

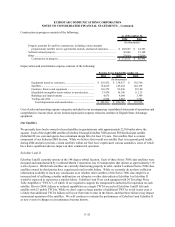

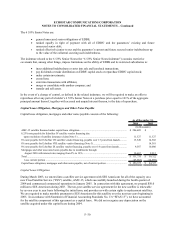

3. Property and Equipment

Property and equipment consist of the following:

Depreciable

Life As of December 31,

(In Years) 2004 2003

(In thousands)

EchoStar I ................................................................................ 12 201,607$ 201,607$

EchoStar II ............................................................................... 12 228,694 228,694

EchoStar III .............................................................................. 12 234,083 234,083

EchoStar IV .............................................................................. 4 78,511 78,511

EchoStar V ............................................................................... 12 210,446 210,446

EchoStar VI .............................................................................. 12 246,022 246,022

EchoStar VII ............................................................................ 12 177,000 177,000

EchoStar VIII ........................................................................... 12 175,801 189,513

EchoStar IX .............................................................................. 12 127,376 127,376

AMC-15 satellite acquired under capital lease (Note 4)........... 10 330,800 -

Furniture, fixtures and equipment ............................................ 2-10 664,778 613,789

Buildings and improvements .................................................... 5-40 159,662 147,191

Equipment leased to customers................................................. 3-4 1,045,949 543,954

Tooling and other ..................................................................... 1-5 14,191 5,100

Land ......................................................................................... - 29,583 27,024

Vehicles ................................................................................... 7 3,414 3,445

Construction in progress .......................................................... - 273,153 86,490

Total property and equipment ............................................. $ 4,201,070 $ 3,120,245

Accumulated depreciation ........................................................ (1,560,902) (1,243,786)

Property and equipment, net ............................................... 2,640,168$ 1,876,459$

F–20