Dish Network 2004 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2004 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

35

or newer, more expensive consumer electronics products in response to new promotions and products offered by our

competitors. In addition, new compression technologies will inevitably render some portion of our current and future

EchoStar receivers obsolete and we will incur additional costs, which may be substantial, to upgrade or replace these

set-top boxes.

Maintain or improve operating margins. We will continue to work to generate cost savings during 2005 by

improving our operating efficiency and attempting to control rising programming costs. During 2004, our operating

margins were negatively impacted by costs associated with the expansion of our installation, in-home service and

call center operations. We are attempting to control these costs by improving the quality of the initial installation,

providing better subscriber education in the use of our products and services, and enhancing our training programs

for our in-home service and call center representatives. However, these initiatives may not be sufficient to maintain

or increase our operational efficiencies and we may not be able to continue to grow our operations cost effectively.

Our operating margins have also been adversely impacted by rising programming costs. Payments we make to

programmers for programming content represent one of the largest components of our operating costs. We expect

programming providers to continue to demand higher rates for their programming. We will continue to negotiate

aggressively with programming providers in an effort to control rising programming costs. However, there can be

no assurance we will be successful in controlling these costs, and we may be forced to drop one or more channels if

we cannot reach acceptable agreements with all of our content providers. In addition, there can be no assurance that

we will be able to increase the price of our programming to offset these programming rate increases without

affecting the competitiveness of our programming packages.

Leverage Increased Satellite Capacity. We have recently entered into agreements to purchase or lease a substantial

amount of additional satellite capacity. We are currently evaluating various opportunities to utilize this capacity,

including, but not limited to, launching satellite two-way and wireless broadband data services, increasing our

international programming and expanding our local and high definition programming. However, we face a variety

of risks and uncertainties that may prevent us from utilizing this additional satellite capacity profitably. These risks

include, among other things, the risks that there may be insufficient market demand for these new services and

program offerings, or that customers might find competing services and program offerings more attractive. In

addition, many of these new services depend on successful development of new technologies which may not

perform as we expect. Our results of operation and financial condition will be adversely affected if we cannot make

profitable use of this additional satellite capacity.

Explanation of Key Metrics and Other Items

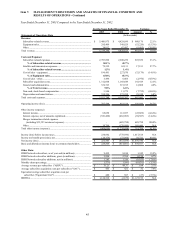

Subscriber-related revenue. “Subscriber-related revenue” consists principally of revenue from basic, movie, local,

international and pay-per-view subscription television services, advertising sales, digital video recorder fees, equipment

rental fees and additional outlet fees from subscribers with multiple set-top boxes and other subscriber revenue.

Contemporaneous with the commencement of sales of co-branded services pursuant to our agreement with SBC during

the first quarter of 2004, “Subscriber-related revenue” also includes revenue from equipment sales, installation and

other services related to that agreement. Revenue from equipment sales to SBC is deferred and recognized over the

estimated average co-branded subscriber life. Revenue from installation and certain other services performed at the

request of SBC is recognized upon completion of the services.

Development and implementation fees received from SBC are being recognized in “Subscriber-related revenue” over

the next several years. In order to estimate the amount recognized monthly, we first divide the number of co-branded

subscribers activated during the month under the SBC agreement by total estimated co-branded subscriber activations

during the life of the contract. We then multiply this percentage by the total development and implementation fees

received from SBC. The resulting estimated monthly amount is recognized as revenue ratably over the estimated

average co-branded subscriber life.

Effective January 1, 2004, we combined “Subscription television service” revenue and “Other subscriber-related

revenue” into “Subscriber-related revenue.” All prior period amounts were reclassified to conform to the current

period presentation.