DHL 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 DHL annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2008

Delivering on the Future

Table of contents

-

Page 1

ANNUAL REPORT 2008 Delivering on the Future -

Page 2

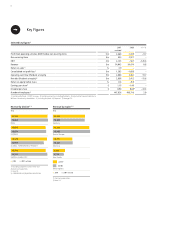

... Revenue by division 1), 2) â,¬m 14,393 14,569 MAIL 13,637 13,874 EXPRESS 14,179 12,959 GLOBAL FORWARDING / FREIGHT 13,718 14,317 SUPPLY CHAIN / CIS 3) 2008 2007 restated Revenue by region 1), 2) â,¬m 16,765 16,678 Germany 19,129 19,463 Rest of Europe 10,171 10,443 Americas 6,292 5,714 Asia Paci... -

Page 3

...Post and DHL brands stand for a wide range of easily accessible services and sustainable solutions for the transport of letters, goods and information. With around 500,000 employees in more than 220 countries and territories, we are one of the world's most important employers. As the largest company... -

Page 4

... FREIGHT Division. +++ SALE OF REAL ESTATE PORTFOLIO APRIL +++ The Group sells a portfolio of approximately 1,300 properties located mainly in Germany to US investor Lone Star for â,¬ 1 billion in cash. +++ GROUP SETS CLIMATE PROTECTION TARGET APRIL +++ Deutsche Post World Net - the largest player... -

Page 5

...we achieved in 2008: We have agreed to sell shares in Deutsche Postbank to Deutsche Bank and we began to reorganise our US express business. We have consistently implemented the initiatives set forth in our Roadmap to Value capital markets programme and ran a tight cost management system. Thanks not... -

Page 6

A B C D GROUP MANAGEMENT REPORT 21 CORPORATE GOVERNANCE 101 CONSOLIDATED FINANCIAL STATEMENTS 125 FURTHER INFORMATION 201 Detailed table of contents -

Page 7

... Key Figures At a Glance Milestones 2008 Delivering on the Future Letter to our Shareholders I II 2 14 A B C D GROUP MANAGEMENT REPORT Overview Business and Environment Capital Market Earnings, Financial Position and Assets and Liabilities Divisions Non-ï¬nancial Performance Indicators Risks... -

Page 8

2 DELIVERING ON THE FUTURE GLOBAL PRESENCE At home in the markets of the future 4 GLOBAL CUSTOMER SOLUTIONS Full service for key customers 6 GOGREEN A drive towards sustainability 8 INDUSTRY EXPERTISE Customised solutions 10 FIRST CHOICE Being the First Choice 12 -

Page 9

... and customised logistics solutions, and we are fulfilling our responsibility to the environment by offering climate-neutral products. Our dedicated employees provide what we need to achieve high customer loyalty. We take our responsibility to our customers' needs, employees, investors and society... -

Page 10

4 At home in the markets of the future GLO BAL PRE SEN CE STR ATE GIC GOA L ause our strong ++ + Delivering on the future - bec e in dynamic future global presence gives us an edg and the Middle East are markets. Asia, Eastern Europe express and logistics the key growth drivers of our business. ++... -

Page 11

... in northern Asia. This new gateway augments the Asia Paciï¬c hubs in Hong Kong, Bangkok, Incheon, Singapore and Sydney. In Jebel Ali, the free-trade zone in Dubai, we have opened the largest transhipment centre of its kind in the Middle East. Our customers in the freight business use the centre... -

Page 12

6 -

Page 13

... market conditions, not to mention achieve encouraging growth rates. DHL is the most important transport services partner for Airbus - one of the world's leading aircraft manufacturers - and will be over the next ï¬ve years. We have developed a new transport concept that streamlines air, ocean... -

Page 14

... as the largest play n ectio prot ate clim have set ourselves a measurable ateclim a rs ome target. Our GoGreen products offer cust intro only not neutral shipping option, which we have nded exte ady duced across Europe but have also alre n. +++ regio c ï¬ Paci Asia the in into 17 countries INITI... -

Page 15

...30 % below 2007 levels by the year 2020. As an interim target, we are striving to improve our CO2 efï¬ciency by 10 % by 2010. To meet this climate protection target, we have developed a systematic approach: the Group's GoGreen programme. By using energyefficient processes and technologies, offering... -

Page 16

10 Customised solutions INDUSTRY EXPERTIS E STRATEGI C GOAL +++ Delivering on the future - because we develop customised logistics solutions for each individual product. As the market leader in outsourced contract logistics, we align our services precisely to our customer's needs. For we are not ... -

Page 17

... structures become more complex and more globally networked, our customers continuously face new challenges when it comes to planning, managing and monitoring their business processes. We lead the market in offering customised logistics solutions to meet these challenges. For example, DHL developed... -

Page 18

12 -

Page 19

...every point our service systematically in all areas and service of contact. This way we will become the best +++ ce. Choi First s provider and every customer' INITIATIVE All of our employees bear a very special responsibility - a responsibility to their customers. In order to meet their product and... -

Page 20

14 Dr Frank Appel, Chairman of the Board of Management -

Page 21

Letter to our Shareholders 15 25 February 2009 Financial year 2008 Deutsche Post World Net Geschäftsbericht 2008 -

Page 22

-

Page 23

... rates in the emerging economies, cut costs and made operational improvements. We increased our reporting transparency by now reporting the logistics business units separately and our financial position is stable. Net cash from operating activities increased significantly, whilst working capital... -

Page 24

...is time to take up our strategy for the future. We want to maintain our position as "Die Post für Deutschland" (the postal service for Germany) whilst making optimum use of the global strength of our logistics business. Together with our around 500,000 employees, we are creating a corporate culture... -

Page 25

... IDENTIFICATION (RFID) is a system that uses radio signals to locate and identify merchandise, batched products and transport assets fitted with special electronic chips. This enables the automatic tracking and tracing of merchandise and assets throughout the supply chain. RFID can help to reduce... -

Page 26

... Report on post-balance sheet date events Report on expected developments Opportunities 40 41 43 50 93 94 98 Signiï¬cant events Earnings Financial position Assets and liabilities 52 DIVISIONS Overview MAIL EXPRESS GLOBAL FORWARDING / FREIGHT SUPPLY CHAIN / CORPORATE INFORMATION SOLUTIONS... -

Page 27

... of the reporting year in a different economic environment. Our financial position appears to be stable. Net cash from operating activities (Postbank at equity) significantly increased, whilst working capital fell. Moreover, because investments were below the prior-year level, free cash flow grew... -

Page 28

... • Dialogue Marketing • Press Services • Parcel Germany • Retail Outlets • Global Mail • Pension Service EXPRESS • Europe • Americas • Asia Pacific • EEMEA SUPPLY CHAIN / CIS • Supply Chain • Corporate Information Solutions Deutsche Post World Net Annual Report 2008 -

Page 29

... the global and regional organisational structure of the two new Board departments. In the third quarter, the Pension Service was reallocated from the FINANCIAL SERVICES Division to the mail business. Having agreed to the sale of our subsidiary, Deutsche Postbank, we have reported its activities... -

Page 30

...,228 new no-par value registered shares in exchange for non-cash contributions in the period to 17 May 2010 and thereby increase the company's share capital by up to â,¬ 174,796,228 (2005 authorised capital, Article 5 (2) of the Articles of Association). Deutsche Post World Net Annual Report 2008 -

Page 31

...share capital. The shares may be purchased through the stock market, a public offer, a public call for offers of sale from the company's shareholders or by some other means in accordance with Section 53 a of the AktG. The Board of Management may use the authorisation for any purpose permitted by law... -

Page 32

...(previous year: 5.2%), the international exchange of goods by 4.8% (Global Trade Navigator) - the lowest growth since 2002. Growth indicators for 2008 % USA Japan 1) China Euro zone 1) Germany 1) Estimates as at 2 February 2009; source: Postbank Research, national statistics. Gross domestic product... -

Page 33

... average annual oil price was around 34 % higher than in 2007 but prices were wildly erratic. In the first half of the year, international oil prices soared. A barrel (159 litres) of Brent Crude climbed from just under US $ 100 at the start of the year to Deutsche Post World Net Annual Report 2008 -

Page 34

... time, trade flows within Asia - the second largest domestic market after Europe - are growing much faster than trade flows within Europe. Compound annual growth rate 2007 - 2008 % Export Asia Paciï¬c Europe Latin America North America Source: Global Trade Navigator; as at December 2008. Import... -

Page 35

... co-operation with Colography Group 2008. 6) Twenty-foot equivalent unit. 7) Total for 14 European countries, excluding bulk and specialities transport. Source: MRSC, freight reports 2007 and 2008, Eurostat 2007. 8) Company estimates based on Datamonitor input. Deutsche Post World Net Annual Report... -

Page 36

...that are geographically close and have a low wage level. Also, for less time-critical shipments, demand is expected to rise for more fuel-efficient transport. Since we are well positioned in the typical low-wage countries of Eastern Europe and Latin America and our range of services covers all means... -

Page 37

... these initiatives have demonstrably higher levels of customer satisfaction. In 2008, this resulted in additional Group revenues. Moreover, those business units operating under the DHL brand and Global Business Services succeeded in reducing their costs. Deutsche Post World Net Annual Report 2008 -

Page 38

... operating highly profitably in the MAIL Division and to enhance our range of services by adding communications products. The DHL brand stands for a comprehensive product portfolio and worldwide logistics presence. Our EXPRESS, Globil FORWARDING /FREIGHT and SUPPLY CHAIN / CIS divisions operate... -

Page 39

... Risk-free rate of return Average risk premium on debt 4.2 % 1.2 % 8.1 % Tax effect Weighting at market rates 1.8 % 9.9 % 70 % Weighting at market rates 5.4 % 30 % Group cost of capital 8.5 % In addition to the cost of capital, the net asset base makes up the second component of the calculation... -

Page 40

...two factors: real estate disposals and a sharp reduction in working capital, both of which are elements of our Roadmap to Value programme. The weighted average cost of capital was set at 8.5 % at the beginning of 2008 and has remained unchanged since then. Deutsche Post World Net Annual Report 2008 -

Page 41

... 50 44.4 %. Key share data 2004 2005 2006 2007 2008 +/-% Year-end closing price High Low Number of shares Market capitalisation as at 31 December Average trading volume per day Annual performance with dividend Annual performance excluding dividend Beta factor 2) Earnings per share 3) Cash ï¬,ow per... -

Page 42

... 2008 30-day moving average Opening or closing price The highest price for the week Body is black if stock closed lower, body is white if it closed higher Opening or closing price The lowest price for the week Aug. 2008 Sep. 2008 Oct. 2008 Nov. 2008 Dec. 2008 Deutsche Post World Net Annual Report... -

Page 43

... with 75 % the year before - still advised investors to buy Deutsche Post shares, 23 % to hold and 14 % to sell. Their average price target was down from â,¬ 26 to â,¬ 14 per share. Most institutional investors in the United States Our ownership structure has scarcely changed from a year ago: KfW... -

Page 44

... price. As a result of this measure, Deutsche Post's stake in Postbank increased to 62.35 % for the time being. Exit from US domestic express market On 10 November 2008, the Group announced that it would withdraw from the domestic express business in the USA at the start of 2009. The international... -

Page 45

... Note 10 Portfolio expanded In the reporting year, the main changes to our portfolio were as follows: • FC (Flying Cargo) International Transportation Ltd., an Israeli company domiciled in Tel Aviv, was included for the first time in profit and loss. We purchased all shares in the company on 31... -

Page 46

...positive impact on earnings. However, the announced withdrawal from the domestic US express business has already reduced earnings by â,¬ 2,117 million. An impairment test led to a loss totalling â,¬ 610 million on the goodwill of Supply Chiin / CIS. In addition, we discontinued use of the Exel brand... -

Page 47

... the Annual General Meeting on 21 April 2009. The total dividend will amount to â,¬ 725 million. Based on the year-end closing price of Deutsche Post shares, the net dividend yield is 5.0 %. The dividend will be distributed on 22 April 2009 and is tax-free for shareholders resident in Germany. 725... -

Page 48

... the Group's financial indicators. Average drawings on credit lines came to only around 17 % in 2008 (previous year: 4.4 %). Managing market price risks The Group manages financial market risk by making use of both primary and derivative financial instruments. Interest rate risks are managed... -

Page 49

... reports and the underlying planning data. Qualitative factors, such as industry-specific features and the company's market position and range of products and services, are also taken into account. The creditworthiness of our Group is reviewed on an ongoing basis by international rating agencies... -

Page 50

... participation in the capital increase at Deutsche Postbank AG. The financial liabilities reported in our balance sheet break down as follows: Financial liabilities (Postbank at equity) â,¬m 2008 Bonds Due to banks Finance lease liabilities Liabilities to Group companies Other ï¬nancial liabilities... -

Page 51

... activities were centred in Germany, the UK and Belgium. In Asia, the focus was on India, Singapore and South Korea. Capex and depreciation, full year â,¬m MAIL 2007 2008 2007 EXPRESS 2008 FORWARDING/ FREIGHT 2007 2008 SUPPLY CHAIN/ CIS 2007 2008 1) Capital expenditure of continuing operations... -

Page 52

... expanded warehousing capacity to support new business. In the Americas region, funds were allocated mainly to new business and building maintenance. The Corporate Information Solutions Business Unit purchased modern printing technology for â,¬ 37 million. Deutsche Post World Net Annual Report 2008 -

Page 53

... working capital was a key factor in the increase in net cash from operating activities. In particular, the reduction in receivables and other assets contributed to the improvement. Selected cash ï¬,ow indicators (Postbank at equity) â,¬m 2007 2008 Cash and cash equivalents as at 31 December Change... -

Page 54

... dividend paid to our shareholders for financial year 2007 accounted for the largest share. In addition, the repayment of financial liabilities led to a cash outflow of â,¬ 658 million. Due to the changes described in the cash flows from the individual activities, cash and cash equivalents increased... -

Page 55

... years required to pay outstanding debt using the whole of the cash flow generated in the year under review. As net debt has dropped and operating cash flow has increased, the dynamic gearing ratio has further improved from an average of 1.0 to 0.7 years. Deutsche Post World Net Annual Report 2008 -

Page 56

... of which Mail Communication Dialogue Marketing Press Services Parcel Germany Global Mail Retail Outlets Pension Service Consolidation / Other Return on sales 1) EXPRESS Loss from operating activities (EBIT) Revenue of which Europe Americas Asia Paciï¬c EEMEA (Eastern Europe, Middle East, Africa... -

Page 57

... Report Divisions 53 MAIL Business units and market positions We deliver Germany's mail Business units and products Mail Communication • Mail products • Special services • Franking • Philately Every single working day, we deliver around 70 million letters. This makes us Europe's largest... -

Page 58

... We deliver mail across borders, serve the domestic markets of countries outside of Germany and also provide special services beyond mail transport. We serve business customers in key domestic mail markets, including the USA, the Netherlands, the UK, Spain and France. In 2008, the global market for... -

Page 59

... Management Report Divisions 55 Strategy and goals Our goal is to continue operating highly profitably in order to compensate for the threat of a diminishing market share. To accomplish this, we plan to systematically expand our range of services, secure quality leadership, reinforce our position... -

Page 60

...structural changes in the way costs are allocated in connection with the unbundling of the SERVICES Division. The Corporate Information Solutions Business Unit is now reported on as part of the SUPPLY CHAIN / CIS Division. The Pension Service has been transferred from the FINANCIAL SERVICES Division... -

Page 61

... Germany - their sales volumes are dropping. Parcel Germany: sales items (millions) 2007 2008 +/-% Q 4 2007 Q 4 2008 +/-% Business customer parcels Private customer parcels Total 646 107 753 661 112 773 2.3 4.7 2.7 179 35 214 189 37 226 5.6 5.7 5.6 Deutsche Post World Net Annual Report 2008 -

Page 62

..., EBIT would have fallen by 14.9 % year-on-year due to the negative impact of increased costs and the aforementioned market environment. Operating cash flow amounted to â,¬ 2,235 million (previous year: â,¬ 1,946 million); the return on sales was 15.7 %. Deutsche Post World Net Annual Report 2008 -

Page 63

Group Management Report Divisions 59 EXPRESS Business units and market positions Network for time-critical shipments spans the globe Regions and products • Europe • Americas • Asia Pacific • EEMEA (Eastern Europe, Middle East and Africa) • DHL Same Day • DHL Time Deï¬nite • DHL Day... -

Page 64

... from US domestic express market B E C D 1) New market portrayal: These ï¬gures are estimates for outbound international shipments < 1,000 kg. Source: MRSC in co-operation with Colography Group 2008. As the largest express market in the Americas, the United States holds a unique position. It is... -

Page 65

...Petersburg from all of Europe's major cities and economic centres. Day-definite road transport in the Middle East, North Africa and Turkey was likewise expanded, enabling us to acquire new contracts in the automotive sector and the consumer goods industry. Deutsche Post World Net Annual Report 2008 -

Page 66

... the country will structure the reorganisation such as to reinforce our position as international shipping experts and ensure that customers receive high service quality. We will thus continue to pose an attractive alternative to our two main competitors in the US express market. Increasing presence... -

Page 67

... in the double digits. In the United States, however, revenue declined in organic terms year-on-year by 13.4 %. Shipment volumes in our domestic product lines were particularly hard hit by the weak US economy and our decision to cease domestic activities. Deutsche Post World Net Annual Report 2008 -

Page 68

... the region slowed mainly in the second half of 2008, we posted organic revenue growth of 9.1 %. Domestic shipment volumes continued to rise in this region. Double-digit revenue growth in the emerging markets In the EEMEA region (Eastern Europe, the Middle East and Africa), revenue increased by 15... -

Page 69

...Intermodal DHL is the world market leader in the air and ocean freight sector. Around 30,000 employees in 150 countries work to ensure that shipments of all kinds are transported to their destination by air or by sea. We also support our customers by providing special transport-related services: We... -

Page 70

... Strategy and goals We are well positioned in our markets due to our air freight, ocean freight and road transport services. Our goal is to continue to grow steadily and organically at a rate above the industry average. To this end, we pursue three approaches: Deutsche Post World Net Annual Report... -

Page 71

...November 2008, we opened the largest transhipment centre of its kind in the Middle East on 80,000 m² in Jebel Ali in the free-trade zone of Dubai. Our customers use the centre as an intermediate storage point when transporting goods between Europe, Africa and Asia. Revenue and earnings performance... -

Page 72

... Latin America, North Asia and Europe in particular. Our industrial projects business, which we have been focussing on for two years, made another above-average contribution to growth, especially in Asia, North America, the Middle East and Africa. European overland transport business performs stably... -

Page 73

Group Management Report Divisions 69 SUPPLY CHAIN/CORPORATE INFORMATION SOLUTIONS Business units and market positions In March 2008, the LOGISTICS Division was dissolved and replaced by the new GLOBAL FORWARDING / FREIGHT Division and the new SUPPLY CHAIN / CORPORATE INFORMATiON SOLUTIONS ... -

Page 74

... aimed at continuing to selectively expand our presence. In 2008, we succeeded in increasing revenue by nearly 20 % in these key emerging economies. We will continue to standardise our business models and deliver services to our customers more efficiently. Deutsche Post World Net Annual Report 2008 -

Page 75

... solutions business as a result of the economic downturn. More than 90 % contract renewal rate Supply Chain 2008: revenue by region Total revenue: â,¬ 12,469 million A B C 67 % Europe / Middle East /Africa 26 % Americas 7 % Asia Paciï¬c C B A In the Supply Chain Business Unit we signed new... -

Page 76

... as well as the decrease in equity holdings to be recognised in profit or loss - announced as an effort to reduce capital market-related risks and portfolios. With respect to net interest income and net fee and commission income - Postbank's customer business-related core income figures - the bank... -

Page 77

... review. Number of employees 2007 2008 +/-% Note 14 Continuing operations At year-end Headcount 1) Full-time equivalents 2) By segment MAIL EXPRESS GLOBAL FORWARDING / FREIGHT SUPPLY CHAIN / CIS Corporate Center / Other By region Germany Europe (excluding Germany) North, Central and South America... -

Page 78

...number of employees has risen dramatically in some cases; in America, however, the number has fallen due to restructuring of the express business. New collective pay agreements settled A C B 1) Full-time equivalents as at 31 December 2008. 2) Continuing operations. On 30 April 2008, Deutsche Post... -

Page 79

...A B 1) Number of trainees, annual average: 3,839. 2) Continuing operations. The new initiative Discover Logistics aims to present logistics as an exciting industry of the future and showcase DHL as an attractive employer. In the year under review, 8,500 users from 122 countries signed up for dhl... -

Page 80

.... In 2008, 135 top staff members met to establish networks, learn about business strategies and further develop their leadership skills. Our internal talent broker - a position we created last year - assisted in over 150 upper management placement processes, raising the internal placement rate to 86... -

Page 81

...below 2007 levels by the year 2020. As the largest global logistics company, this target makes us the first major company in our industry to set a quantifiable target that includes emissions from outsourced transport services. As an interim target, we are striving to improve our carbon efficiency by... -

Page 82

...in terms of sustainability was once again monitored by rating agencies in 2008. Sustainable Asset Management gave us a rating of 65 / 100 (previous year: 74 / 100). This drop is primarily due to a change in the rating method. The average score for transport and logistics companies was 50 points. The... -

Page 83

...in the Group. The heads of Global Sourcing and their sixteen product group managers work closely with regional procurement managers and report to the head of Corporate Procurement. This allows us to pool our needs worldwide whilst satisfying the service and quality requirements of internal customers... -

Page 84

...and ensure high quality and flexibility in the supply chain. In the reporting year, nine suppliers were the best at meeting these requirements. We recognised them at our first Global Supplier Day for exceptional, substantially improved and innovative services. Since 2008, all standard contracts have... -

Page 85

... times: 43 hours on average We use all available technical and operational tools to ensure high-quality and efficient mail processing. In Germany, we maintain a nationwide transport and delivery network consisting of 82 mail centres that process an average of some 70 million items per working day... -

Page 86

... to Asia we have seen document transit performance improvements by more than three percentage points. • Further improvements were made in transit time: An average of 98.8 % (previous year: 98.0 %) of all shipments were delivered by the appointed time. • In terms of customer service, DHL Express... -

Page 87

...having improved our services through strict quality management and implementation of our First Choice methodology. In addition, the logistics magazine Supply Chain Asia named us Airfreight Forwarder of the Year 2008. Focus on customer satisfaction reaps rewards in contract logistics business GLOBAL... -

Page 88

... Press Services • Retail Outlets • Pension Service What our brands do DHL • EXPRESS • GLOBAL FORWARDING/FREIGHT • SUPPLY CHAIN/CIS • Global Mail • Parcel Germany Well-established and well-managed brands are amongst the most valuable assets of any company, domestic or international... -

Page 89

... All business involves opportunities and risks. Our Group-wide opportunity and risk management system gives us a head start in dealing with potential changes and events. The process developed to serve this system is built around uniform methods to identify and analyse key trends and to communicate... -

Page 90

... costcutting programme. Starting in 2009, the Group aims to lower indirect costs substantially - by â,¬ 1 billion by 2010. We also plan to increase our share of important domestic and international express and logistics markets. The restructuring of our US express business considerably reduces our... -

Page 91

...liberalisation of postal markets poses risks for Deutsche Post AG due to increased competition in Germany, it also opens up new opportunities in other European postal markets. In 2008, cross-border mail in Europe between Deutsche Post AG and 14 other Western European postal operators was governed by... -

Page 92

... risks for our express activities in the long term. We will refocus our US operations fully on the international express business. Restructuring will cost some â,¬ 3 billion spread over two years. The majority of this amount has already been recorded in 2008. Deutsche Post World Net Annual Report... -

Page 93

... Committee. A lower threshold of â,¬ 5 million applies to capital expenditures in Global Business Services. Approved projects are closely monitored, allowing material risks to be detected early at the Board level and appropriate action to be taken. Deutsche Post World Net Annual Report 2008 -

Page 94

...our domestic express business in the USA and are now concentrating on international business in that market. We began the restructuring process in November 2008, which will further reduce the number of employees there by 9,500. As reported in connection with business strategy risks, the overall cost... -

Page 95

... by changes in the availability and price of outside insurance. The second category consists of risks that have a low probability of occurrence but could entail high losses, such as air transport risks. These risks are transferred to external insurers. Deutsche Post World Net Annual Report 2008 -

Page 96

... sense. There are therefore no material risks to report in this area. Overall assessment of the Group's risk position The Group faces significant risks relating to general operating conditions and liberalisation of the German mail market. The global financial crisis and fierce competition are also... -

Page 97

... to 125,000 company employees at 2,400 sites in 28 European countries outside Germany, starting in spring 2009. We expect to save over â,¬ 150 million over the five-year term of the agreement. Structure of Postbank contract adjusted On 14 January 2009, Deutsche Post AG and Deutsche Bank AG agreed... -

Page 98

... forecasts 2008 2009 Global trade volume Real gross domestic product Global Industrial nations Emerging markets Central and Eastern Europe Former CIS states Emerging markets in Asia Middle East Latin America and the Caribbean Africa Source: IMF, World Economic Outlook, October 2008; update, January... -

Page 99

... market for press services is likely to contract somewhat because of the increasing use of new media. We are seeking to maintain our revenue position here too by drawing on rising subscription figures and higher average prices. The expected economic downturn will also impact the international mail... -

Page 100

... freight forwarding business services for SME In the coming year we plan to implement suitable solutions that will limit the impact of the anticipated economic downturn and gain additional market share. As part of this process, we will focus in particular on the important customer group of small... -

Page 101

... withdrew from the domestic US express business at the start of 2009 and will restructure our organisation accordingly. We will also streamline our management structure for sales and production in our MAIL Division with a view to improving our process management, optimising our costs and harmonising... -

Page 102

...to outsource. We expect that we will benefit in a weak economy from our leading market position and the trust vested in our customer relationships. As trust is important in a crisis, we expect that customers will prefer to stay with the provider they know. Deutsche Post World Net Annual Report 2008 -

Page 103

... marketing, value-added services based on mail, and transport and international delivery. By continuously improving the cost of our transport and delivery network and making the cost structure more flexible, we are able to respond faster to changes in mail volumes. Providing automated points of sale... -

Page 104

... focusing on customer relationships and project implementation. The potential annual savings in IT run into the triple-digit millions. This Annual Report contains forward-looking statements that relate to the business, financial performance and results of operations of Deutsche Post AG. Forward... -

Page 105

... and collection") will be installed in a total of 450 DHL Parcel Germany delivery vehicles by summer 2009. The system ensures that new employees not yet familiar with the area can find their destinations, and it will enable DHL to reduce labour costs, fuel consumption and CO2 emissions. Symbol... -

Page 106

103 109 111 112 113 114 REPORT OF THE SUPERVISORY BOARD SUPERVISORY BOARD Members Committees BOARD OF MANAGEMENT 109 109 MANDATES HELD BY THE BOARD OF MANAGEMENT MANDATES HELD BY THE SUPERVISORY BOARD CORPORATE GOVERNANCE REPORT Remuneration Report 116 -

Page 107

.... Our strategic corporate initiatives - Roadmap to Value, First Choice and GoGreen - have been well received. These programmes have already led to encouraging progress in increasing enterprise value, customer satisfaction and environmental protection. Deutsche Post World Net Annual Report 2008 -

Page 108

... to Value capital markets programme and personnel changes in the management of Deutsche Post AG. All major decisions affecting the company were discussed in detail with the Board of Management, which informed us in a timely and comprehensive manner on all key issues relating to planning and business... -

Page 109

... domestic US express business, including the costs that this will entail. In the future, Deutsche Post World Net will focus on its international core competencies in the US express market. The exit from the market occurred as planned in January 2009. As a Deutsche Post World Net Annual Report 2008 -

Page 110

..., a number of real estate transactions were approved. Furthermore, individual Board of Management members gave presentations on the business performance of their respective divisions for discussion by the committee. Key topics included the US express business, the mail business in Germany and the... -

Page 111

...of Management and the Supervisory Board submitted an updated Declaration of Conformity pursuant to Section 161 of the Aktiengesetz (Germany stock corporation act) and published it on the company's website. The previous declarations can also be viewed on this website. In financial year 2008, Deutsche... -

Page 112

... Committee, the Supervisory Board reviewed the annual and consolidated financial statements and the management reports for financial year 2008 in the financial statements meeting on 25 February 2009. The auditors' reports were made available to all Supervisory Board members and were discussed in... -

Page 113

...Council, Deutsche Post AG Silke Oualla-Weiß (until 6 May 2008) Chair of Works Council, DHL Express Betriebs GmbH, Düsseldorf (Dortmund ofï¬ce) Margrit Wendt (until 6 May 2008) Chair of European Works Council Forum Chair of Deutsche Post World Net Forum Deutsche Post World Net Annual Report 2008 -

Page 114

110 Deutsche Post World Net Annual Report 2008 -

Page 115

... Finance including Controlling, Corporate Accounting and Reporting, Investor Relations, Corporate Finance, Corporate Internal Audit/Security, Taxes and Global Business Services. C BRUCE EDWARDS SUPPLY CHAIN /CIS Born in 1955, member of the Board of Management since 4 March 2008, appointed until... -

Page 116

... Board, Deputy Chair) • PB Capital Corp.1) (Board of Directors, Chair) • PB (USA) Holdings Inc.1) (Board of Directors, Chair) • Bundesverband deutscher Banken e.V. (Berlin, Board of Directors) Statutory mandate Comparable mandate 1) Group mandate Deutsche Post World Net Annual Report 2008 -

Page 117

...2008) • Allianz Lebensversicherungs-AG • Bayer AG • Deutsche Bank AG, until 29 May 2008 • Deutsche Lufthansa AG (Chair) • Voith AG • Willy Bogner GmbH & Co. KG • LP Holding GmbH (Supervisory Board, Chair) • Tetra Laval Group (Switzerland, Board) Deutsche Post World Net Annual Report... -

Page 118

... to the Supervisory Board for a five-year term on an individual basis. In March 2008, an assembly of delegates elected new employee representatives to the Supervisory Board pursuant to the MitbestG. Their terms of office began upon the close of the AGM on Deutsche Post World Net Annual Report 2008 -

Page 119

... As part of our Group-wide compliance system, we have set up a Global Values Office and Regional Values Offices to provide advice on and monitor implementation of compliance processes. We have also established a Clearing Committee made up of members of our Deutsche Post World Net Annual Report 2008 -

Page 120

... and the company or its executive and controlling bodies did not call into question the auditors' independence. Remuneration Report The remuneration report also forms part of the Group Management Report. Board of Management remuneration The total remuneration paid to Board of Management members is... -

Page 121

... basis of a long-term incentive plan. The remuneration paid to active members of the Board of Management in financial year 2008 totalled â,¬ 11.89 million (previous year: â,¬ 15.70 million). This amount comprised â,¬9.01 million in non-performance-related components (previous year: â,¬ 8.68 million... -

Page 122

... prior to the issue date. The performance period is the last sixty trading days before the end of the lock-up period. The average share price (closing price) is calculated as the average of the closing rates of Deutsche Post shares in Deutsche Börse AG's Xetra electronic trading system. As in the... -

Page 123

... Board of Management may choose between ongoing pension payments and a lump sum payment. The benefit amount depends on the pensionable income and the pension level derived from the years of service. Pensionable income consists of the annual basic salary, which is calculated using the average salary... -

Page 124

... changes in the consumer price index in Germany. Pension commitments under the previous system: individual breakdown Pension commitments for the Board of Management Pension commitments Pension level on 31 Dec. 2008 % Maximum pension level % Service cost for pension obligation Financial year 2008... -

Page 125

...continued using the assessment basis applicable at the time of his appointment to the Board of Management. Pension commitments under the new system: individual breakdown â,¬ Total contribution for 2008 Pension account balance as at 31 Dec. 2008 Service cost for pension obligation Financial year 2008... -

Page 126

... conversion rate is less than 50 % of the value of the company. In the event the right to early termination is exercised or a Board of Management contract is terminated by mutual consent under the same conditions, the Board of Management member is entitled to payment to compensate the remaining term... -

Page 127

... compensation on a pro rata basis. The members of the Supervisory Board are entitled to claim out-of-pocket expenses incurred in the exercise of their office. Any value-added tax on the Supervisory Board remuneration and out-of-pocket expenses is reimbursed. Deutsche Post World Net Annual Report... -

Page 128

...work on the Supervisory Board. Shareholdings of the Board of Management and Supervisory Board As at 31 December 2008, the shares in Deutsche Post AG held by the Board of Management and Supervisory Board amounted to less than 1 % of the company's share capital. Deutsche Post World Net Annual Report... -

Page 129

...of collecting, handling and transporting used, damaged, unwanted and end-of-life goods and /or packaging for disposal, recycling or recovery. It can also refer to the return of reusable transit equipment (pallets, containers etc.) to a point further up the supply chain (upstream). Symbol: Recycling -

Page 130

... 172 172 BALANCE SHEET 32 33 Income tax assets and obligations 34 CASH FLOW STATEMENT 35 36 37 STATEMENT OF CHANGES IN EQUITY 38 39 40 SEGMENT REPORTING 41 42 43 NOTES Basis of accounting Consolidated group Signiï¬cant transactions New developments in international accounting under IFRS... -

Page 131

... costs Proï¬t / loss before income taxes Income tax expense Proï¬t / loss from continuing operations Discontinued operations Proï¬t / loss from discontinued operations Consolidated net proï¬t / loss for the period attributable to Deutsche Post AG shareholders Minorities Basic earnings per share... -

Page 132

... other securities from ï¬nancial services Financial instruments Cash and cash equivalents Assets held for sale Current assets Total assets EQUITY AND LIABILITIES Issued capital Other reserves Retained earnings Equity attributable to Deutsche Post AG shareholders Minority interest Equity Provisions... -

Page 133

... due to discontinued operations Total net cash used in ï¬nancing activities Net change in cash and cash equivalents Effect of changes in exchange rates on cash and cash equivalents Changes in cash and cash equivalents associated with assets held for sale Changes in cash and cash equivalents due to... -

Page 134

... net proï¬t 1) Total changes in equity recognised in income and not recognised in income Balance at 31 December 2007 Balance at 1 January 2008 Capital transactions with owner Capital contribution from retained earnings Dividend Stock option plans (exercise) Stock option plans (issuance) 2 19... -

Page 135

Consolidated Financial Statements 131 Segment Reporting Segments by division â,¬m MAIL 1) 1 January to 31 December 2007 2008 2007 EXPRESS 1) 2008 GLOBAL FORWARDING / FREIGHT 1) 2007 2008 SUPPLY CHAIN / Corporate Center / CIS 1) Other 1) 2007 2008 2007 2008 Continuing operations 2007 2008 ... -

Page 136

... and new company formations required to be included in financial year 2008: Companies included for the ï¬rst time Equity interest % Inclusion method Date of acquisition/ initial inclusion Notes EXPRESS Express Couriers Australia Pty Ltd., Australia Polar Air Cargo Worldwide Inc., USA SUPPLY CHAIN... -

Page 137

...of 2008, Deutsche Post Beteiligungen Holding GmbH, Germany, increased its stake in Williams Lea Holdings plc., UK, from 66 % to 96 % for a purchase price of â,¬ 220 million. The financial liability for the remaining outstanding shares fell to â,¬ 29 million. In April 2008, DHL Exel Supply Chain Hong... -

Page 138

...China) Co. Ltd., China (formerly Exel-Sinotrans Freight Forwarding Co. Ltd.) was included in the income statement items until March 2008 inclusive. Since April 2008, it has been included in the consolidated fi nancial statements as a fully consolidated company. Deutsche Post World Net Annual Report... -

Page 139

...core competencies in the US express market in future and will discontinue its domestic air and ground express business at the end of January 2009. However, the full range of the Group's international products will continue to be offered in the USA. The total restructuring costs will amount to around... -

Page 140

... October 2008. The Deutsche Postbank Group has made use of these amendments. Further details can be found in Note 38. New accounting pronouncements adopted by the European Union IFRS 8 (Operating Segments), which supersedes the existing IAS 14 (Segment Reporting), contains new provisions relating to... -

Page 141

... fi nancial statements since the Group is not applying the requirements of IFRS for the first time. In May 2008, the IASB issued Improvements to International Financial Reporting Standards 2008, the fi rst standard resulting from its annual improvement process which is intended to deal with minor... -

Page 142

... to net profit required led to changes in loans and advances to customers, deferred taxes and retained earnings. 5 expenses are generally translated at the monthly closing rates. The resulting currency translation differences are taken directly to equity. In financial year 2008, currency... -

Page 143

... costs to sell or its value in use, whichever is higher. The value in use is the present value of the pre-tax cash flows expected to be derived from the asset in future. The discount rate used is a pre-tax rate reflecting current market conditions. If the Deutsche Post World Net Annual Report 2008 -

Page 144

...rst time for financial year 2006. Under this option, fi nancial assets or financial liabilities may be measured at fair value through profit or loss on initial recognition if this eliminates or significantly reduces a measurement or recognition inconsistency (accounting mismatch). The Group made use... -

Page 145

... hedged item and the risk to be hedged, the Group uses fair value hedges and cash flow hedges. The carrying amounts of fi nancial assets not carried at fair value through profit or loss are tested for impairment at each balance sheet date and whenever there are indications of impairment. The amount... -

Page 146

... fair value thus calculated for probable options is recognised in income under staff costs and allocated over the term of the options. Stock appreciation rights (SAR) issued to members of the Board of Management and executives are measured on the basis of Deutsche Post World Net Annual Report 2008 -

Page 147

... entire length of service of the employees, taking into account changes in key parameters. The majority of the defined benefit plans in Germany relate to Deutsche Post AG. The defi ned benefit obligations of the Deutsche Postbank Group are almost entirely related to pension plans in Germany. Other... -

Page 148

...liabilities are calculated by using the tax rates applicable in the individual countries at the balance sheet date or announced for the time when the deferred tax assets and liabilities are realised. The tax rate of 29.8 % applied to German Group companies comprises the corporation tax rate plus the... -

Page 149

... following financial year. The Group has operating activities around the globe and is subject to local tax laws. Management can exercise judgement when calculating the amounts of current and deferred taxes. Although management believes that it has made a reasonable estimate relating to tax matters... -

Page 150

...units: Mail Communication, Dialogue Marketing, Press Services, Parcel Germany, Global Mail and the retail outlets. The Pension Service was transferred from the FINANCIAL SERVICES Division to the mail business. Corporate Information Solutions was transferred from the MAIL Division to the SUPPLY CHAIN... -

Page 151

... divisions. If comparable external market prices exist for services or products offered internally within the Group, these market prices or market-oriented prices are used as transfer prices (arm's length principle). The transfer prices for services for which no external market exists are generally... -

Page 152

... repayment. In June 2008, the provision for the funding of shortfalls in the Postal Civil Service Health Insurance Fund was reversed in the amount of â,¬ 61 million. Miscellaneous other operating income includes a large number of smaller individual items. Deutsche Post World Net Annual Report 2008 -

Page 153

...restructuring measures in the USA in relation to compensation payments. The average number of the Group's employees in the year under review, classified by employee group, was as follows: 2007 2008 Hourly workers and salaried employees Deutsche Postbank Group: 15,459 (previous year: 15,578) Civil... -

Page 154

...operating expenses 1) Change in presentation of the Deutsche Postbank Group (see Notes 3 and 5). MAIL EXPRESS GLOBAL FORWARDING / FREIGHT SUPPLY CHAIN / CIS Corporate Center / Other Write-downs 3 596 0 13 0 612 4 125 0 19 65 213 In the Americas region of the EXPRESS Division in the previous year... -

Page 155

...nancial statements and in the opening tax accounts amount to â,¬ 2.0 billion as at 31 December 2008 (previous year: â,¬ 3.4 billion). The effects from deferred tax assets of German Group companies not recognised on tax loss carryforwards and temporary differences relate primarily to Deutsche Post AG... -

Page 156

... million) on structured credit products. Charges of â,¬786 million were also determined in relation to the remeasurement of embedded derivatives from the structured credit substitution business. Consolidated net proï¬t / loss for the period In financial year 2008, the Group generated a consolidated... -

Page 157

...sheet items of the Deutsche Postbank Group as assets held for sale in accordance with IFRS 5. The addition in terms of purchased customer lists relates mainly to DHL Logistics China (â,¬56 million - value at the time of purchase price allocation). The BHW customer list recognised in ear- lier years... -

Page 158

...-tax discount rates are then determined iteratively. % The cash f low projections are based on management's adopted detailed budgets for EBIT and capital expenditure with a three-year planning horizon (2009 to 2011). The perpetual annuity (value added from 2012 on) is calculated using a long-term... -

Page 159

.... An impairment loss was also recognised for the Corporate Information Solutions (CIS) CGU as at 31 December 2008 in the amount of â,¬174 million. A total impairment loss of â,¬ 610 million was therefore determined for the SUPPLY CHAIN / CIS segment, largely caused by the general deterioration in... -

Page 160

... change in this balance sheet item is mostly due to the disposal of property by Deutsche Post AG as a result of the sale of the portfolio to the investor Lone Star and to the reclassification of the amounts relating to the Deutsche Postbank Group (previous year: â,¬ 73 million), which are reported... -

Page 161

... be able to use these tax loss carryforwards and temporary differences within the framework of tax planning. Most of the loss carry forwards are attributable to Deutsche Post AG. It will be possible to utilise these tax loss carryforwards for an indefinite period of time. For foreign companies, the... -

Page 162

... from cost absorption Receivables from sales of assets Creditors with debit balances Receivables from insurance business Receivables from Group companies Receivables from employees Rent receivables Receivables from loss compensation (recourse claims) Receivables from cash on delivery Receivables... -

Page 163

... reported under these items relate mainly to the following matters: Assets 2007 2008 2007 Liabilities 2008 Deutsche Postbank Group Deutsche Postbank Group - BHW Bank's credit card and sales ï¬nancing business DHL Express (France) SAS - land/buildings Deutsche Post AG - real estate DHL Supply Chain... -

Page 164

...796 2,727 56,000 To increase share capital against non-cash contributions 2003 Executive Stock Option Plan Exercise of option/conversion rights 39.3 Authorisation to acquire own shares By way of a resolution adopted by the Annual General Meeting on 6 May 2008, the company is authorised to acquire... -

Page 165

...Meeting. Deutsche Post AG did not hold any own shares on 31 December 2008. 39.4 Disclosures on corporate capital (Postbank at equity) The equity ratio stood at 23.8 % in financial year 2008 (previous year: 31.4 %). Corporate capital is controlled by the net gearing ratio which is defined as net debt... -

Page 166

...in the statement of changes in equity. 41 â,¬m Deutsche Postbank Group DHL Sinotrans International Air Courier Ltd., China Other companies Minority interest 2007 restated 1) 2008 2,633 60 85 2,778 1,914 67 45 2,026 â,¬m As at 1 January Dividend payment Consolidated net proï¬t or loss for the... -

Page 167

... determined by taking into account current long-term rates of return on bonds (government and corporate) and then applying to these rates a suitable risk premium for other asset classes based on historical market returns and current market expectations. Deutsche Post World Net Annual Report 2008 -

Page 168

...present value of the obligation, the fair value of plan assets and the pension provision Deutsche Postbank Group Germany United Kingdom Other Total 2008 Present value ... 1,149 - 1,149 0 8,196 4,050 12,246 - 6,235 - 439 -2 2 5,572 262 5,834 - 1,149 4,685 Deutsche Post World Net Annual Report 2008 -

Page 169

... Financial Statements 165 Notes 44.5 â,¬m Changes in the present value of total deï¬ ned beneï¬ t obligations Deutsche Postbank Group Germany United Kingdom Other Total 2008 Present value of total deï¬ned beneï¬t obligations at 1 January Current service cost, excluding employee... -

Page 170

... the amounts of the Deutsche Postbank Group would result in a present value of defi ned benefit obligations of â,¬ 10,853 million as at 31 December 2008, a fair value of plan assets of â,¬ 5,843 million and a funded status of â,¬ 5,010 million in total. Deutsche Post World Net Annual Report 2008 -

Page 171

... are expected with regard to net pension provisions in 2009 (â,¬ 275 million of this relates to the Group's expected direct pension payments and â,¬ 308 million to expected employer contributions to pension funds, excluding the Deutsche Postbank Group). Deutsche Post World Net Annual Report 2008 -

Page 172

... the extent that they exceed the greater of 10 % of the present value of the obligations or of the fair value of plan assets. The excess amount is spread over the expected remaining working lives of active employees and recognised in the income statement. Deutsche Post World Net Annual Report 2008 -

Page 173

...year: â,¬ 96 million) by other tax provisions. Risks from business activities comprise obligations such as expected losses and warranty obligations. Miscellaneous other provisions include a large number of individual items, none of which exceeds â,¬ 30 million. Deutsche Post World Net Annual Report... -

Page 174

... classified as liabilities from financial services. 46 â,¬m The decrease in fi nancial liabilities mainly results from reclassifying the subordinated debt of the Deutsche Postbank Group as liabilities associated with assets held for sale in accordance with IFRS 5. 2007 2008 Bonds, of which non... -

Page 175

...conditions Carrying amount 2007 â,¬m Carrying amount 2008 â,¬m Bank Interest rate End of term Deutsche Post International B. V., Netherlands Deutsche Post International B. V., Netherlands Deutsche Post International B. V., Netherlands Deutsche Post AG, Germany Deutsche Post AG, Germany European... -

Page 176

...102 5,112 The increase in the derivatives' fair value mainly results from exchange rate fluctuations and an increase in the portfolio's volume. Further details on derivatives can be found in Note 51.2. Of the tax liabilities, â,¬ 349 million (previous year: â,¬ 341 million) are accounted for by VAT... -

Page 177

... financial liabilities) result in net cash from or used in operating activities. Net cash from operating activities can be broken down into net cash from operating activities before changes in working capital and net cash from changes in working capital. 50.1 Deutsche Post World Net Annual Report... -

Page 178

...company for dividend payments or the repayment of debt. Since net cash from operating activities rose and net cash used in investing activities fell, free cash flow (continuing operations) improved significantly increasing from â,¬ 1,498 million in the previous year to â,¬ 2,448 million in financial... -

Page 179

...operational risk control and reporting at Group level. The Internal Audit unit is a key element of the Deutsche Postbank Group's business and process-independent monitoring system. In terms of the Postbank's organisational structure, it is assigned to the chairman of the Management Board and reports... -

Page 180

... and reported regularly to the Deutsche Postbank Group management. The market disruptions have had a clearly negative impact on capital market portfolios and thus on the earnings situation of the Deutsche Postbank Group in financial year 2008. The risk profi le of the Deutsche Postbank Group in 2008... -

Page 181

... contracts of the Deutsche Postbank Group â,¬m Notional amount 2007 Fair value Positive fair values Negative fair values Notional amount 2008 Fair value Positive fair values Negative fair values Trading derivatives Currency derivatives OTC products Currency forwards Currency swaps Total portfolio... -

Page 182

... fair value Fair values of financial instruments which are carried at amortised cost or at the hedged fair value are compared with the carrying amounts in the following table: Carrying amounts / fair value â,¬m 2007 Carrying amount Fair value 2008 Carrying amount Fair value Assets Cash reserve... -

Page 183

... to limit them. The financial instruments used are accounted for in accordance with IAS 39. Liquidity management Liquidity in the Group is managed in a largely centralised system to ensure a continuous supply of cash for the Group companies. Liquidity reserves consist of bilateral credit lines... -

Page 184

... requires a company to disclose a sensitivity analysis, showing how profit or loss and equity are affected by hypothetical changes in exchange rates at the reporting date. In this process, the hypothetical changes in exchange rates are analysed in relation Deutsche Post World Net Annual Report 2008 -

Page 185

... accounts as well as internal and external loans extended by Deutsche Post AG. In addition, hypothetical changes in exchange rates affect equity and the fair values of those derivatives used to hedge off-balance-sheet obligations and highly probable future currency transactions - designated as cash... -

Page 186

...counterparty limit, the use of which is regularly monitored. An impairment test is performed at the balance sheet dates to see whether, due â,¬m Carrying amount before impairment loss to the individual counterparty's credit rating, an impairment loss is to be recognised for the positive fair values... -

Page 187

... to â,¬ 34 million (previous year: â,¬- 11 million). The significant increase in the fair values compared with 2007 is explained by the change in market rate levels. As at 31 December 2008, a â,¬ 30 million (previous year: â,¬ 35 million) adjustment was made to the carrying amount of the underlying... -

Page 188

...risk, and their fair values at the balance sheet date amounted to â,¬ 15 million (previous year: â,¬26 million). The investments relate to internal Group loans which mature in 2014. The Group is exposed to cash flow risks arising from variable interest rate liabilities. These risks were hedged using... -

Page 189

... the scope of IFRS 7 Fair value of ï¬nancial instruments under IFRS 7 Amortised cost Amortised cost Fair value Amortised cost 406 55 5,917 37 1,350 ... 103 - 499 - 32 - 103 - 117 0 - 3,711 - 3,293 - 250 - 779 - 4,980 - 1,034 - 10,336 - 531 - 3,931 Deutsche Post World Net Annual Report 2008 -

Page 190

...a hedged item in a fair value hedge and are thus subject to a basis adjustment. Accounting is therefore neither fully at fair value nor at amortised cost. 2) Restatement of the prior-year ï¬gure due to the Deutsche Postbank Group restatement (see Note 5). Deutsche Post World Net Annual Report 2008 -

Page 191

...Outside the scope of IFRS 7 Fair value of ï¬nancial instruments under IFRS 7 Amortised cost Amortised cost Fair value Amortised cost 115 6,679 134,160 52 4,683... 251 - 40 0 - 8,403 - 337 - 1,556 - 5,384 - 186,763 - 4,531 - 625 - 4,822 - 570 203,013 Deutsche Post World Net Annual Report 2008 -

Page 192

... for which a fair value cannot be determined reliably. The shares in these companies are not quoted on an active market; they are therefore recognised at cost. There are no plans to sell a material number of the available-for-sale financial assets recognised as at 31 December 2008 in the near future... -

Page 193

... universal service and competitive services. Th is also relates to co-operation agreements between Deutsche Post AG and Deutsche Postbank AG as well as between Deutsche Post AG and the business parcel service marketed by DHL Vertriebs GmbH. Deutsche Post AG and Deutsche Postbank AG hold that the new... -

Page 194

...the company or to receive a cash settlement in the amount of the difference between the issue price and the average price of the Deutsche Post shares during the last five trading days prior to the exercise date, at the respective Board member's discretion. Deutsche Post World Net Annual Report 2008 -

Page 195

... the respective closing price of Deutsche Post shares on the previous day and the fi xed issue price, if demanding performance targets are met. The fair value of the 2006 SAR Plan and the 2006 Long-Term Incentive Plan (LTIP) for Board members was determined using a stochastic simulation model. As... -

Page 196

... companies were conducted on an arm's length basis at standard market terms and conditions. Transactions were conducted in financial year 2008 with major related parties, resulting in the following items in the consolidated financial statements: Deutsche Post World Net Annual Report 2008 -

Page 197

... as the service cost resulting from the pension provisions for active members of the Board of Management. The share-based remuneration amount relates to the share-based remuneration expense recognised in financial year 2008. It is itemised in the following table: 2008 SAR Total Stock options SAR... -

Page 198

... the active members of the Board of Management in financial year 2008 including the components with long-term incentive effect totalled â,¬ 16.7 million (previous year: â,¬ 22.1 million). Of this amount, â,¬ 9.0 million (previous year: â,¬ 8.7 million) relates to components not linked to performance... -

Page 199

...DHL Express (Netherlands) B.V. DHL International (UK) Ltd. DHL Sinotrans International Air Courier Ltd. DHL Logistics (Brazil) Ltda. DHL Logistics (China) Co., Ltd. DHL Logistics (Schweiz) AG DHL Exel Supply Chain (Spain) S. L. Williams Lea Limited DHL Danzas Air & Ocean (Netherlands) B.V DHL Global... -

Page 200

... GmbH • Deutsche Post World Net Market Research and Innovation GmbH • DHL Airways GmbH • DHL Automotive GmbH • DHL BWLog GmbH • DHL Express Germany GmbH • DHL Global Forwarding GmbH • DHL Global Management GmbH • DHL Home Delivery GmbH • DHL Hub Leipzig GmbH • DHL International... -

Page 201

...the Spanish telecommunications operator Telefónica signed a telecoms service agreement in January 2009 to manage services across 28 European countries over the next five years. Telefónica will thus become the Group's primary fi xed and mobile telecommunications provider in Europe. The agreement is... -

Page 202

...assets Financial instruments Cash and cash equivalents Assets held for sale Current assets Total assets EQUITY AND LIABILITIES Issued capital Other reserves Retained earnings Equity attributable to Deutsche Post AG shareholders Minority interest Equity Provisions for pensions and other employee bene... -

Page 203

... consolidated fi nancial statements give a true and fair view of the assets, liabilities, financial position and profit or loss of the Group, and the management report of the Group includes a fair review of the development and performance of the business and the position of the Group, together with... -

Page 204

... consolidated financial statements prepared by Deutsche Post AG, Bonn, comprising the income statement, the balance sheet, cash flow statement, statement of changes in equity and the notes to the consolidated financial statements, together with the group management report for the business year from... -

Page 205

...: Our customers are able to buy stamps for their mail via the internet, whether it be for a letter, package or parcel. The two-dimensional barcode can be printed out from their computer using a standard printer. The barcode contains all the important information about the item, such as the type of... -

Page 206

203 204 206 III IV INDEX GLOSSARY CONTACTS 8-YEAR REVIEW EVENTS -

Page 207

... B Balance sheet 50 f., 128, 136 ff., 144 ff., 153 ff. Board of Management Bonds Brands 17 f., 25 ff., 104 ff., 111, 114 ff., 190 ff., 199 44, 46, 170 25, 33, 71, 84, 99, 135, 150, 153 G Global Business Services C Capital expenditure Cash conversion rate Cash ï¬,ow Cash ï¬,ow statement Collective... -

Page 208

... markets in the member states of the European Union. Global Customer Solutions Customer relationship management organisation for the Group's largest and most important global clients. Contract logistics Performance of complex logistics and logisticsrelated tasks along the value chain by a service... -

Page 209

..., price control and the universal service. Standard periodical A press product of which no more than 30 % consists of journalistic reporting. Supply chain A series of connected resources and processes from sourcing materials to delivering goods to consumers. Deutsche Post World Net Annual Report... -

Page 210

... annual report External E-mail: ir @ deutschepost.de Online: investors.dpwn.com Internal GeT and DHL Webshop Mat. no. 675- 602- 211 Publication On 10 March 2009, in German and English. English translation Deutsche Post Foreign Language Services et al. The English version of the Annual Report 2008... -

Page 211

8-Year Review 8-year review 2001 to 2008 â,¬m 2001 restated 2002 restated 2003 restated 2004 restated 2005 restated 2006 restated 2007 restated 2008 Revenue MAIL EXPRESS LOGISTICS GLOBAL FORWARDING / FREIGHT SUPPLY CHAIN / CIS FINANCIAL SERVICES SERVICES Divisions total Corporate Center / Other (... -

Page 212

...net debt and equity (from 2004 including minority interest). 12) Net debt / cash ï¬,ow from operating activities. 13) The weighted average number of shares for the period was used for the calculation. 14) Cash ï¬,ow from operating activities. 15) To be proposed to the AGM. 16) Year-end closing price... -

Page 213

IV Events Financial calendar 1) 21 April 2009 6 May 2009 23 July 2009 31 July 2009 5 November 2009 Annual General Meeting (Frankfurt am Main) Interim report on the ï¬rst quarter of 2009, investors conference call Press conference and investors conference on the ï¬rst half of 2009 Interim report... -

Page 214

Deutsche Post AG Headquarters Investor Relations 53250 Bonn Germany www.dpwn.com