Crucial 2011 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2011 Crucial annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

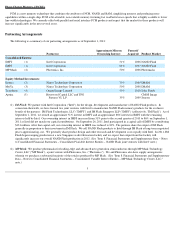

On September 24, 2010, Oracle America Inc. ("Oracle"), successor to Sun Microsystems, a DRAM purchaser that opted-out of a direct

purchaser class action suit that was settled, filed suit against us in U.S. District Court for the Northern District of California. The complaint alleges

DRAM price-fixing and other violations of federal and state antitrust and unfair competition laws based on purported conduct for the period from

August 1, 1998 through at least June 15, 2002. Oracle is seeking joint and several damages, trebled, as well as restitution, disgorgement, attorneys'

fees, costs and injunctive relief.

We are unable to predict the outcome of these lawsuits. An adverse court determination in any of these lawsuits alleging violations of antitrust

laws could result in significant liability and could have a material adverse effect on our business, results of operations or financial condition.

The semiconductor memory industry is highly competitive.

We face intense competition in the semiconductor memory market from a number of companies, including Elpida Memory, Inc.; Hynix

Semiconductor Inc.; Samsung Electronics Co., Ltd.; SanDisk Corporation; Spansion Inc. and Toshiba Corporation. Some of our competitors are

large corporations or conglomerates that may have greater resources to withstand downturns in the semiconductor markets in which we compete,

invest in technology and capitalize on growth opportunities. Our competitors seek to increase silicon capacity, improve yields, reduce die size and

minimize mask levels in their product designs. The transitions to smaller line-width process technologies and 300mm wafers in the industry have

resulted in significant increases in the worldwide supply of semiconductor memory. Increases in worldwide supply of semiconductor memory also

result from semiconductor memory fab capacity expansions, either by way of new facilities, increased capacity utilization or reallocation of other

semiconductor production to semiconductor memory production. Our competitors may increase capital expenditures resulting in future increases

in worldwide supply. Increases in worldwide supply of semiconductor memory, if not accompanied with commensurate increases in demand,

would lead to further declines in average selling prices for our products and would materially adversely affect our business, results of operations

or financial condition.

The downturn in the worldwide economy may harm our business.

The downturn in the worldwide economy had an adverse effect on our business. A continuation or further deterioration of depressed

economic conditions could have an even greater adverse effect on our business. Adverse economic conditions affect demand for devices that

incorporate our products, such as personal computers and other computing and networking products, mobile devices, Flash memory cards and

USB devices. Reduced demand for our products could result in continued market oversupply and significant decreases in our average selling

prices. A continuation of current negative conditions in worldwide credit markets would limit our ability to obtain external financing to fund our

operations and capital expenditures. In addition, we may experience losses on our holdings of cash and investments due to failures of financial

institutions and other parties. Difficult economic conditions may also result in a higher rate of losses on our accounts receivables due to credit

defaults. As a result, our business, results of operations or financial condition could be materially adversely affected.

Inotera's liquidity risk may adversely impact our ownership interest and supply agreement.

Because of significant market declines in the selling price of DRAM, Inotera incurred net losses of $278 million for the six-month period

ended June 30, 2011. Also, Inotera's current liabilities exceeded its current assets by $2.3 billion as of June 30, 2011, which exposes Inotera to

liquidity risk. Further, under generally accepted accounting principles in the Republic of China, Inotera reported a loss for its quarter ended

September 30, 2011 of an additional New Taiwan dollars 7,022 million (approximately $241 million U.S. dollars). Inotera's management has

developed plans to improve its liquidity. If Inotera is unable to adequately improve its liquidity, we may have to impair our $323 million

investment in Inotera. In connection with our ownership equity interest in Inotera, we have rights and obligations to purchase 50% of the wafer

production capacity of Inotera. In 2011, we purchased $ 641 million of DRAM products from Inotera, and our supply from Inotera accounted for

37% or our DRAM gigabit production in the fourth quarter of 2011. As a result, if our supply of DRAM from Inotera is impacted, our business,

results of operations or financial condition could be materially adversely affected.

Our supply agreement with Inotera involves numerous risks.

Our supply agreement with Inotera involves numerous risks including the following:

15

• we have experienced difficulties and delays in ramping production at Inotera on our technology and may continue to experience

difficulties and delays in the future;

• we may experience continued difficulties in transferring technology to Inotera;

• costs associated with manufacturing inefficiencies resulting from underutilized capacity;