Crucial 2011 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2011 Crucial annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 1A. RISK FACTORS

In addition to the factors discussed elsewhere in this Form 10-K, the following are important factors which could cause actual results or

events to differ materially from those contained in any forward-looking statements made by or on behalf of us.

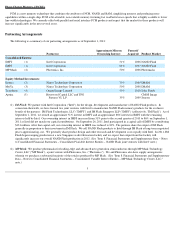

We have experienced dramatic declines in average selling prices for our semiconductor memory products which have adversely affected

our business.

If average selling prices for our memory products decrease faster than we can decrease per gigabit costs, our business, results of operations or

financial condition could be materially adversely affected. We have experienced significant decreases in our average selling prices in recent years

as noted in the table below. In some prior periods, average selling prices for our memory products have been below our manufacturing costs.

We may be unable to reduce our per gigabit manufacturing costs at the rate average selling prices decline.

Our gross margins are dependent upon continuing decreases in per gigabit manufacturing costs achieved through improvements in our

manufacturing processes, including reducing the die size of our existing products. In future periods, we may be unable to reduce our per gigabit

manufacturing costs at sufficient levels to improve or maintain gross margins. Factors that may limit our ability to reduce costs include, but are not

limited to, strategic product diversification decisions affecting product mix, the increasing complexity of manufacturing processes, technological

barriers and changes in process technologies or products that may require relatively larger die sizes. Per gigabit manufacturing costs may also be

affected by the relatively smaller production quantities and shorter product lifecycles of certain specialty memory products.

An adverse outcome relating to allegations of anticompetitive conduct could materially adversely affect our business, results of operations

or financial condition.

On May 5, 2004, Rambus, Inc. ("Rambus") filed a complaint in the Superior Court of the State of California (San Francisco County) against

us and other DRAM suppliers alleging that the defendants harmed Rambus by engaging in concerted and unlawful efforts affecting Rambus

DRAM ("RDRAM") by eliminating competition and stifling innovation in the market for computer memory technology and computer memory

chips. Rambus' complaint alleges various causes of action under California state law including, among other things, a conspiracy to restrict output

and fix prices, a conspiracy to monopolize, intentional interference with prospective economic advantage, and unfair competition. Rambus is

seeking a judgment for damages of approximately $3.9 billion, joint and several liability, trebling of damages awarded, punitive damages, a

permanent injunction enjoining the defendants from the conduct alleged in the complaint, interest, and attorneys' fees and costs. Trial began on

June 20, 2011, and the case went to the jury on September 21, 2011. At the time of this filing, a jury verdict is pending. We cannot predict when a

verdict will be reached or when a formal judgment would be entered by the Court subsequent to a verdict. In the event of an adverse judgment,

we would anticipate filing appropriate post-judgment motions and appeals. We may be required to post a bond or other security to stay

enforcement of an adverse judgment pending appeal. Depending on the amount required, we cannot assure you we would be able to obtain

sufficient security to pursue an appeal. We are unable to predict the outcome of this lawsuit and therefore cannot determine the likelihood of loss

nor estimate a range of possible loss. Accordingly, we have not provided an accrual for an adverse judgment in the September 1, 2011, financial

statements. However, we have accrued a liability and charged operations for estimated costs to successfully defend the matter. An adverse

judgment may have a material impact on our business, results of operations and financial condition, including liquidity.

14

DRAM

NAND Flash

(percentage change in average selling prices)

2011 from 2010

(39

)%

(17

)%

2010 from 2009

28

%

*

(18

)%

2009 from 2008

(52

)%

(56

)%

2008 from 2007

(51

)%

(67

)%

2007 from 2006

(23

)%

(56

)%

* Only increase in DRAM pricing since 2004.