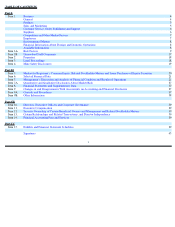

CompUSA 2014 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2014 CompUSA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our information systems networks, including our websites, and applications could be adversely affected by viruses or worms and may be

vulnerable to malicious acts such as hacking. The availability and efficiency of sales via our websites could also be adversely affected by

“denial of service”

attacks and other unfair competitive practices. Although we take preventive measures, these procedures may not be

sufficient to avoid harm to our operations, which could have an adverse effect on our results of operations.

On March 10, 2015 the Company announced that its Technology Products business segment would be exiting the retail store business in

order to accelerate its focus on its business to business (“B2B”)

operations. This exit plan includes the closing of substantially all of its

retail stores , closing a distribution center ,

and implementing a general workforce reduction to align available resources with a B2B focus

as well as transitioning retail customers to online consumer sales. The Company has engaged outside firms to assist with the retail store

liquidation ,

as well as the workforce reduction, and anticipates that all of these actions will be completed by the end of the second quarter

of 2015. The Company anticipates that one time exit charges will aggregate between $50 and $55 million (including approximately $4

million of severance expenses, and $39 million in lease exit costs) substantially all of which will require cash expenditures. The Company

expects these costs to be paid out beginning in the first quarter of 2015 through the end of 2017

. After completion of these actions the

Company will see a substantial decline in retail revenues, however the Company expects to realize improved profitability of between $18

and $22 million.

There can be no assurance the Company will timely realize the level of proceeds it expects from the liquidation of the retail store

inventory or that it will be able to timely

exit its existing lease commitments at expected costs levels. Failure to achieve these expectations

will result in increased cash exit costs for the Company and could have a material adverse effect on its operating results.

The Company

believes it will be able to maintain its key B2B vendor relationships despite decreases in previous levels of purchasing from those venders

attributable to the closed retail store business; however, there can be no assurance the Company will not experience difficulties with

certain vendor relationships. There can be no assurance the Company can effectively transition former customers of its retail stores to

become customers of the Company’s online websites. There can be no assurance that the exit activities described above ,

and the

accelerated focusing of our efforts on B2B operations ,

will be sufficient to stabilize our North America Technology Products business

and allow for the growth of our B2B business . There is no assurance that our

marketing and merchandising strategies will improve our

operating results.

There are risks and uncertainties associated with effecting acquisition transactions, particularly

in integrating and managing the combined

operations, technologies, technology platforms and products of the acquired companies and realizing the anticipated economic,

operational and other benefits in a timely manner. Our failure to do so could result in substantial costs and delays or other operational,

technical or financial problems. Integration efforts also may divert management attention and resources.

We have made two acquisitions in the past twelve months, and there is a risk that integration difficulties or a significant decline in

revenues of the acquired business may cause us not to realize expected benefits from the transactions and may affect our results. The

success of these acquisitions depends on our ability to realize the anticipated benefits and cost savings from combining the acquired

businesses with our existing business, including growing the revenues of the acquired businesses through cross selling and other

initiatives. We may not be able to achieve these objectives, in whole or in part, or be able to do so in a timely manner. Furthermore, the

acquired businesses are, and will in the short term continue to be, engaged in transitioning their businesses from the existing IT platforms

on which they operate (and which are licensed from the sellers of those businesses under standard transition services agreements) to our

IT platforms. This transition is complicated and affects many inter-

related business functions; if we are unable to timely and effectively

affect the IT transition aspect of the integration, or fail to do so without disruption, the acquired businesses operations and our results

would be materially adversely affected. The integration process, and the issues that can arise, can be complex and unforeseen operating

challenges or unbudgeted situations can occur. Additional risks in acquisition transactions may include our inability to timely and

effectively integrate the acquired company’

s accounting, human resource, and other administrative systems, and coordination of product,

sales and marketing functions. In the case of foreign acquisitions, such as the acquisition of SCC/Misco, we will need to integrate

operations across different cultures and languages and to address the particular economic, currency, political, and regulatory risks

associated with specific countries.

Subject to certain exceptions, generally we will be responsible for the liabilities and obligations of the

acquired businesses incurred or occurring prior to acquisition, including contingent liabilities. In this regard, we rely heavily on the

representations and warranties provided to us by the sellers of acquired companies, including as they relate to compliance with laws and

contractual requirements. If any of these representations and warranties is inaccurate or breached, such inaccuracy or breach could result

in costly litigation and assessment of liability for which there may not be adequate recourse against

such sellers, in part due to contractual

time limitations and limitations of liability.

11

Table of Contents

•

We are accelerating our focus on our B2B technology business and exiting the retail store consumer electronics business; the success of

our North America Technology Products segment is dependent on our ability to grow our B2B business.

•

We have recently completed two acquisitions; our operations will be impacted by our ability to timely and efficiently transition and

integrate those acquisitions with the rest of our business in the US and EMEA.