Cogeco 2002 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2002 Cogeco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8Cogeco Cable Inc.

The following presents a more in-depth analysis of the

Corporation’s operations and current financial position,

as well as a perspective on the future. This analysis

should be read in conjunction with the Corporation’s

consolidated financial statements, which start on page

21 and the selected quarterly information on page 40.

Certain statements throughout these pages may constitute

forward-looking statements that involve risks and uncer-

tainties. Future results will be affected by a number o f

factors pertaining to technology, markets, competition

and regulation, including those described in the uncertainties

and main risk factors section of this management’s

discussion and analysis. Therefore, actual results may be

materially different from those expressed or implied by

such forward-looking statements.

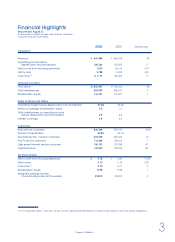

Discussion on the Achievement

of our Key Financial Objectives

Cogeco Cable achieved a 2.1% revenue growth, mainly

owing to the full-year impact in revenue of acquisitions

during fiscal year 2001. The Corporation achieved an

increase in revenue from continued growth in customers

with high-speed Internet and digital services and rate

increases implemented during fiscal years 2001 and

2002. As of August 31, 2002, Cogeco Cable served

158,192 high-speed Internet customers, surpassing its

original target of 148,000. With 144,950 digital terminals,

Cogeco Cable also exceeded its original target of

130,000. However, this growth was mostly offset by a

decline in revenue from the loss of basic and extended

tier customers as well as promotions and price re d u c t i o n s .

As of August 31, 2002, Cogeco Cable was serving

836,368 basic service customers, of which 71% w e r e

located in Ontario and 29% in Quebec. This translates i n t o

a loss of 4.8% of Cogeco Cable’s basic service customer

base since the end of fiscal year 2001. These losses have

mostly been the result of greater than anticipated

competitive pre s s u res from direct-to-home satellite

providers, which have made significant investments to

build market share, and from “black market” US and

Canadian satellite use. Consequently, Cogeco Cable

fell short of its original revenue growth target.

Cogeco Cable’s operating margin before depreciation

and amortization increased from 36.6% in fiscal year

2001 to 37.6% for fiscal year 2002. This improvement is

due to cost reduction initiatives in fiscal years 2001 and

2002, and ongoing process improvements. Although a

margin of 38.5% was planned, the increase was an

a c h i e v e m e n t considering the slower revenue growth

during fiscal year 2002.

The Corporation continued its vast network modern i z a t i o n

p rogram with the result that 86% of households are cur-

rently served by two-way broadband cable plant. During

fiscal year 2002, investments were made in high-speed

I n t e rnet and digital technology niches, including VOD.

During the first quarter of fiscal year 2002, Cogeco Cable

completed the transition of its high-speed Internet service

to provide a fully independent service for its Ontario

customers, ending its relationship with Excite@HomeT M.

Consequently, Cogeco Cable now serves all of its high-

speed Internet customers independently.

During fiscal year 2002, the $122.1 million capital expen-

diture program, less than originally planned, was mostly

financed through $111.2 million of Cash Flow (the

Corporation defines “Cash Flow” as cash flow from

operating activities before unusual items and changes in

non-cash working capital items). The balance was

financed from existing bank credit facilities. Due to lower

than expected revenue growth, the Corporation slightly

missed its original target of funding its capital expendi-

tures solely from Cash Flow. Depreciation of fixed assets,

amortization of deferred charges, and financial expense

were essentially in line with original targets.

Management’s Discussion

and Analysis