Cogeco 2002 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2002 Cogeco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

Cogeco Cable Inc.

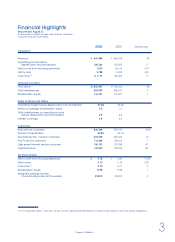

Capital Expenditures

(in millions of dollars)

2001 2002 2003

Actual Actual Forecast

System modernization,

extension and fiber optic $ 67 40% $ 57 47% $ 47 44%

High-speed Internet and

digital technology 38 23 20 16 26 24

Maintenance and other 61 37 45 37 34 32

To t a l $1 6 6 1 0 0% $ 1 2 2 1 0 0 % $ 1 0 7 1 0 0 %

Cable System Acquisitions

During fiscal year 2002, Cogeco Cable did not acquire

any cable systems. In fiscal year 2001, Cogeco Cable

completed the acquisition of cable systems serving

approximately 73,700 basic service customers in Ontario

and 30,100 basic service customers in Quebec. The total

purchase price for cable system acquisitions completed

during 2000–2001 amounted to $226.1 million, and was

financed by cash payments totaling $80.9 million as well

as the issue of approximately 3.8 million subordinate

voting shares.

Capital Ex p e n d i t u res and

D e f e r red Charge s

The annual capital expenditure program decreased

from $166.4 million in 2000–2001 to $122.1 million in 2001–

2002. The table below presents a summary of capital

expenditures for the past two fiscal years, and the fore-

cast for 2002–2003.

The 2002 capital expenditures plan focused mainly on

completing the two-way broadband upgrade of the

network, as well as extending digital technology to the

remaining Quebec regions. As of August 31, 2002, 86% of

Cogeco Cable’s total homes passed had access to

high-speed Internet, and digital services were offered to

close to 95% of homes passed.

Increase in deferred charges went from $1.5 million in

fiscal year 2001 to $28.0 million in fiscal year 2002.

$20.3 million of this increase relates to subsidies on sales

of 71,233 digital terminals, and other costs incurred in

order to expand customer base. The balance relates to

costs from the issuance of two Senior Secured Notes,

from the amendment to the Term Facility and from the

introduction of new digital services.

F i n a n c i n g

On November 1, 2001, Cogeco Cable completed, pur-

suant to a private placement, the issue of 6.83% Series A

Senior Secured Notes for US $150 million maturing October

31, 2008, and 7.73% Series B Senior Secured Notes for CDN

$175 million maturing October 31, 2011. In addition,

Cogeco Cable completed cro s s - c u r r ency swap agre e-

ments to fully hedge its financial obligations with re s p e c t

to the US denominated Series A Senior Secured Notes.

Taking into consideration the cro s s - c u r rency swap agre e-

ments, the interest rate effectively incurred by Cogeco

Cable for the Series A Senior Secured Notes is 7.254%. Net

p roceeds of CDN $410 million, after underwriters’ fees and

other expenses, were applied to reduce Cogeco Cable’s

bank debt.

At its request and in light of the successful completion of

the private placement mentioned above, Cogeco

Cable amended its Te rm Facility during the fourth

quarter of fiscal year 2002. The changes resulted in a

reduction of the total commitment from $585 million to

$400 million. The amendment also provides the Corpo-

ration with more financial flexibility, while the maturity of

the facility and future reduction of commitment levels

remain unchanged.

No dividend was paid during fiscal year 2002. In the first

quarter of fiscal year 2001, the Corporation paid a

dividend of $0.03 per share and no dividend was paid

t h e re a f t e r. This revised dividend policy reflected more

d i fficult than expected competitive conditions and the

Corporation’s need to focus more of its available cash flow

on investments in system upgrades and new technologies.