Cogeco 2002 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2002 Cogeco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

Cogeco Cable Inc.

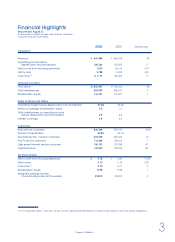

Financial Highlights

Years ended August 31,

(in thousands of dollars, except rates of return and ratios,

customers and per share data)

2002 2001 Variance

Operations

Revenue $ 447,984 $ 438,768 2%

Operating income before

depreciation and amortization 168,346 160,509 5

Net income from recurring operations 7,200 26,616 (73)

Net income 3,788 5,818 (35)

Cash Flow(1) 111,173 105,369 6

Financial Condition

Total assets $1,833,967 $1,784,264 3%

Total indebtedness 829,599 805,572 3

Shareholders’ equity 716,797 712,877 1

Rates of Return and Ratios

Operating margin before depreciation and amortization 37.6% 36.6%

Return on average shareholders’ equity 0.5 1.0

Total indebtedness on operating income

before depreciation and amortization 4.9 5.0

Interest coverage 2.8 3.0

Customers

Basic service customers 836,368 878,766 (5)%

Percent of penetration 60.8% 64.7%

Discretionary Tier 1 service customers 633,078 684,026 (7)

Pay-TV service customers 116,484 108,626 7

High-speed Internet service customers 158,192 107,938 47

Digital terminals 144,950 105,292 38

Per Share (basic)

Net income from recurring operations $ 0.18 $ 0.69 (74)%

Net income 0.10 0.15 (33)

Cash Flow(1) 2.79 2.71 3

Shareholders’ equity 17.98 17.88 1

Weighted average number

of outstanding shares (in thousands) 39,872 38,813 3

(1) The Corporation defines “Cash Flow” as cash flow from operating activities before unusual items and changes in non-cash working capital items.