Cogeco 2002 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2002 Cogeco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.11

Cogeco Cable Inc.

On November 16, 2001, Cogeco Cable completed the

transition of its high-speed Internet service in Ontario to

become a fully integrated service provider, and ceased

to do business with Excite@HomeT M, which was in financial

d i fficulty. For fiscal year 2002, the net cost savings from the

transition have had the effect of increasing operating

income before depreciation and amortization by

$2.4 million. During the fourth quarter of fiscal year 2002,

the monthly increase in operating income before depre-

c i a t i o n and amortization per high-speed Internet cus-

tomer amounted to an average of $2.72.

Other operating costs, expressed as a percentage of

revenue, declined in 2001–2002. The decrease in other

operating costs is the result of an overall cost re d u c t i o n

plan started in the second quarter of fiscal year 2001.

Cogeco Cable further reduced its staff by appro x i m a t e l y

100 full-time employees during the first quarter of fiscal

year 2002, which has led to significant cost reductions.

Management fees to COGECO Inc. re p resented appro x i-

mately 1.7% of revenue in fiscal year 2002, unchanged

f rom fiscal year 2001. For fiscal year 2003, management

expects these fees to be indexed, based on the Consumer

Price Index, and to re p r esent a marginally smaller pro p o r-

tion of re v e n u e .

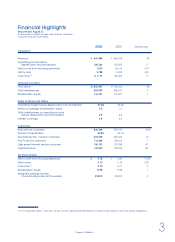

Operating Income before

Depreciation and Amortization

Operating income before depreciation and amortization

totaled $168.3 million, an increase of $7.8 million or 4.9%.

The operating margin before depreciation and amortization

increased from 36.6% to 37.6%. The increase is the result

of Cogeco Cable’s cost reduction initiatives.

Depreciation, Amortization and

Financial Expense

As a result of the adoption by the Corporation of the

new accounting requirements of the Canadian Institute

of Chartered Accountants (“CICA”), the customer base

ceased to be amortized effective September 1, 2001.

Amortization of the customer base amounted to $10.4

million ($9.4 million after income taxes) during fiscal

year 2001. The new recommendations also require that

the Corporation review its intangible assets for

impairment as of the date of adoption of the new

recommendations, and at least annually in subsequent

periods. Management has completed its review, which

indicates that intangible assets are not impaired as at

August 31, 2002.

D e p reciation and amortization rose by 3.3%, from

$92.1 million in fiscal year 2001 to $95.1 million in fiscal

year 2002, (excluding amortization of the customer base

in 2001, depreciation and amortization increased by

16.4% in 2002). The increase stemmed mainly from the

following: the network modernization program, capital

e x p e n d i t u re s related to high-speed Internet and digital

s e r v i c e s, higher deferred charges principally resulting

from subsidies on sales of 71,233 digital terminals during

fiscal year 2002, and cable system acquisitions during

fiscal year 2001.

Financial expense climbed by 10.8%, from $53.8 million in

fiscal year 2001 to $59.6 million in fiscal year 2002. Major

factors explaining this increase were: cable systems

acquired during fiscal year 2001, the higher interest rates

on the Senior Secured Notes issued on November 1,

2001, compared to those of the Term Facility, and the

cost to finance the portion of capital expenditures and

d e f e r re d charges exceeding Cash Flow.

Unusual Items

In 2001–2002, Cogeco Cable incurred an expense of

$4.9 million before income taxes as a result of staff

reductions. In 2000–2001, the Corporation elected to

write off its investment in IP telephony for $29.3 million

and other assets for $1.2 million, for an aggregate

amount of $30.5 million before income taxes.