Cogeco 2002 Annual Report Download

Download and view the complete annual report

Please find the complete 2002 Cogeco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual

Report 2002

Table of contents

-

Page 1

Annual Report 2002 -

Page 2

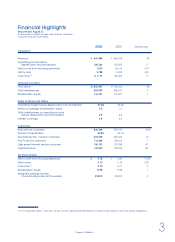

... Management's Discussion and Analysis Consolidated Financial Statements Ten-Year Financial Highlights Selected Quarterly Information Investor Information Customer Statistics Corporate Management and Board of Directors Operations and Corporate Information 3 4 8 21 38 40 41 42 43 44 Cogeco Cable... -

Page 3

...Toronto Stock Exchange. Cogeco Cable is evolving into one of Canada's major telecommunications companies, by building on its cable distribution base with the offering of analog, digital and high-speed Internet services. Cogeco Cable provides 1,124,358 service units to the 1,375,494 households passed... -

Page 4

... and amortization Interest coverage Customers Basic service customers Percent of penetration Discretionary Tier 1 service customers Pay-TV service customers High-speed Internet service customers Digital terminals Per Share (basic) Net income from recurring operations Net income Cash Flow (1) $1,833... -

Page 5

... of both legal and illegal satellite services has caused the number of Cogeco Cable's basic video service customers to decline by 5%. The spectacular 47% growth in customers to the Cogeco Cable high-speed Internet service and 35% growth in customers to its digital service allowed the Corporation... -

Page 6

... with each passing quarter, starting with 1.5% in the second quarter, 1.3% in the third and 1.0% in the fourth. High sales and promotion costs associated with a $20 rebate for each of the first five months of the Cogeco Cable high-speed Internet service were in line with prevailing market conditions... -

Page 7

... by good take-up rates. Currently, 16.5% of basic video service customers in areas where the service is available subscribe to the digital service. This will likely increase following the introduction of our new Video-On-Demand (VOD) and Interactive Television (iTV) services, currently at various... -

Page 8

..., high-speed Internet and eventually telephony to the existing basic video services, thus confirming that Cogeco Cable is a sound long-term investment vehicle. We wish to take this opportunity to extend our appreciation to members of the Board of Directors and to the management and staff of Cogeco... -

Page 9

... in customers with high-speed Internet and digital services and rate increases implemented during fiscal years 2001 and 2002. As of August 31, 2002, Cogeco Cable served 158,192 high-speed Internet customers, surpassing its original target of 148,000. With 144,950 digital terminals, Cogeco Cable also... -

Page 10

...were implemented, ranging from $2 to $3 per customer for discretionary tiers and most service bundles offered in Ontario. In addition, a $5 monthly rate increase for high-speed Internet customers in Ontario and Quebec was introduced during the second semester of fiscal year 2002. A price increase of... -

Page 11

..., the increased number of customers subscribing to product bundling, the launch of ARTV (a new tier channel in Quebec) and the launch of 50 specialty channels available on the Ontario digital product offering. The savings related to the cancellation of Excite@HomeTM royalties, as Cogeco Cable became... -

Page 12

...is the result of an overall cost reduction plan started in the second quarter of fiscal year 2001. Cogeco Cable further reduced its staff by approximately 100 full-time employees during the first quarter of fiscal year 2002, which has led to significant cost reductions. Management fees to COGECO Inc... -

Page 13

...15 per share in fiscal year 2001. Supplemental Discussion - Accounting for Stock Options During fiscal year 2002, 161,909 stock options were granted. The Corporation early adopted the new CICA recommendations regarding stock-based compensation. As discussed in Note 12 on page 32, Cogeco Cable has... -

Page 14

... 2002 capital expenditures plan focused mainly on completing the two-way broadband upgrade of the network, as well as extending digital technology to the remaining Quebec regions. As of August 31, 2002, 86% of Cogeco Cable's total homes passed had access to high-speed Internet, and digital services... -

Page 15

... Shares (The Toronto Stock Exchange) (in dollars) 93 94 95 96 97 98 99 00 01 02 Share Price/Cash Flow Share Price/Shareholders' Equity 24,000 12,000 98 99 00 01 02 Trading Volume of Subordinate Voting Shares (The Toronto Stock Exchange) (in thousands of shares) 14 Cogeco Cable... -

Page 16

... $25 million operating line of credit with a number of financial institutions. These bank facilities are not guaranteed by the parent company COGECO Inc. As at August 31, 2002, the Corporation had utilized $129 million of its Term Facility. Cogeco Cable is on schedule with financial expense payments... -

Page 17

... growth should stem mainly from the 2002 rate increases for the high-speed Internet service and Quebec basic service, from the growth in penetration of high-speed Internet and digital services, and from the introduction of VOD and iTV services. Cogeco Cable expects to achieve 6% growth in operating... -

Page 18

... capital in property, plant and equipment. Cogeco Cable plans to continue investing in cable system capacity upgrades, two-way capability and additional equipment required to support the distribution of more video services, including digital television services, VOD and iTV services, as well as the... -

Page 19

... the lawful reception of licensed Canadian direct-to-home satellite services, and from the unlawful reception of both licensed Canadian and unlicensed US satellite services. While the rate of erosion of Cogeco Cable's analog customer base has abated somewhat and the Corporation's digital customer... -

Page 20

... fees and lower operating margins as a result. Buy rates and related returns from the VOD service will be influenced by the availability and cost of premium movie products yet to be licensed by a number of major film producers and distributors. Cogeco Cable is relying on Worldgate Interactive, Inc... -

Page 21

... it has become increasingly difficult to manage the changes required by the diverse and rapidly changing cable service offerings in a highly competitive environment. Cogeco Cable is still considering a range of options for the development and integration of its cable customer management systems. The... -

Page 22

... Statements Table of Contents Management's Responsibility Auditors' Report Consolidated Statements of Income Consolidated Statements of Retained Earnings Consolidated Balance Sheets Consolidated Statements of Cash Flow Notes to Consolidated Financial Statements 22 22 23 23 24 25 26 Cogeco Cable... -

Page 23

...external auditors have free access to the Audit Committee, with or without the presence of management. Their report follows. Louis Audet President and Chief Executive Officer Pierre Gagné Vice-President, Finance and Chief Financial Officer Auditors' Report To the Shareholders of Cogeco Cable Inc... -

Page 24

... (in thousands of dollars) 2002 Balance at beginning Changes in accounting policies Net income Share issue costs, net of related income taxes of $1,372 Excess of price paid over the attributed value of subordinate voting shares cancelled Dividends on multiple voting shares Dividends on subordinate... -

Page 25

... of dollars) 2002 Assets Fixed assets (note 7) Deferred charges (note 8) Customer base (note 9) Cash and cash equivalents Accounts receivable Income tax receivable Prepaid expenses $...264 On behalf of the Board of Directors Maurice Myrand Director Henri P. Labelle Director 24 Cogeco Cable Inc. -

Page 26

... financing activities Increase in long-term debt Repayment of long-term debt Issue of subordinate voting shares Subordinate voting shares issue costs Purchase of subordinate voting shares for cancellation Dividends on multiple voting shares Dividends on subordinate voting shares Net change in cash... -

Page 27

... per share data) 1. Significant accounting policies Nature of operations Cogeco Cable Inc. (the "Corporation") is a Canadian public company whose shares are listed on the Toronto Stock Exchange. The Corporation's core business is providing cable television services and high-speed Internet access... -

Page 28

... 31, 2002, management has determined that no impairement existed. The following table shows the effect of applying the recommendations on net income and basic and diluted earnings per share for the year ended August 31, 2001: Net income Amortization of customer base, net of income taxes Adjusted... -

Page 29

... cost for employee stock options as the excess, if any, of the quoted market price of the subordinate voting shares at the date of grant over the amount an employee must pay to acquire these shares, and to include in its financial statements pro forma disclosures of net income and earnings per share... -

Page 30

... assets Future income tax liabilities: Fixed assets Deferred charges Customer base Total future income tax liabilities Net future income tax liabilities 67,931 11,719 142,901 222,551 $ 172,667 $ 45,353 4,531 49,884 $ 2001 30,557 5,219 35,776 54,011 8,059 141,321 203,391 $ 167,615 Cogeco Cable Inc... -

Page 31

... 1, 2000, and resulted in an increase in future income tax liabilities of $71.2 million, an increase in customer base of $69.1 million and a decrease in retained earnings of $2.1 million. 7. Fixed assets 2002 Cost Lands Buildings Cable systems Equipment, programming equipment, furniture and... -

Page 32

... coupon rate of 6.83% per annum, payable semi-annually. These agreements have resulted in an effective interest rate of 7.254% on the Canadian dollar equivalent of the U.S. debt. The exchange rate applicable to the principal portion of the debt has been fixed at CDN $1.5910. Cogeco Cable Inc... -

Page 33

...530,548 $ 628,894 2002 Number of shares Balance at beginning Shares issued for cash consideration Shares issued for the acquisition of cable systems (note 3) Shares issued for cash under the Employee Stock Purchase Plan and the Stock Option Plan Purchase of shares for cancellation Balance at end 24... -

Page 34

...000 shares are available under this plan. A total of 2,000,000 subordinate voting shares are reserved for the purpose of the Stock Option Plan. The minimum purchase price for which options are granted is not less than the market value of such shares at the time the option is granted. Granted options... -

Page 35

...Earnings per share The following table provides a reconciliation between basic and diluted earnings per share: 2002 Net income Weighted average number of multiple voting and subordinate voting shares outstanding Effect of dilutive stock options Weighted average number of diluted multiple voting and... -

Page 36

... through leases. Disbursements for the purchase of fixed assets totaled $121,323,000 ($165,592,000 in 2001). c) Other information 2002 Financial expense paid Income taxes paid Shares issued for the acquisition of cable systems $ 46,767 4,680 - 2001 $ 40,705 3,348 145,293 Cogeco Cable Inc. 35 -

Page 37

... pension plan. The following table provides a reconciliation of the change in the plans' benefit obligations and fair value of plan assets, and a statement of the funded status as at August 31: 2002 Change in accrued benefit obligation Accrued benefit obligation at beginning of year Service cost... -

Page 38

..., financial and strategic planning services. Under this agreement, the Corporation pays management fees equal to 2% of its total revenue subject to a maximum amount. Management fee payments, as at August 31, 2002, are limited to $7,710,000 ($7,518,000 in 2001) and are indexed annually based on the... -

Page 39

... than twelve months of the acquisitions of Cablevue (Quinte) Limited and related companies, of Harrowby Communications and related companies, of Muskoka Cable Systems Limited and related companies, of Huntsville Cable Services Limited, of Médiacâble inc. and of Décibel inc. 38 Cogeco Cable Inc. -

Page 40

... of its related companies for a nine-month and six-day period only. Furthermore, this ratio does not consider that cash and cash equivalents were used subsequently to reduce total indebtedness. (11) Operating income before depreciation and amortization / Financial expense. Cogeco Cable Inc. 39 -

Page 41

...changes in non-cash working capital items. (2) The addition of quarterly per share information may not correspond to the total given the fluctuation of shares outstanding. Trading Statistics (in dollars, except subordinate voting share volumes) The Toronto Stock Exchange 2002 Quarters ended, High... -

Page 42

... Debentures, Series A BBB (Low) BB (High) BBB BBB - Cogeco Cable's credit ratings have a negative trend. As at August 31,2002 Share Information Number of multiple voting shares (10 votes per share) outstanding Number of subordinate voting shares (1 vote per share) outstanding 15,691,100 24,182... -

Page 43

... is offered. Bundles including basic service, discretionary tiers, multiple outlets with the option to include pay television, the advantages of digital service and high-speed Internet service. Basic Service Breakdown by province Ontario Southern Regions Other Regions Quebec Total in Canada 643,112... -

Page 44

... and General Manager, Cable Ontario Jules Grenier Vice-President and General Manager, Cable Quebec Yves Mayrand Vice-President, Legal Affairs and Secretary Ron Perrotta Vice-President, Marketing and Sales Louise St-Pierre Vice-President and Chief Information Officer Christian Jolivet Director, Legal... -

Page 45

....: (819) 372-9292 Fax: (819) 372-3318 Jules Grenier Vice-President and General Manager Hélène Dubuc Vice-President, Communications and Programming Jacques Gravel Vice-President, Network Operations Corporate Information Head Office 1 Place Ville Marie Suite 3636 Montreal, Quebec H3B 3P2 Tel.: (514...