Chesapeake Energy 2013 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2013 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9

Costs Incurred in Natural Gas and Oil Property Acquisition, Exploration and Development

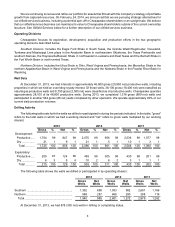

The following table sets forth historical costs incurred in natural gas and oil property acquisitions, exploration and

development activities during the periods indicated:

Years Ended December 31,

2013 2012 2011

($ in millions)

Acquisition of Properties:

Proved properties ................................................................................... $ 22 $ 332 $ 48

Unproved properties ............................................................................... 997 2,981 4,736

Exploratory costs ...................................................................................... 699 2,353 2,261

Development costs ................................................................................... 4,888 6,733 5,497

Costs incurred(a)(b) .............................................................................. $ 6,606 $ 12,399 $ 12,542

___________________________________________

(a) Exploratory and development costs are net of joint venture drilling and completion cost carries of $884 million,

$784 million and $2.570 billion in 2013, 2012 and 2011, respectively.

(b) Includes capitalized interest and asset retirement cost as follows:

Capitalized interest ........................................................................... $ 815 $ 976 $ 727

Asset retirement obligations ............................................................. $ 7 $ 32 $ 3

A summary of our exploration and development, acquisition and divestiture activities in 2013 by operating division

is as follows:

Gross

Wells

Drilled

Net

Wells

Drilled

Exploration

and

Development

Acquisition

of Unproved

Properties

Acquisition

of Proved

Properties

Sales of

Unproved

Properties

Sales of

Proved

Properties Total(a)

($ in millions)

Southern.. 1,352 698 $ 4,233 $ 169 $ 22 $ (1,252) $ (1,130) $ 2,042

Northern... 588 287 1,354 828 — (570) (411) 1,201

Total.... 1,940 985 $ 5,587 $ 997 $ 22 $ (1,822) $ (1,541) $ 3,243

___________________________________________

(a) Includes capitalized internal costs of $315 million and related capitalized interest of $815 million.

Acreage

The following table sets forth as of December 31, 2013 the gross and net developed and undeveloped natural

gas and oil leasehold and fee mineral acreage. "Gross" acres are the total number of acres in which we own a working

interest. "Net" acres refer to gross acres multiplied by our fractional working interest. Acreage numbers do not include

our unexercised options to acquire additional acreage.

Developed

Leasehold Undeveloped

Leasehold Fee Minerals Total

Gross

Acres Net

Acres Gross

Acres Net

Acres Gross

Acres Net

Acres Gross

Acres Net

Acres

(in thousands)

Southern.................. 6,528 3,271 4,376 2,724 127 18 11,031 6,013

Northern .................. 2,113 1,505 8,284 4,806 752 466 11,149 6,777

Total..................... 8,641 4,776 12,660 7,530 879 484 22,180 12,790

Most of our leases have a three- to five-year primary term, and we manage lease expirations to ensure that we

do not experience unintended material expirations. Our leasehold management efforts include scheduling our drilling

to establish production in paying quantities in order to hold leases by production, timely exercising our contractual

rights to pay delay rentals to extend the terms of leases we value, planning noncore divestitures to high-grade our