Chesapeake Energy 2013 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2013 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.7

Our proved reserves as of December 31, 2013 included PUDs more than directly offsetting producing wells in

two resource plays: the Marcellus Shale and the Eagle Ford Shale. In all other areas, we restricted PUD locations to

immediate offsets to producing wells. Within the Marcellus and Eagle Ford Shale plays, we used both public and

proprietary geologic data to establish continuity of the formation and its producing properties. This included seismic

data and interpretations (2-D, 3-D and micro seismic); open hole log information (collected both vertically and

horizontally) and petrophysical analysis of the log data; mud logs; gas sample analysis; drill cutting samples;

measurements of total organic content; thermal maturity; sidewall cores; whole cores; and data measured in our internal

core analysis facility. After the geologic area was shown to be continuous, statistical analysis of existing producing

wells was conducted to generate an area of reasonable certainty at distances from established production. Undrilled

locations within this proved area could be booked as PUDs. However, due to other factors and requirements of SEC

reserves reporting rules, numerous locations within the proved area of these two statistically evaluated plays have not

yet been booked as PUDs.

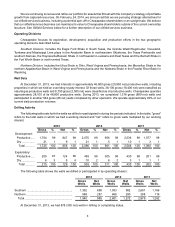

Our annual net decline rate on producing properties is projected to be 30% from 2014 to 2015, 20% from 2015

to 2016, 15% from 2016 to 2017, 12% from 2017 to 2018 and 11% from 2018 to 2019. Of our 1.809 bboe of proved

developed reserves as of December 31, 2013, 183 mmboe, or approximately 10%, were non-producing.

Chesapeake's ownership interest used in calculating proved reserves and the associated estimated future net

revenue was determined after giving effect to the assumed maximum participation by other parties to our farm-out and

participation agreements. The prices used in calculating the estimated future net revenue attributable to proved reserves

do not reflect market prices for natural gas and oil production sold subsequent to December 31, 2013. The estimated

proved reserves may not be produced and sold at the assumed prices.

The Company's estimated proved reserves and the standardized measure of discounted future net cash flows of

the proved reserves as of December 31, 2013, 2012 and 2011, and the changes in quantities and standardized measure

of such reserves for each of the three years then ended, are shown in Supplemental Disclosures About Natural Gas,

Oil and NGL Producing Activities included in Item 8 of this report. No estimates of proved reserves comparable to those

included herein have been included in reports to any federal agency other than the SEC.

There are numerous uncertainties inherent in estimating quantities of proved reserves and in projecting future

rates of production and timing of development expenditures, including many factors beyond our control. The reserve

data represent only estimates. Reserve engineering is a subjective process of estimating underground accumulations

of natural gas and oil that cannot be measured exactly, and the accuracy of any reserve estimate is a function of the

quality of available data and of engineering and geological interpretation and judgment. As a result, estimates made

by different engineers often vary. In addition, results of drilling, testing and production subsequent to the date of an

estimate may justify revision of such estimates, and such revisions may be material. Accordingly, reserve estimates

often differ from the actual quantities of natural gas, oil and NGL that are ultimately recovered. Furthermore, the

estimated future net revenue from proved reserves and the associated present value are based upon certain

assumptions, including prices, future production levels and costs that may not prove correct. Future prices and costs

may be materially higher or lower than the prices and costs as of the date of any estimate.

Reserves Estimation

Chesapeake's Corporate Reserves Department prepared approximately 19% of the proved reserves estimates

(by volume) disclosed in this report. Those estimates were based upon the best available production, engineering and

geologic data.

Chesapeake's Director - Corporate Reserves is the technical person primarily responsible for overseeing the

preparation of the Company's reserve estimates. His qualifications include the following:

• 16 years of practical experience in petroleum engineering, including eight years of this experience in the

estimation and evaluation of reserves;

• Bachelor of Science degree in Chemical Engineering; and

• member in good standing of the Society of Petroleum Engineers.

We ensure that the key members of the Department have appropriate technical qualifications to oversee the

preparation of reserves estimates, including, with respect to our engineers, a minimum of an undergraduate degree

in petroleum, mechanical or chemical engineering or other applicable technical discipline. With respect to our

engineering technicians, a minimum of a four-year degree in mathematics, economics, finance or other technical/