Chesapeake Energy 2013 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2013 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

___________________________________________

(a) Oil equivalent is based on six mcf of natural gas to one barrel of oil or one barrel of NGL. This ratio reflects an

energy content equivalency and not a price or revenue equivalency. In recent years, the price for a bbl of oil and

NGL has been significantly higher than the price for six mcf of natural gas.

(b) Includes revenue and operating costs and excludes depreciation and amortization, general and administrative

expenses, impairments of fixed assets and other, net gains or losses on sales of fixed assets and interest expense.

See Depreciation and Amortization of Other Assets, Impairments of Fixed Assets and Other and Net (Gains)

Losses on Sales of Fixed Assets under Results of Operations in Item 7 for details of the depreciation and

amortization and impairments of assets and net gains or losses on sales of fixed assets associated with our

marketing, gathering and compression and oilfield services operating segments.

(c) Includes stock-based compensation and excludes restructuring and other termination costs.

(d) Includes the effects of realized (gains) losses from interest rate derivatives, but excludes the effects of unrealized

(gains) losses from interest rate derivatives; amount is shown net of amounts capitalized. Realized (gains) losses

include settlements related to the current period interest accrual and the effect of (gains) losses on early terminated

trades. Unrealized (gains) losses include changes in the fair value of open interest rate derivatives offset by

amounts reclassified to realized (gains) losses during the period.

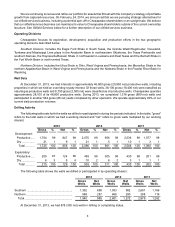

Natural Gas, Oil and NGL Reserves

The tables below set forth information as of December 31, 2013 with respect to our estimated proved reserves,

the associated estimated future net revenue and present value (discounted at an annual rate of 10%) of estimated

future net revenue before and after future income taxes (standardized measure) at such date. Neither the pre-tax

present value of estimated future net revenue nor the after-tax standardized measure is intended to represent the

current market value of the estimated natural gas, oil and NGL reserves we own. All of our estimated natural gas and

oil reserves are located within the U.S.

December 31, 2013

Natural Gas Oil NGL Total

(bcf) (mmbbl) (mmbbl) (mmboe)

Proved developed ............................................... 8,583 201 177 1,809

Proved undeveloped ........................................... 3,151 223 122 869

Total proved(a) ....................................................... 11,734 424 299 2,678

Proved

Developed Proved

Undeveloped Total

Proved

($ in millions)

Estimated future net revenue(b) ........................................................... $ 30,414 $ 17,921 $ 48,335

Present value of estimated future net revenue(b) .............................. $ 15,371 $ 6,305 $ 21,676

Standardized measure(b)(c) ............................................................................................................................ $ 17,390

Operating Division Natural

Gas Oil NGL Oil

Equivalent

Percent of

Proved

Reserves Present

Value

(bcf) (mmbbl) (mmbbl) (mmboe) ($ millions)

Southern .......................... 6,974 383 220 1,766 66% $ 15,087

Northern........................... 4,760 41 79 912 34% 6,589

Total............................. 11,734 424 299 2,678 100% $ 21,676 (b)

(a) Includes 61 bcf of natural gas, 2 mmbbl of oil and 6 mmbbl of NGL reserves owned by the Chesapeake Granite

Wash Trust, 30 bcf of natural gas, 1 mmbbl of oil and 3 mmbbl of NGL of which are attributable to the noncontrolling

interest holders.

(b) Estimated future net revenue represents the estimated future gross revenue to be generated from the production

of proved reserves, net of estimated production and future development costs, using prices and costs under

existing economic conditions as of December 31, 2013. For the purpose of determining "prices", we used the

unweighted arithmetic average of the prices on the first day of each month within the 12-month period ended