Chesapeake Energy 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

-

113

-

114

-

115

-

116

-

117

-

118

-

119

-

120

-

121

-

122

-

123

-

124

-

125

-

126

-

127

-

128

-

129

-

130

-

131

-

132

-

133

-

134

-

135

-

136

-

137

-

138

-

139

-

140

-

141

-

142

-

143

-

144

-

145

-

146

-

147

-

148

-

149

-

150

-

151

-

152

-

153

-

154

-

155

-

156

-

157

-

158

-

159

-

160

-

161

-

162

-

163

-

164

-

165

-

166

-

167

-

168

-

169

-

170

-

171

-

172

-

173

-

174

-

175

-

176

-

177

-

178

-

179

-

180

Table of contents

-

Page 1

-

Page 2

-

Page 3

-

Page 4

-

Page 5

-

Page 6

-

Page 7

... City, Oklahoma 73118 (Address of principal executive offices) (Zip Code) (405) 848-8000 (Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered Common Stock, par value $0.01 New...

-

Page 8

... Disagreements With Accountants on Accounting and Financial Disclosure ...Controls and Procedures ...Other Information ...PART III Directors, Executive Officers and Corporate Governance...Executive Compensation ...Security Ownership of Certain Beneficial Owners and Management and Related Stockholder...

-

Page 9

... Barnett Shale in the Fort Worth Basin of north-central Texas. We also own substantial marketing, compression and oilfield services businesses. The map below illustrates the locations of Chesapeake's natural gas and oil exploration and production operations.

The Company's estimated proved reserves...

-

Page 10

... structure to best position the Company to maximize shareholder value going forward as we execute our strategic priorities. We reorganized the Company into Northern and Southern operating divisions as well as an Exploration and Subsurface Technology unit and Operations and Technical Services unit...

-

Page 11

...Barnett Shale in the Fort Worth Basin in north-central Texas. Northern Division. Includes the Utica Shale in Ohio, West Virginia and Pennsylvania, the Marcellus Shale in the northern Appalachian Basin in West Virginia and Pennsylvania and the Niobrara Shale in the Powder River Basin in Wyoming. Well...

-

Page 12

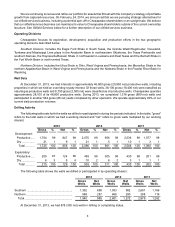

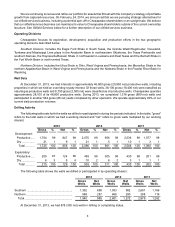

... The following table sets forth information regarding the production volumes, natural gas, oil and NGL sales, average sales prices received, other operating income and expenses for the periods indicated: Years Ended December 31, 2013 2012 2011 Net Production: Natural gas (bcf) ...Oil (mmbbl) ...NGL...

-

Page 13

...(b)

(c) (d)

Natural Gas, Oil and NGL Reserves The tables below set forth information as of December 31, 2013 with respect to our estimated proved reserves, the associated estimated future net revenue and present value (discounted at an annual rate of 10%) of estimated future net revenue before and...

-

Page 14

... in 2013 related primarily to revised well spacing in our core development area in the Marcellus Shale, the extension of our development plan beyond five years for locations outside the core of our Eagle Ford Shale acreage, the removal of PUDs with only marginally economic estimated production, and...

-

Page 15

... prices and costs as of the date of any estimate. Reserves Estimation Chesapeake's Corporate Reserves Department prepared approximately 19% of the proved reserves estimates (by volume) disclosed in this report. Those estimates were based upon the best available production, engineering and geologic...

-

Page 16

... We follow comprehensive SEC-compliant internal policies to determine and report proved reserves. Reserves estimates are made by experienced reservoir engineers or under their direct supervision. The Corporate Reserves Department reviews all of the Company's proved reserves at the close of each...

-

Page 17

... expirations. Our leasehold management efforts include scheduling our drilling to establish production in paying quantities in order to hold leases by production, timely exercising our contractual rights to pay delay rentals to extend the terms of leases we value, planning noncore divestitures to...

-

Page 18

..., our midstream business provided services to joint working interest owners and other third-party customers. Chesapeake generated revenues from its gathering, treating and compression activities through various gathering rate structures. The Company also processed a portion of its natural gas at...

-

Page 19

... oilfield services company that provides a wide range of well site services, primarily to Chesapeake and its working interest partners. These services include drilling, hydraulic fracturing, oilfield rentals, rig relocation, fluid handling and disposal and manufacturing of natural gas compressor...

-

Page 20

... method of drilling and completing wells; the surface use and restoration of properties upon which oil and gas facilities are located, including the construction of well pads, pipelines, impoundments and associated access roads; water withdrawal; the plugging and abandoning of wells; the recycling...

-

Page 21

.... Midstream Operations Historically, Chesapeake invested, directly and through an affiliate, in gathering systems and processing facilities to complement our natural gas operations in regions where we had significant production and additional infrastructure was required. In 2013 and 2012, we sold...

-

Page 22

.... In addition, local land use restrictions, such as city ordinances, zoning laws, and traffic regulations, may restrict or prohibit the performance of well drilling in general or hydraulic fracturing in particular. The trend in environmental regulation is to place more restrictions and limitations...

-

Page 23

... persons the costs of such actions. The Safe Drinking Water Act (SDWA), Underground Injection Control (UIC) program prohibits any underground injection unless authorized by a permit. Chesapeake recycles and reuses some produced water and we also dispose of produced water in Class II UIC wells, which...

-

Page 24

...of the U.S. Department of Energy, to report on a well-by-well basis the additives and chemicals and amount of water used in the hydraulic fracturing process for each of the wells we operate. The website, www.fracfocus.org, also includes information about how hydraulic fracturing works, the chemicals...

-

Page 25

... report released in late 2012 and a final draft report expected to be released for public comment and peer review in late 2014. In addition, the BLM published a revised draft of proposed rules that would impose new requirements on hydraulic fracturing operations conducted on federal and tribal lands...

-

Page 26

... the future. Facilities Chesapeake owns an office complex in Oklahoma City and owns or leases various field offices in cities or towns in the areas where we conduct our operations. Executive Officers Robert D. Lawler, President, Chief Executive Officer and Director Robert D. ("Doug") Lawler, 47, has...

-

Page 27

... and London. His positions at Anadarko included Vice President of Operations from May to August 2013; Director, Corporate Planning from July 2012 to May 2013; General Manager - Appalachian Basin from June 2009 to July 2012; and Manager, Reserves and Planning Southern Region from January to June...

-

Page 28

...and development activities for a company using the full cost method of accounting. Additionally, any internal costs that can be directly identified with acquisition, exploration and development activities are included. Any costs related to production, general corporate overhead or similar activities...

-

Page 29

... service and future income tax expense or to depreciation, depletion and amortization, discounted using an annual discount rate of 10%. Price Differential. The difference in the price of natural gas, oil or NGL received at the sales point and the New York Mercantile Exchange (NYMEX). Productive Well...

-

Page 30

...iii) gains and losses related to de-designated cash flow hedges originally designated to settle against current period production revenues. Unrealized gains and losses include the change in fair value of open derivatives scheduled to settle against future period production revenues offset by amounts...

-

Page 31

... payment represents a limitedterm overriding royalty interest in natural gas and oil reserves that (i) entitles the purchaser to receive scheduled production volumes over a period of time from specific lease interests; (ii) is free and clear of all associated future production costs and capital...

-

Page 32

... be able to anticipate at this time. Future cash flows from operations are subject to a number of risks and variables, such as the level of production from existing wells, prices of natural gas and oil, our success in developing and producing new reserves and the other risk factors discussed herein...

-

Page 33

... proved natural gas, oil and NGL reserves discounted at 10% plus the lower of cost or market value of unproved properties, adjusted for the impact of derivatives accounted for as cash flow hedges. We are required to write down the carrying value of our natural gas and oil assets if capitalized costs...

-

Page 34

...hydraulic fracturing and for other reasons. In addition, wells that are profitable may not meet our internal return targets, which are dependent upon the current and future market prices for natural gas and oil, costs associated with producing natural gas, oil and NGL and our ability to add reserves...

-

Page 35

..., including, but not limited to, buying and selling reserves and leases, obtaining goods and services needed to operate our business and marketing natural gas, oil or NGL. Competitors include multinational oil companies, independent production companies and individual producers and operators. Some...

-

Page 36

... water for our drilling operations or are unable to dispose of or recycle the water we use economically and in an environmentally safe manner. Development activities require the use of water. For example, the hydraulic fracturing process that we employ to produce commercial quantities of natural gas...

-

Page 37

... an active price and basis risk management program related to the natural gas and oil we produce for our own account in order to manage the impact of low commodity prices and to predict future cash flows with greater certainty. We have used the OTC market exclusively for our natural gas and oil...

-

Page 38

... from Chesapeake, we will no longer control these services and may experience increased costs and be subject to increased competition with third parties for drilling rigs, hydraulic fracturing, equipment and other products and services we now source internally. Delays in developing our natural gas...

-

Page 39

... resolution of the Tenth Circuit appeal. 2012 Securities and Shareholder Litigation. A putative class action was filed in the U.S. District Court for the Western District of Oklahoma on April 26, 2012 against the Company and its former Chief Executive Officer (CEO), Aubrey K. McClendon. On July 20...

-

Page 40

... May 2, 2012, Chesapeake and Mr. McClendon received notice from the SEC that its Fort Worth Regional Office had commenced an informal inquiry into, among other things, certain of the matters alleged in the foregoing 2012 securities and shareholder lawsuits. On December 21, 2012, the SEC's Fort Worth...

-

Page 41

...Board of Directors. In addition, our corporate revolving bank credit facility contains a restriction on our ability to declare and pay cash dividends on our common or preferred stock if an event of default has occurred. The certificates of designation for our preferred stock prohibit payment of cash...

-

Page 42

... of employee restricted stock. We make matching contributions to our 401(k) plan and deferred compensation plan using Chesapeake common stock that is held in treasury or is purchased by the respective plan trustees in the open market. The plans contain no limitation on the number of shares that...

-

Page 43

...financial statements, including the notes thereto, appearing in Items 7 and 8, respectively, of this report.

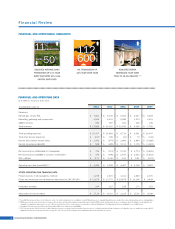

2013 REVENUES: Natural gas, oil and NGL ...Marketing, gathering and compression ...Oilfield services ...Total Revenues ...OPERATING EXPENSES: Natural gas, oil and NGL production ...Production...

-

Page 44

... STATEMENT OF OPERATIONS DATA (continued): EARNINGS (LOSS) PER COMMON SHARE: Basic ...Diluted ...CASH DIVIDEND DECLARED PER COMMON SHARE ...CASH FLOW DATA: Cash provided by operating activities ...Cash used in investing activities ...Cash provided by (used in) financing activities ...BALANCE SHEET...

-

Page 45

...sets forth certain information regarding our production volumes, natural gas, oil and natural gas liquids (NGL) sales, average sales prices received, other operating income and expenses for the periods indicated: Years Ended December 31, 2013 2012 2011 Net Production: Natural gas (bcf) ...Oil (mmbbl...

-

Page 46

.... In recent years, the price for a bbl of oil and NGL has been significantly higher than the price for six mcf of natural gas. Includes revenue and operating costs and excludes depreciation and amortization, general and administrative expenses, impairments of fixed assets and other, net gains or...

-

Page 47

...assets sales in 2012 and 2013, we believe that we will receive proceeds in excess of $150 million in 2014 that were held back for title review and other purposes at the time of closing (see Haynesville and Eagle Ford divestitures and Mississippi Lime joint venture below). Currently, we are marketing...

-

Page 48

...agreement covering acreage dedication areas in the Mississippi Lime play. In May 2013, CMD sold its wholly owned subsidiary, Granite Wash Midstream Gas Services, L.L.C. (GWMGS), to MarkWest Oklahoma Gas Company, L.L.C., a wholly owned subsidiary of MarkWest Energy Partners, L.P. (NYSE: MWE), for net...

-

Page 49

... master lease agreements and term loan. Based upon our 2014 capital expenditure budget, our forecasted operating cash flow and projected levels of indebtedness, we are projecting that we will be in compliance with the financial maintenance covenants of our corporate revolving bank credit facility...

-

Page 50

... gas and oil assets: Eagle Ford ...Marcellus ...Haynesville ...Permian Basin ...Texoma ...Chitwood Knox ...Fayetteville Shale ...SIPC (Mississippi Lime) joint venture ...TOT (Utica) joint venture ...CNOOC (Niobrara) joint venture ...TOT (Barnett) joint venture ...Volumetric production payments...

-

Page 51

... a decrease in the natural gas price received for natural gas sold (excluding the effect of gains or losses on derivatives) from $3.12 per mcf in 2011 to $1.77 per mcf in 2012. Changes in cash flow from operations are largely due to the same factors that affect our net income, excluding various non...

-

Page 52

...Other Uses of Cash and Cash Equivalents: Additions to other property and equipment(b) ...Acquisition of drilling company ...Payments on credit facility borrowings, net ...Cash paid to purchase debt ...Cash paid for prepayment of mortgage ...Dividends paid ...Cash paid to purchase preferred shares of...

-

Page 53

... paid dividends on our preferred stock of $171 million, $171 million and $172 million in 2013, 2012 and 2011, respectively. Bank Credit Facilities During 2013, we had two revolving bank credit facilities as sources of liquidity. Corporate Oilfield Services Credit Facility(a) Credit Facility(b) ($ in...

-

Page 54

... loan, corporate revolving bank credit facility, secured hedging facility and equipment master lease agreements). For further discussion of the terms of our oilfield services credit facility, see Note 3 of the notes to our consolidated financial statements included in Item 8 of this report. Hedging...

-

Page 55

... cash and, if applicable, shares of our common stock using a net share settlement process. Included in this discount was $303 million as of December 31, 2013 associated with the equity component of our contingent convertible senior notes. This discount is amortized based on an effective yield method...

-

Page 56

... to have sub-standard credit, unless the credit risk can otherwise be mitigated. During 2013, 2012 and 2011, we recognized nominal amounts of bad debt expense related to potentially uncollectible receivables. Contractual Obligations and Off-Balance Sheet Arrangements From time to time, we enter into...

-

Page 57

.... Executive management is involved in all risk management activities and the Board of Directors reviews the Company's derivative program at its quarterly board meetings. We believe we have sufficient internal controls to prevent unauthorized trading. As of December 31, 2013, our natural gas and...

-

Page 58

... information concerning the fair value of our natural gas and oil derivative instruments. December 31, 2013 2012 ($ in millions) Derivative assets (liabilities): Fixed-price natural gas swaps ...Natural gas three-way collars ...Natural gas call options ...Natural gas basis protection swaps ...Fixed...

-

Page 59

... million in 2013, 2012 and 2011, respectively. See Item 7A of this report for a complete listing of all of our derivative instruments as of December 31, 2013. A change in natural gas, oil and NGL prices has a significant impact on our revenues and cash flows. Assuming our 2013 production levels, an...

-

Page 60

... Northern Division includes the Utica and Niobrara unconventional liquids plays and the Marcellus unconventional natural gas play. The Marcellus Shale accounted for approximately 25% of our estimated proved reserves by volume as of December 31, 2013. Production for the Marcellus Shale for 2013, 2012...

-

Page 61

..., respectively. Our revenues and operating expenses from our marketing business increased substantially in 2013 compared to 2012 and 2011. In 2013, we marketed significantly more oil and NGL from both Chesapeake-operated wells and for third parties while our marketing of natural gas was virtually...

-

Page 62

... 8 of this report for further discussion of our stock-based compensation. Chesapeake follows the full cost method of accounting under which all costs associated with natural gas and oil property acquisition, drilling and completion activities are capitalized. We capitalize internal costs that can be...

-

Page 63

... cost method of accounting, which limits the amount of costs we can capitalize and requires us to write off these costs if the carrying value of natural gas and oil assets in the evaluated portion of our full cost pool exceeds the sum of the present value of expected future net cash flows of proved...

-

Page 64

... of debt and extinguishment of other financing of $193 million in 2013, $200 million in 2012 and $176 million in 2011. In 2013, we terminated the financing master lease agreement on our real estate surface properties in the Fort Worth, Texas area for $258 million and recorded a loss of approximately...

-

Page 65

... on a well by well or lease or field basis versus the aggregated "full cost" pool basis. Additionally, gain or loss is generally recognized on all sales of natural gas and oil properties under the successful efforts method. As a result, our financial statements differ from those of companies that...

-

Page 66

... net revenues. Any excess of the net book value, less deferred income taxes, is generally written off as an expense. See Natural Gas and Oil Properties in Note 1 of the notes to our consolidated financial statements included in Item 8 of this report for further information on the full cost method...

-

Page 67

... volatility of natural gas, oil and NGL prices and, to a lesser extent, interest rates and foreign exchange rates, the Company's financial condition and results of operations can be significantly impacted by changes in the market value of our derivative instruments. As of December 31, 2013, 2012 and...

-

Page 68

... Company. On July 26, 2013, the Company and Mr. McClendon rescinded the December 2008 sale of an antique map collection pursuant to the terms of a settlement agreement terminating pending shareholder litigation that was approved by the District Court of Oklahoma County, Oklahoma on January 30, 2012...

-

Page 69

....

In 2013, 2012 and 2011, Chesapeake sold produced gas to our 30%-owned investee, Twin Eagle Resource Management LLC. Hydraulic fracturing and other services provided to us by FTS in the ordinary course of business. As well operators, we are reimbursed by other working interest owners through the...

-

Page 70

...reserves and projecting future rates of production and the amount and timing of development expenditures; declines in the prices of natural gas and oil potentially resulting in a write-down of our asset carrying values; our ability to generate profits or achieve targeted results in drilling and well...

-

Page 71

... in 2012 and 2013, we bought natural gas and oil calls to, in effect, lock in sold call positions. Due to lower natural gas, oil and NGL prices, we were able to achieve this at a low cost to us. In some cases, we deferred the payment of the premium on these trades to the related month of production...

-

Page 72

... put option. Options: Chesapeake sells, and occasionally buys, call options in exchange for a premium. At the time of settlement, if the market price exceeds the fixed price of the call option, Chesapeake pays the counterparty such excess on sold call options, and Chesapeake receives such excess...

-

Page 73

... in the month of related production based on the terms specified in the original contract as noted below. December 31, 2013 ($ in millions) $ (174) 216 16 $ 58

2014 ...2015 ...2016 - 2022 ...Total ...

The table below reconciles the changes in fair value of our natural gas and oil derivatives during...

-

Page 74

... our exposure to changes in the fair value of our senior notes and floatingto-fixed interest rate swaps (we receive a floating market rate and pay a fixed interest rate) to manage our interest rate exposure related to our bank credit facility borrowings. As of December 31, 2013, the following...

-

Page 75

... in our expected cash flows related to changes in foreign exchange rates and therefore the swaps are designated as cash flow hedges. The fair values of the cross currency swaps are recorded on the consolidated balance sheet as an asset of $2 million as of December 31, 2013. The eurodenominated debt...

-

Page 76

... FINANCIAL STATEMENTS CHESAPEAKE ENERGY CORPORATION

Management's Report on Internal Control Over Financial Reporting ...Consolidated Financial Statements: Report of Independent Registered Public Accounting Firm ...Consolidated Balance Sheets at December 31, 2013 and 2012 ...Consolidated Statements...

-

Page 77

... the Company's internal control over financial reporting as of December 31, 2013 has been audited by PricewaterhouseCoopers LLP, an independent registered public accounting firm, as stated in its report which appears herein. /s/ ROBERT D. LAWLER Robert D. Lawler President and Chief Executive Officer...

-

Page 78

...position of Chesapeake Energy Corporation and its subsidiaries at December 31, 2013 and 2012, and the results of their operations and their cash flows for each of the three years in the period ended December 31, 2013 in conformity with accounting principles generally accepted in the United States of...

-

Page 79

CHESAPEAKE ENERGY CORPORATION AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS

December 31, 2013 ($ in millions) CURRENT ASSETS: Cash and cash equivalents ($1 and $1 attributable to our VIE) ...Restricted cash ...Accounts receivable, net ...Short-term derivative assets ...Deferred income tax asset ......

-

Page 80

CHESAPEAKE ENERGY CORPORATION AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS - (Continued)

December 31, 2013 ($ in millions) CURRENT LIABILITIES: Accounts payable ...Short-term derivative liabilities ($5 and $4 attributable to our VIE) ...Accrued interest ...Current maturities of long-term debt, net ...

-

Page 81

...ENERGY CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS Years Ended December 31, 2013 2012 2011 ($ in millions except per share data) REVENUES: Natural gas, oil and NGL ...Marketing, gathering and compression ...Oilfield services ...Total Revenues ...OPERATING EXPENSES: Natural gas...

-

Page 82

..., net of income tax expense (benefit) of $3 million, $0 and $0...Other Comprehensive Income (Loss) ...COMPREHENSIVE INCOME (LOSS) ...COMPREHENSIVE INCOME ATTRIBUTABLE TO NONCONTROLLING INTERESTS ...COMPREHENSIVE INCOME (LOSS) ATTRIBUTABLE TO CHESAPEAKE ...

$

Years Ended December 31, 2013 2012 2011...

-

Page 83

... ...Proceeds from sales of investments ...Acquisition of drilling company ...(Increase) decrease in restricted cash ...Other ...Net Cash Used In Investing Activities ...CASH FLOWS FROM FINANCING ACTIVITIES: Proceeds from credit facilities borrowings ...Payments on credit facilities borrowings...

-

Page 84

...) SUPPLEMENTAL CASH FLOW INFORMATION: Interest, net of capitalized interest ...Income taxes, net of refunds received ...SUPPLEMENTAL DISCLOSURE OF SIGNIFICANT NON-CASH INVESTING AND FINANCING ACTIVITIES: Change in accrued drilling and completion costs ...Change in accrued acquisitions of proved and...

-

Page 85

... stock-based compensation...Dividends on common stock ...Dividends on preferred stock ...Exercise of stock options ...Balance, end of period ...RETAINED EARNINGS: Balance, beginning of period ...Net income (loss) attributable to Chesapeake ...Dividends on common stock ...Dividends on preferred stock...

-

Page 86

... ENERGY CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY - (Continued)

Years Ended December 31, 2013 2012 2011 ($ in millions) TREASURY STOCK - COMMON: Balance, beginning of period ...Purchase of 251,403, 652,443 and 425,140 shares for company benefit plans ...Release...

-

Page 87

... TO CONSOLIDATED FINANCIAL STATEMENTS 1. Basis of Presentation and Summary of Significant Accounting Policies Description of Company Chesapeake Energy Corporation ("Chesapeake" or the "Company") is a natural gas and oil exploration and production company engaged in the acquisition, exploration and...

-

Page 88

.... December 31, 2013 2012 ($ in millions) $ 1,548 $ 1,457 417 592 63 24 62 23 150 168 (18) (19) $ 2,222 $ 2,245

Natural gas, oil and NGL sales ...Joint interest ...Oilfield services ...Related parties(a) ...Other ...Allowance for doubtful accounts ...Total accounts receivable, net ..._____ (a) See...

-

Page 89

... firms. In addition, our internal engineers review and update our reserves on a quarterly basis. Proceeds from the sale of natural gas and oil properties are accounted for as reductions of capitalized costs unless such sales involve a significant change in proved reserves and significantly alter the...

-

Page 90

... Bronco Drilling Company acquisition and $15 million in our Horizon Drilling Services acquisition. Quoted market prices are not available for these reporting units and their fair values are based upon several valuation analyses, including discounted cash flows. We performed annual impairment tests...

-

Page 91

... wells at defined delivery points and delivers the product to third parties, at which time revenues are recorded. Chesapeake's results of operations related to its natural gas, oil and NGL marketing activities are presented on a "gross" basis, because we act as a principal rather than an agent...

-

Page 92

... for contract drilling, hydraulic fracturing, oilfield rentals, oilfield trucking and other oilfield services operations for both Chesapeake-operated wells and wells operated by third parties. • Drilling. Revenues are generated by drilling oil and natural gas wells for our customers under daywork...

-

Page 93

... value of derivatives scheduled to settle over the next twelve months based on market prices/rates as of the respective balance sheet dates. Cash settlements of our derivative instruments are generally classified as operating cash flows unless the derivatives are deemed to contain, for accounting...

-

Page 94

... of our stock options was immaterial in the calculation of diluted EPS for these two years. The following table sets forth the net income adjustments and shares of common stock related to our outstanding cumulative convertible preferred stock and participating securities in 2013 and 2012: Net Income...

-

Page 95

CHESAPEAKE ENERGY CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) For the year ended December 31, 2011, all outstanding equity securities that were convertible into common stock were included in the calculation of diluted EPS. A reconciliation of basic EPS and ...

-

Page 96

... are convertible, at the holder's option, prior to maturity under certain circumstances into cash and, if applicable, shares of our common stock using a net share settlement process. One such triggering circumstance is when the price of our common stock exceeds a threshold amount during a specified...

-

Page 97

... CONSOLIDATED FINANCIAL STATEMENTS - (Continued) levels determined by reference to the trading price of our common stock. The notes were not convertible under this provision in 2013, 2012 or 2011. In general, upon conversion of a contingent convertible senior note, the holder will receive cash equal...

-

Page 98

... similar to those contained in the Company's corporate revolving bank credit facility, including covenants that limit our ability to incur indebtedness, grant liens, make investments, loans and restricted payments and enter into certain business combination transactions. Other covenants include...

-

Page 99

... rights agreement, we agreed to file a registration statement enabling holders of the COO senior notes to exchange the privately placed COO senior notes for publicly registered notes with substantially the same terms. The exchange offer was completed in July 2013. Bank Credit Facilities During 2013...

-

Page 100

... to declare and pay cash dividends on our common or preferred stock if an event of default has occurred. Oilfield Services Credit Facility. Our $500 million syndicated oilfield services revolving bank credit facility is used to fund capital expenditures and for general corporate purposes associated...

-

Page 101

... of legal counsel. We account for legal defense costs in the period the costs are incurred. July 2008 Common Stock Offering. On February 25, 2009, a putative class action was filed in the U.S. District Court for the Southern District of New York against the Company and certain of its officers and...

-

Page 102

... Securities and Exchange Commission that its Fort Worth Regional Office had commenced an informal inquiry into, among other things, certain of the matters alleged in the foregoing 2012 securities and shareholder lawsuits. On December 21, 2012, the SEC's Fort Worth Regional Office advised Chesapeake...

-

Page 103

... Environmental Protection (WVDEP) to resolve alleged violations of the Clean Water Act (CWA) and the West Virginia Water Pollution Control Act at 27 sites in West Virginia. In a complaint filed against CALLC the same day in the U.S. District Court for the Northern District of West Virginia, the EPA...

-

Page 104

... and Transportation Agreements We have contractual commitments with midstream service companies and pipeline carriers for future gathering, processing and transportation of natural gas and liquids to move certain of our production to market. Working interest owners and royalty interest owners, where...

-

Page 105

... of the shortfall, however, and the cash payment we ultimately make to Total could exceed amounts we have accrued. Affiliate Commitments Under the terms of our corporate revolving bank credit facility, certain of our subsidiaries, including our oilfield services companies, are not guarantors of the...

-

Page 106

... 31, 2013 and 2012 are detailed below. December 31, 2013 Revenues and royalties due others ...Accrued natural gas, oil and NGL drilling and production costs...Joint interest prepayments received ...Accrued compensation and benefits ...Other accrued taxes ...Accrued dividends ...Other ...Total...

-

Page 107

... 31, 2012, this amount consisted primarily of an obligation related to 111 real estate surface properties in the Fort Worth, Texas area that we financed in 2009 for approximately $145 million and for which we entered into a 40-year master lease agreement whereby we agreed to lease the sites for...

-

Page 108

... volumetric production payments were $3.407 billion and $2.807 billion, respectively. Deferred tax assets relating to tax benefits of employee share-based compensation have been reduced for stock options exercised and restricted stock that vested in periods in which Chesapeake was in a net operating...

-

Page 109

... previously recorded benefits were recorded as reductions to additional paid-in capital. At December 31, 2013, Chesapeake had federal income tax NOL carryforwards of approximately $592 million and state NOL carryforwards of approximately $7.0 billion (deferred tax assets related to these state NOL...

-

Page 110

... Company. On July 26, 2013, the Company and Mr. McClendon rescinded the December 2008 sale of an antique map collection pursuant to the terms of a settlement agreement terminating pending shareholder litigation that was approved by the District Court of Oklahoma County, Oklahoma on January 30, 2012...

-

Page 111

....

In 2013, 2012 and 2011, Chesapeake sold produced gas to our 30%-owned investee, Twin Eagle Resource Management LLC. Hydraulic fracturing and other services provided to us by FTS in the ordinary course of business. As well operators, we are reimbursed by other working interest owners through the...

-

Page 112

... STATEMENTS - (Continued) Preferred Stock Following is a summary of our preferred stock, including the primary conversion terms as of December 31, 2013:

Liquidation Preference per Share Holder's Conversion Right Company's Conversion Right From Company's Market Conversion Trigger(a)

Preferred Stock...

-

Page 113

... liabilities and the preferred shares are included in noncontrolling interests on our consolidated balance sheets. Pursuant to the CHK C-T LLC Agreement, CHK C-T is required to retain an amount of cash equal to the next two quarters of preferred dividend payments and, until December 31, 2013, it was...

-

Page 114

...a net-well basis, at which time the associated liability will be reversed and the sale of the ORRIs reflected as an adjustment to the capitalized cost of our natural gas and oil properties. Under the ORRI obligation, we delivered an ORRI in approximately 84 net wells in 2013 and 77 net wells in 2012...

-

Page 115

... balance sheets. Pursuant to the CHK Utica LLC Agreement, CHK Utica is required to retain a cash balance equal to the next two quarters of preferred dividend payments. The amounts reserved for paying such dividends, approximately $37 million and $44 million as of December 31, 2013 and 2012...

-

Page 116

... Trust. In November 2011, Chesapeake Granite Wash Trust (the "Trust") sold 23,000,000 common units representing beneficial interests in the Trust at a price of $19.00 per common unit in its initial public offering. The common units are listed on the New York Stock Exchange and trade under the symbol...

-

Page 117

...Wireless), a privately owned company engaged in research, development and production of wireless seismic systems and any related technology that deliver seismic information obtained from standard geophones in real time to laptop and desktop computers. As of December 31, 2013 and 2012, $9 million and...

-

Page 118

...grants may result in state and federal income tax benefits related to the difference between the market price of the common stock at the date of vesting and the date of grant. During 2013, 2012 and 2011, we recognized reductions in tax benefits related to restricted stock of $14 million, $32 million...

-

Page 119

... Company used the following weightedaverage assumptions to estimate the fair value of the stock options granted in 2013: Expected option life - years ...Volatility ...Risk-free interest rate ...Dividend yield ...The following table provides information related to stock option activity for 2013, 2012...

-

Page 120

...FINANCIAL STATEMENTS - (Continued) The vesting of certain stock option grants may result in state and federal income tax benefits related to the difference between the market price of the common stock at the date of vesting and the date of grant. During the years ended December 31, 2013 and 2012, we...

-

Page 121

...gas, oil and NGL production expenses...Marketing, gathering and compression expenses ...Oilfield services expenses ...Total ...10. Employee Benefit Plans

Our qualified 401(k) profit sharing plan (401(k) Plan) is the Chesapeake Energy Corporation Savings and Incentive Stock Bonus Plan, which is open...

-

Page 122

...put option strike price. • Options: Chesapeake sells, and occasionally buys, call options in exchange for a premium. At the time of settlement, if the market price exceeds the fixed price of the call option, Chesapeake pays the counterparty such excess on sold call options, and Chesapeake receives...

-

Page 123

... rate swaps (we receive a floating market rate and pay a fixed interest rate) to manage our interest rate exposure related to our bank credit facilities borrowings. The notional amount and the estimated fair value of our interest rate derivative liabilities as of December 31, 2013 and 2012 are...

-

Page 124

... in our expected cash flows related to changes in foreign exchange rates and therefore the swaps are designated as cash flow hedges. The fair values of the cross currency swaps are recorded on the consolidated balance sheet as an asset of $2 million as of December 31, 2013. The eurodenominated debt...

-

Page 125

CHESAPEAKE ENERGY CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The following tables present the netting offsets of derivative assets and liabilities in the consolidated balance sheets as of December 31, 2013 and December 31, 2012: December 31, 2013 Derivative...

-

Page 126

... 2013 2012 2011 ($ in millions) $ 5 $ 8 $ 16

Fair Value Derivatives Interest rate contracts ...

Location of Gain (Loss) Interest expense

Cash Flow Hedges. A reconciliation of the changes in accumulated other comprehensive income (loss) in our consolidated statements of stockholders' equity related...

-

Page 127

... either cash flow or fair value hedges: Years Ended December 31, 2013 2012 2011 ($ in millions) $ 159 $ 892 $ 348 (63) (1) (12) $ 96 $ 891 $ 336

Derivative Contracts

Location of Gain (Loss)

Commodity contracts ...Natural gas, oil and NGL Interest rate contracts ...Interest expense Total ...Credit...

-

Page 128

...into cash-settled natural gas, oil and NGL price and basis derivatives with the counterparties. Our obligations under the multi-counterparty facility are secured by proved reserves, the value of which must cover the fair value of the transactions outstanding under the facility by at least 1.65 times...

-

Page 129

... other leading energy companies pursuant to which we sold a portion of our leasehold, producing properties and other assets located in eight different resource plays and received cash of $8.0 billion and commitments by our counterparties to pay our share of future drilling and completion costs of...

-

Page 130

... Production Payments From time to time, we have sold certain of our producing assets which are located in more mature producing regions through the sale of VPPs. A VPP is a limited-term overriding royalty interest in natural gas and oil reserves that (i) entitles the purchaser to receive scheduled...

-

Page 131

...on market prices at the time of production, and the purchased natural gas and liquids are resold at market prices. Our outstanding VPPs consist of the following: Volume Sold VPP # Date of VPP Location Anadarko Basin Granite Wash Mid-Continent Barnett Shale East Texas and Texas Gulf Coast South Texas...

-

Page 132

CHESAPEAKE ENERGY CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The volumes produced on behalf of our VPP buyers during 2013, 2012 and 2011 were as follows: Year Ended December 31, 2013

VPP # Natural Gas (bcf) Oil (mbbl) NGL (mbbl) Total (bcfe)

10 9 8 6 5 4 3...

-

Page 133

... Ltd...Fair Value -% 10% Other ...- -% -% Total investments ...

$

$

FTS International, Inc. FTS International, Inc. (FTS), based in Fort Worth, Texas, is a privately held company which, through its subsidiaries, provides hydraulic fracturing and other services to oil and gas companies. In 2013, we...

-

Page 134

...), based in Oklahoma City, Oklahoma, is a private independent oil and natural gas company engaged in the production, acquisition and exploitation of oil and natural gas properties. In 2013, we recorded positive equity method adjustments of $10 million related to our share of Chaparral's net income...

-

Page 135

...not a guarantor of any of Chesapeake's debt. The creditors or beneficial holders of the Trust have no recourse to the general credit of Chesapeake; however, we have certain obligations to the Trust through the development agreement that are secured by a drilling support lien on our retained interest...

-

Page 136

... subsidiary of Chesapeake, entered into a partnership agreement with KKR Royalty Aggregator LLC (KKR) to form Mineral Acquisition Company I, L.P. The purpose of the partnership is to acquire mineral interests, or royalty interests carved out of mineral interests, in oil and natural gas basins in the...

-

Page 137

... agreement covering acreage dedication areas in the Mississippi Lime play. In 2013, CMD sold its wholly owned subsidiary, Granite Wash Midstream Gas Services, L.L.C. (GWMGS), to MarkWest Oklahoma Gas Company, L.L.C., a wholly owned subsidiary of MarkWest Energy Partners, L.P. (NYSE:MWE), for net...

-

Page 138

... and land (other than our core campus) in the Oklahoma City area. In addition, as of December 31, 2013 we were continuing to pursue the sale of various land and buildings located in the Fort Worth, Texas area. The land and buildings in both the Oklahoma City and Fort Worth areas are reported under...

-

Page 139

...consolidated statement of operations. In addition, in 2012, we recognized $26 million of impairment losses on certain of our drilling rigs that we expected would have insufficient cash flow to recover carrying values because of a change in business climate resulting from depressed natural gas prices...

-

Page 140

... of certain assets used to promote natural gas demand, $15 million for the termination of a contract drilling agreement with a third party, $2 million related to the estimated 2012 shortfall of our net acreage maintenance commitment with Total in the Barnett Shale and $16 million related to various...

-

Page 141

... and other termination costs for the years ended December 31, 2013, 2012 and 2011: Years Ended December 31, 2013 2012 2011 ($ in millions) Restructuring charges under workforce reduction plan: Salary expense ...Acceleration of stock-based compensation...Other termination benefits ...Total...

-

Page 142

... using quoted market prices as they consist of exchange-traded securities. Investments. The fair value of Chesapeake's investments in Clean Energy and Gastar common stock was based on quoted market prices. Other Current Liabilities. Liabilities related to Chesapeake's deferred compensation plan...

-

Page 143

CHESAPEAKE ENERGY CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The following table provides fair value measurement information for financial assets (liabilities) measured at fair value on a recurring basis as of December 31, 2013 and 2012: Quoted Prices in ...

-

Page 144

... and settlements: Sales ...Settlements ...Ending Balance as of December 31, 2012 ..._____ (a)

$ $

$

Natural Gas, Oil and NGL Sales Interest Expense 2013 2012 2013 2012 ($ in millions) $ $ 410 382 $ $ 567 374 $ $ (1) - $ $ 6 -

Total gains (losses) included in earnings for the period ...Change in...

-

Page 145

... sell certain of our buildings and land (other than our core campus) in the Oklahoma City area. Fair value measurements were applied with respect to these non-financial assets, measured on a nonrecurring basis, to determine impairments. We used the income approach, specifically discounted cash flows...

-

Page 146

...rentals, hydraulic fracturing and other oilfield services operations for both Chesapeakeoperated wells and wells operated by third parties. Management evaluates the performance of our segments based upon income (loss) before income taxes. Revenues from the sale of natural gas, oil and NGL related to...

-

Page 147

...statements of operations related to oilfield services performed for Chesapeake-operated wells. The following table presents selected financial information for Chesapeake's operating segments:

Exploration and Production Year Ended December 31, 2013: Revenues ...Intersegment revenues ...Total revenues...

-

Page 148

CHESAPEAKE ENERGY CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

Exploration and Production Year Ended December 31, 2012: Revenues ...Intersegment revenues ...Total revenues ...Unrealized gains on commodity derivatives...Natural gas, oil, NGL and other ...

-

Page 149

... ENERGY CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

Marketing, Gathering and Compression

Exploration and Production Year Ended December 31, 2011: Revenues ...Intersegment revenues ...Total revenues ...Unrealized losses on commodity derivatives...Natural gas...

-

Page 150

... are subject to the covenants and guarantees in the oilfield services revolving bank credit facility agreement referred to in Note 3 that limit their ability to pay dividends or distributions or make loans to Chesapeake. In addition, subsidiaries with noncontrolling interests, consolidated variable...

-

Page 151

CHESAPEAKE ENERGY CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) CONDENSED CONSOLIDATING BALANCE SHEET AS OF DECEMBER 31, 2013 ($ in millions)

Guarantor Subsidiaries NonGuarantor Subsidiaries

Parent

Eliminations

Consolidated

CURRENT ASSETS: Cash and cash ...

-

Page 152

CHESAPEAKE ENERGY CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) CONDENSED CONSOLIDATING BALANCE SHEET AS OF DECEMBER 31, 2012 ($ in millions)

Guarantor Subsidiaries(a) NonGuarantor Subsidiaries

Parent

(a)

Eliminations

Consolidated

CURRENT ASSETS: Cash and...

-

Page 153

... and compression.. Oilfield services ...Total Revenues ...OPERATING EXPENSES: Natural gas, oil and NGL production...Production taxes ...Marketing, gathering and compression.. Oilfield services ...General and administrative...Restructuring and other termination costs ...Natural gas, oil and NGL...

-

Page 154

... and compression.. Oilfield services ...Total Revenues ...OPERATING EXPENSES: Natural gas, oil and NGL production...Production taxes ...Marketing, gathering and compression.. Oilfield services ...General and administrative...Restructuring and other termination costs ...Natural gas, oil and NGL...

-

Page 155

... production...Production taxes ...Marketing, gathering and compression.. Oilfield services ...General and administrative...Natural gas, oil and NGL depreciation, depletion and amortization ...Depreciation and amortization of other assets ...Impairments of fixed assets and other...Net gains on sales...

-

Page 156

......Other investing activities ...Net Cash Used In Investing Activities ...CASH FLOWS FROM FINANCING ACTIVITIES: Proceeds from credit facilities borrowings ...Payments on credit facilities borrowings . Proceeds from issuance of senior notes, net of discount and offering costs ...Cash paid to purchase...

-

Page 157

...Net Cash Used In Investing Activities ...CASH FLOWS FROM FINANCING ACTIVITIES: Proceeds from credit facilities borrowings ...Payments on credit facilities borrowings ...Proceeds from issuance of senior notes, net of discount and offering costs ...Proceeds from issuance of term loans, net of discount...

-

Page 158

...Other investing activities ...Net Cash Used In Investing Activities ...CASH FLOWS FROM FINANCING ACTIVITIES: Proceeds from credit facilities borrowings ...Payments on credit facilities borrowings ...Proceeds from issuance of senior notes, net of discount and offering costs ...Cash paid to purchase...

-

Page 159

CHESAPEAKE ENERGY CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) 22. Recently Issued Accounting Standards Recently Adopted Accounting Standards In February 2012, the Financial Accounting Standards Board (FASB) issued guidance changing the presentation ...

-

Page 160

...24 0.24

$ $

(0.24) (0.24)

March 31, 2012 Total revenues ...Gross profit (loss)(a)(c) ...Net income (loss) attributable to Chesapeake(c) ...Net income (loss) available to common stockholders(c) ...Net earnings (loss) per common share: Basic ...Diluted ...(a) (b) (c) $ $ $ $

Quarters Ended June 30...

-

Page 161

... About Natural Gas, Oil and NGL Producing Activities (unaudited)

Net Capitalized Costs Capitalized costs related to Chesapeake's natural gas, oil and NGL producing activities are summarized as follows: December 31, 2013 2012 ($ in millions) Natural gas and oil properties: Proved ...Unproved...

-

Page 162

... December 31, 2013 2012 2011 51% 44% 19% 30% 24% 7% -% 21% 42% -% -% 9%

Ryder Scott Company, L.P...PetroTechnical Services, Division of Schlumberger Technology Corporation ...Netherland, Sewell & Associates, Inc...Lee Keeling and Associates, Inc...

Proved natural gas, oil and NGL reserves are those...

-

Page 163

... is relatively minor compared to the cost of a new well. The information below on our natural gas, oil and NGL reserves is presented in accordance with regulations prescribed by the SEC. Our reserve estimates are generally based upon extrapolation of historical production trends, analogy to similar...

-

Page 164

CHESAPEAKE ENERGY CORPORATION AND SUBSIDIARIES SUPPLEMENTARY INFORMATION - (Continued) Gas (bcf) December 31, 2012 Proved reserves, beginning of period ...Extensions, discoveries and other additions ...Revisions of previous estimates...Production ...Sale of reserves-in-place ...Purchase of reserves-...

-

Page 165

... using current statutory income tax rates including consideration of the current tax basis of the properties and related carryforwards, giving effect to permanent differences and tax credits. The resulting future net cash flows are reduced to present value amounts by applying a 10% annual discount...

-

Page 166

CHESAPEAKE ENERGY CORPORATION AND SUBSIDIARIES SUPPLEMENTARY INFORMATION - (Continued) The following summary sets forth our future net cash flows relating to proved natural gas, oil and NGL reserves based on the standardized measure: Years Ended December 31, 2013 2012 2011 ($ in millions) (a) (b) $ ...

-

Page 167

... in reports we file or submit under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in SEC rules and forms, and that such information is accumulated and communicated to management, including our principal executive and principal financial officers...

-

Page 168

... to the definitive Proxy Statement to be filed by Chesapeake pursuant to Regulation 14A of the General Rules and Regulations under the Securities Exchange Act of 1934 not later than April 30, 2014 (the "2014 Proxy Statement"). ITEM 11. Executive Compensation

The information called for by this...

-

Page 169

... among Chesapeake, as issuer, the subsidiaries signatory thereto, as Subsidiary Guarantors and The Bank of New York Mellon Trust Company, N.A., as Trustee, with respect to 6.875% Senior Notes due 2020. Form 10-Q SEC File Number 001-13726 Exhibit 3.1.1 Filing Date 8/10/2009 Filed Herewith Furnished...

-

Page 170

... 27, 2008 among Chesapeake, as issuer, the subsidiaries signatory thereto, as Subsidiary Guarantors and The Bank of New York Mellon Trust Company, N.A., as Trustee, with respect to 2.25% Contingent Convertible Senior Notes due 2038. Form 8-K SEC File Number 001-13726 Exhibit 4.12.2 Filing Date 11/15...

-

Page 171

Incorporated by Reference Exhibit Number 4.8.1* Exhibit Description Indenture dated as of February 2, 2009 among Chesapeake, as issuer, the subsidiaries signatory thereto, as Subsidiary Guarantors and The Bank of New York Mellon Trust Company, N.A., as Trustee, with respect to 9.5% Senior Notes due ...

-

Page 172

... Credit Agreement, dated as of September 25, 2012, among Chesapeake Energy Corporation, as the Company, Chesapeake Exploration L.L.C., as Borrower, Union Bank, N.A., as Administrative Agent, and the several lenders parties thereto. Form 8-A SEC File Number 001-13726 Exhibit 4.4 Filing Date 4/8/2013...

-

Page 173

..., Goldman Sachs Bank USA and Jefferies Finance LLC, as Syndication Agent, and the several banks and other financial institution or entities from time to time parties thereto Chesapeake's 2003 Stock Incentive Plan, as amended. Form of 2013 Restricted Stock Award Agreement for Chesapeake's 2003 Stock...

-

Page 174

.... Performance Share Unit Award Agreement for Amended and Restated Long Term Incentive Plan between Chesapeake and Aubrey K. McClendon. Restated Founder Well Participation Program. 10-Q 001-13726 10.8 8/6/2013 Form 8-K SEC File Number 001-13726 Exhibit 10.1 Filing Date 2/4/2013 Filed Herewith...

-

Page 175

... Exhibit Number 10.6†Exhibit Description Chesapeake Energy Corporation Amended and Restated Deferred Compensation Plan. Chesapeake Energy Corporation Deferred Compensation Plan for NonEmployee Directors. Employment Agreement dated as of May 20, 2013 between Robert D. Lawler and Chesapeake Energy...

-

Page 176

... and Chesapeake Energy Corporation. Chesapeake Energy Corporation 2013 Annual Incentive Plan Ratios of Earnings to Fixed Charges and Combined Fixed Charges and Preferred Dividends. Subsidiaries Chesapeake. of Form 8-K SEC File Number 001-13726 Exhibit 10.2 Filing Date 4/19/2013 Filed Herewith...

-

Page 177

Incorporated by Reference Exhibit Number 99.1 Exhibit Description Report of PetroTechnical Services, Division of Schlumberger Technology Corporation. Report of Ryder Company, L.P. Scott Form SEC File Number Exhibit Filing Date Filed Herewith X Furnished Herewith

99.2 101.INS 101.SCH 101.CAL

X X X ...

-

Page 178

... Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. CHESAPEAKE ENERGY CORPORATION Date: February 26, 2014 By: /s/ ROBERT D. LAWLER Robert D. Lawler President and Chief Executive Officer

POWER OF ATTORNEY...

-

Page 179

-

Page 180