Canon 2009 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2009 Canon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4 CANON ANNUAL REPORT 2009

Overview of Fiscal 2009

Early in 2009, during what was being called the worst global

recession in 100 years, it was diffi cult to predict the future course

of the global economy. Today, looking back at the year, we see

that conditions faced by each region were as follows.

In the United States drastic measures taken to stimulate the

economy appeared to have had some success from the third

quarter of 2009, including positive GDP growth. Nonetheless, new

housing starts and new car sales failed to maintain hoped-for

momentum targeted by government stimulus measures.

Europe also saw a rise in GDP during the same period. Driving

growth were measures taken to stimulate individual consumption,

including automobile-buyback programs and public works invest-

ment. Delays in resolving bad debt and high unemployment,

however, continued to have a negative effect on the real economy.

In Asia, primarily China, measures taken to stimulate consump-

tion in rural areas were successful, kick-starting an early recovery.

Japan, at long last, began showing signs of emerging from a

period of intense economic stagnation. This was the result of

increased exports and manufacturing owing to growth in China

and emerging markets. Economic indicators, however, have yet to

regain the levels seen prior to the fi nancial crisis.

Fiscal 2009 Performance Results

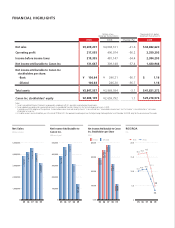

In 2009, Canon’s consolidated net sales declined 21.6% to

¥3,209.2 billion and the gross profi t ratio dipped 2.8 percentage

points to 44.5%. Operating profi t fell 56.2% to ¥217.1 billion

compared with the previous fi scal year. By segment,

*

in the Offi ce

Business Unit, sales declined 26.8% to ¥1,645.1 billion, and

operating profi t dropped 49.8% to ¥229.4 billion. Within the

Consumer Business Unit, sales decreased 10.6% to ¥1,301.2

billion and operating profi t declined 17.8% to ¥183.5 billion. In

the Industry and Others Business Unit, sales fell 31.5% to ¥358.0

billion and the operating loss deteriorated from ¥47.9 billion to

¥76.0 billion. By geographic area, sales in Europe fell 25.8% to

¥995.2 billion, as was also the case in the Americas, where sales

declined 22.6% to ¥894.2 billion. In Japan, sales slipped 19.1% to

¥702.3 billion, and elsewhere in Asia and Oceania sales decreased

15.4% to ¥617.5 billion.

Turning to operating expenses, Canon’s selling, general and

administrative expenses declined 15.2% year on year to ¥905.7

billion. The Company’s R&D expenses decreased 18.6% to ¥304.6

billion, accounting for 9.5% of net sales. Net income attributable

to Canon Inc. was down 57.4% to ¥131.6 billion, while net in-

come attributable to Canon Inc. stockholders per share came to

¥106.64, in both basic and diluted terms.

Unfavorable currency exchange rates added to the severity of

the business environment in 2009. Although the start of the year

saw the yen-dollar rate in the low nineties, and for a time it

seemed headed to top ¥100, it instead went in the other direction,

appreciating an annual average of ¥10 in 2009. The yen also appre-

ciated against the euro for the year by an average of over ¥21.

As for returning profi ts to stockholders, Canon emphasizes

the stable return of free cash fl ow to stockholders, and intends to

pay a full-year dividend per share of ¥110, the same amount paid

in the previous fi scal year.

*

Segment sales include intersegment sales.

Accomplishments amid Adversity

As we had set out to do, we improved our management quality to

ride out the storm under our own power. Specifi cally, reductions

in inventories and other actions taken enabled the Company to

expand cash fl ows, steer its way toward signifi cantly increased

stockholders’ equity, and maintain a sound fi nancial condition.

The Offi ce Business Unit positioned itself for action in antici-

pation of an economic turnaround in the near future. Specifi c

initiatives included the launch of a new offi ce equipment series,

the strengthening of our solutions business, and the reinforcement

of our direct-sales network in the United States. Also, in March

2010, Canon turned Océ N.V., a major Netherlands-based printing

company, into a consolidated subsidiary.

In the Consumer Business Unit, we were able to improve the

profi tability of our camera business. This upturn was attributable

to the launching of attractive new products in a timely manner

and the optimizing of inventory management.

Through the Industry and Others Business Unit, Canon

restructured its semiconductor equipment business. All these

strategic initiatives taken in individual business units empowered

Canon to further improve management quality throughout 2009,

a year of unprecedented economic turbulence.

Measures for a New Era of Growth

In the course of nurturing new growth in 2010, we will work to

further improve management soundness so as to be able to look

Achieving a Turnaround in the First Year of

Improved Management Quality

CanonAR_0325_再校戻し_ipc.indd 4 10.3.26 2:41:50 PM