BP 2015 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2015 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Corporate governance

Strategic imperatives represented the final third. These included relative

RRR, S&OR, and major project delivery, each weighted equally.

Preliminary assessment of BP’s relative RRR indicated a positive outcome

with an expected first place amongst the comparator group. The final

ranking will be determined once the actual results for 2015 have been

published by other comparator companies. For the purposes of this report,

and in accordance with the UK regulations, first place has been assumed.

Any adjustment to this will be reported in next year’s annual report on

remuneration. Based on a provisional first place assessment, 11.1% of the

overall shares for this measure are expected to vest.

S&OR has improved significantly over the 2013-15 period, with a

downward trend over the period in tier 1 process safety events (53%),

recordable injury frequency (30%), and loss of primary containment (28%).

The operating management system continued to mature and there has

been a continual rise in assessed conformance levels. Consequently

10.4% of overall shares will vest for the safety measures.

Fifteen major projects were delivered over the three years – well ahead of

plan and resulting in full vesting for this measure. As a result, 11.1% of

overall shares will vest.

As in past years, the committee also considered the true underlying

operational and financial performance of the group during the period and

whether any other factors should be taken into account. Following this

review, the committee assessed that a preliminary 77.6% vesting was a

fair reflection of the overall performance, pending confirmation of the

relative reserves replacement ratio result. This will result in the vesting

shown in the table below.

The vested shares for current executive directors are subject to a further

three-year retention period before they will be released to the individuals in

2019.

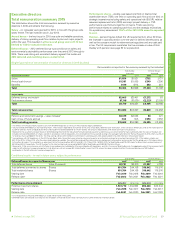

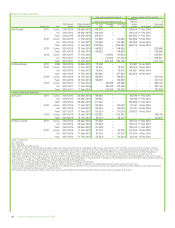

2013-2015 performance shares preliminary outcome

Shares

awarded

Shares vested

including dividends

Value of

vested shares

Bob Dudley 1,384,026 1,262,868 $7,116,261

Dr Brian Gilvary 637,413 597,628 £2,223,176

2012-2014 final outcomes confirmation

Last year it was reported that the committee had made a preliminary

assessment of second place for the relative RRR in the 2012-2014

performance shares element. In May 2015 the committee reviewed the

results for all comparator companies as published in their reports and

accounts and assessed that BP was in first place relative to other oil majors

and that the full 11.1% of shares would vest for this performance measure

as opposed to 7.8% for second place. This resulted in a final overall vesting

of 63.8% (versus 60.5% as preliminarily outlined in the 2014 report) for the

entire award. This change is reflected in the single figure table on page 77.

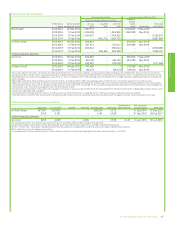

2016 implementation

Consistent with application of policy and our previous approach, shares are

expected to be awarded in March 2016 to the maximum value allowed

under the policy, five-and-a-half-times salary for Bob Dudley and four-times

salary for Dr Brian Gilvary. These will be awarded under the performance

share element of the EDIP and will be subject to a three-year performance

period. Those shares that vest are subject, after tax, to an additional

three-year retention period. The 2016-2018 performance share element

will be assessed over three years based on the following measures:

relative TSR (one third); cumulative operating cash flow (one third); and

strategic imperatives (one third) including relative RRR; S∨ and major

project delivery, all equally weighted.

These measures continue to be aligned with BP’s strategic priorities of

safe, reliable and compliant operations, competitive project execution,

disciplined financial choices and sources of future growth. The committee

agreed targets and scales for measures that will be used to assess

performance at the end of the three-year performance period and these

will be disclosed retrospectively, to the extent that they are no longer

commercially sensitive.

For S&OR the committee will study annual results based on outcomes

from the annual cash bonus for the period 2016 to 2018 and make a

determination of the three-year outcome. Similarly for operating cash flow

the committee, at the end of the period, will make a determination of the

three-year outcome by comparing the cumulative actual annual results

against the cumulative actual annual targets.

TSR and RRR will be assessed on a relative basis compared with the other

oil majors Chevron, ExxonMobil, Shell and Total with the following vesting

schedule.

Relative performance ranking

BP’s ranking place versus oil majors

Vesting percentage for each

relative performance measure

First 100%

Second 80%

Third 25%

Fourth or fifth Nil

BP Annual Report and Form 20-F 2015 81