BP 2015 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2015 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

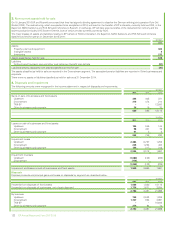

1. Significant accounting policies, judgements, estimates and assumptions – continued

Own equity instruments – Treasury shares

The group’s holdings in its own equity instruments are shown as deductions from shareholders’ equity at cost. Treasury shares represent BP shares

repurchased and available for specific and limited purposes. For accounting purposes, shares held in Employee Share Ownership Plans (ESOPs) to

meet the future requirements of the employee share-based payment plans are treated in the same manner as treasury shares and are, therefore,

included in the financial statements as treasury shares. Consideration, if any, received for the sale of such shares is also recognized in equity, withany

difference between the proceeds from sale and the original cost being taken to the profit and loss account reserve. No gain or loss is recognized in the

income statement on the purchase, sale, issue or cancellation of equity shares. Shares repurchased under the share buy-back programme which are

immediately cancelled are not shown as treasury shares, but are shown as a deduction from the profit and loss account reserve in the group statement

of changes in equity.

Revenue

Revenue arising from the sale of goods is recognized when the significant risks and rewards of ownership have passed to the buyer, which is typically

at the point that title passes, and the revenue can be reliably measured.

Revenue is measured at the fair value of the consideration received or receivable and represents amounts receivable for goods provided in the normal

course of business, net of discounts, customs duties and sales taxes.

Physical exchanges are reported net, as are sales and purchases made with a common counterparty, as part of an arrangement similar to a physical

exchange. Similarly, where the group acts as agent on behalf of a third party to procure or market energy commodities, any associated fee income is

recognized but no purchase or sale is recorded. Additionally, where forward sale and purchase contracts for oil, natural gas or power have been

determined to be for trading purposes, the associated sales and purchases are reported net within sales and other operating revenues whether or not

physical delivery has occurred.

Generally, revenues from the production of oil and natural gas properties in which the group has an interest with joint operation partners are recognized

on the basis of the group’s working interest in those properties (the entitlement method). Differences between the production sold and the group’s

share of production are not significant.

Finance costs

Finance costs directly attributable to the acquisition, construction or production of qualifying assets, which are assets that necessarily take a substantial

period of time to get ready for their intended use, are added to the cost of those assets until such time as the assets are substantially ready for their

intended use. All other finance costs are recognized in the income statement in the period in which they are incurred.

Impact of new International Financial Reporting Standards

There are no new or amended standards or interpretations adopted during the year that have a significant impact on the financial statements.

Not yet adopted

The following pronouncements from the IASB will become effective for future financial reporting periods and have not yet been adopted by the group.

IFRS 9 ‘Financial Instruments’ will supersede IAS 39 ‘Financial Instruments: Recognition and Measurement’ and is effective for annual periods

beginning on or after 1 January 2018. IFRS 9 covers classification and measurement of financial assets and financial liabilities, impairment methodology

and hedge accounting.

IFRS 15 ‘Revenue from Contracts with Customers’ provides a single model for accounting for revenue arising from contracts with customers and is

effective for annual periods beginning on or after 1 January 2018. IFRS 15 will supersede IAS 18 ‘Revenue’.

The IASB has issued IFRS 16 ‘Leases’ which provides a new model for lease accounting in which all leases, other than short-term and small-ticket-item

leases, will be accounted for by the recognition on the balance sheet of a right-to-use asset and a lease liability, and the subsequent amortization of the

right-to-use asset over the lease term. IFRS 16 will be effective for annual periods beginning on or after 1 January 2019 and is expected to have a

significant effect on the group’s financial statements, significantly increasing the group’s recognized assets and liabilities and potentially affecting the

presentation and timing of recognition of charges in the income statement. Information on the group’s leases currently classified as operating leases,

which are not recognized on the balance sheet, is provided in Note 27.

BP does not expect to adopt IFRS 9 or IFRS 15 before 1 January 2018 and has not yet determined its date of adoption for IFRS 16. The group has not

yet completed its evaluation of the effect of adoption of these standards. The EU has not yet adopted IFRS 9, IFRS 15 or IFRS 16.

There are no other standards and interpretations in issue but not yet adopted that the directors anticipate will have a material effect on the reported

income or net assets of the group.

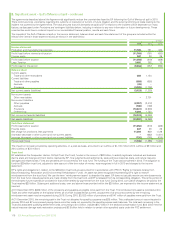

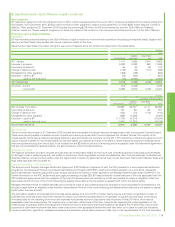

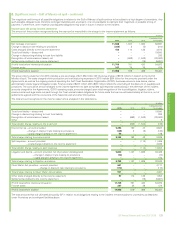

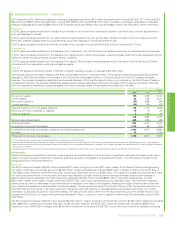

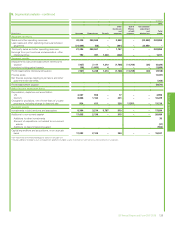

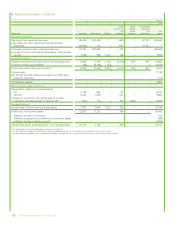

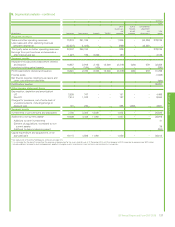

2. Significant event – Gulf of Mexico oil spill

As a consequence of the Gulf of Mexico oil spill in April 2010, BP continues to incur costs and has also recognized liabilities for certain future costs.

Liabilities of uncertain timing or amount, for which no provision has been made, have been disclosed as contingent liabilities.

The cumulative pre-tax income statement charge since the incident amounts to $55.5 billion. For more information on the types of expenditure

included in the cumulative income statement charge, see Impact upon the group income statement below. The cumulative income statement charge

does not include amounts for obligations that BP considers are not possible, at this time, to measure reliably. For further information, including

developments in relation to business economic loss claims under the Plaintiffs’ Steering Committee (PSC) settlement, see Provisions and contingent

liabilities below.

On 2 July 2015, agreements in principle to settle all federal and state claims and claims made by more than 400 local government entities were signed.

These agreements in principle were subject to execution of definitive agreements, including a Consent Decree with the United States and Gulf states

with respect to the Clean Water Act penalty and natural resource damages and other claims, a Settlement Agreement with five Gulf states with

respect to state claims for economic loss, property damage and other claims, and resolution to BP’s satisfaction of the economic loss, property

damage and other claims with more than 400 local government entities. The proposed Consent Decree between the United States, the Gulf states and

BP was available for public comment until early December 2015 and is subject to final court approval. The Consent Decree and Settlement Agreement

with the five Gulf states are conditional upon each other and neither will become effective unless there is final court approval of the Consent Decree.

The United States is expected to file a motion with the court to enter the Consent Decree as a final settlement around the end of March, which the

court will then consider. During 2015, the Settlement Agreement with the five Gulf states was executed. BP has accepted releases received from the

vast majority of local government entities and payments required under those releases were made during 2015. For more information on the proposed

Consent Decree and Settlement Agreement see Legal proceedings on page 238.

BP Annual Report and Form 20-F 2015 117

Financial statements