BP 2015 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2015 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Downstream

We continued to improve our personal and process

safety and delivered strong operations and

marketing performance, contributing to record

replacement cost profit before interest and tax.

• Fuels and lubricants marketing – we invest in higher-returning

businesses with reliable cash flows and growth potential.

• Portfolio quality – we maintain our focus on quality by high-grading of

assets combined with capital discipline.

• Simplification and efficiency – we are embedding a culture of

simplification and efficiency to support performance improvement

and make our businesses even more competitive.

Disciplined execution of our strategy is helping improve our underlying

performance and create a more resilient business that is better able to

withstand external environmental impacts. This is with the aim of

ensuring Downstream remains a reliable source of cash flow for BP.

Our performance summary

• For Downstream safety performance see page 45.

• We have delivered record replacement cost profit before interest and

tax and pre-tax returns this year, demonstrating that we are

creating a more resilient Downstream business.

• We delivered strong availability and operational performance across

our refining portfolio and year-on-year improvement in utilization.

• We commenced the European launch of our BP fuels with ACTIVE

technology in Spain, which are designed to remove dirt and protect

car engines.

• We announced the agreement to restructure our German refining

joint operation with Rosneft.

• We halted operations at Bulwer refinery in Australia.

• In Air BP we completed the integration of Statoil Fuel and Retail’s

aviation business which added more than 70 airports to our global

network.

• In our lubricants business we launched Castrol’s Nexcel, an

innovative automotive oil-change technology.

• We completed start-up of the Zhuhai 3 plant in China – the world’s

largest single train purified terephthalic acid (PTA) unit.

• Our simplification and efficiency programmes contributed to material

progress in lowering cash costs . These programmes include

right-sizing the Downstream organization, implementing site-by-site

improvement plans to deliver manufacturing efficiency in refining and

petrochemicals, and focusing on third-party costs.

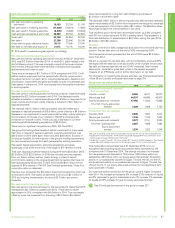

Downstream profitability ($ billion)

Underlying RC profit before interest and tax

RC profit before interest and tax

2011 2012 2013 2014 2015

8

6

4

2

5.5 6.0

2.9 2.9

4.4

7.1 7.5

3.6 3.7

6.5

See Financial performance on page 35 for the main factors influencing

downstream profit.

Outlook for 2016

• We anticipate a weaker refining environment.

• We expect the financial impact of refinery turnarounds to be higher

than 2015 as a result of increased turnaround activity.

Our business model and strategy

The Downstream segment has global manufacturing and marketing

operations. It is the product and service-led arm of BP, made up of

three businesses:

• Fuels – includes refineries, fuels marketing and convenience retail

businesses, together with global oil supply and trading activities that

make up our fuels value chains (FVCs). We sell refined petroleum

products including gasoline, diesel and aviation fuel.

• Lubricants – manufactures and markets lubricants and related

products and services globally, adding value through brand,

technology and relationships, such as collaboration with original

equipment manufacturing partners.

• Petrochemicals – manufactures, sells and distributes products, that

are produced mainly using proprietary BP technology, and are then

used by others to make essential consumer products such as paint,

plastic bottles and textiles. We also license our technologies to third

parties.

We aim to run safe and reliable operations across all our businesses,

supported by leading brands and technologies, to deliver high-quality

products and services that meet our customers’ needs.

Our strategy focuses on a quality portfolio that aims to lead the

industry, as measured by net income per barrel , with improving

returns and growing operating cash flow . Our five strategic priorities

are:

• Safe and reliable operations – this remains our first priority and

we continue to drive improvement in personal and process

safety performance.

• Advantaged manufacturing – we continue to build a top-quartile

refining business by having a competitively advantaged portfolio

underpinned by operational excellence that helps to reduce exposure

to margin volatility. In petrochemicals we seek to sustainably improve

earnings potential and make the business more resilient to a bottom

of cycle environment through portfolio repositioning, improved

operational performance and efficiency benefits.

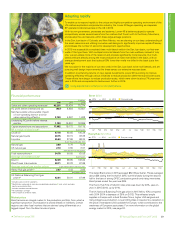

The Cherry Point refinery processes crude oil sourced from Alaska,

mid-continent US and Canada and has a capacity of 234,000 barrels per day.

BP Annual Report and Form 20-F 201534