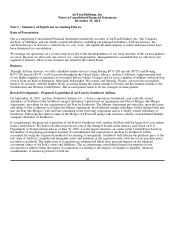

Airtran 2010 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2010 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

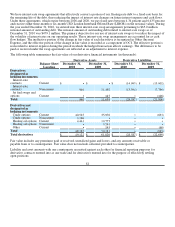

The table below summarizes, as of December 31, 2010, all scheduled aircraft fleet additions:

B737 Aircraft Purchases B717 Aircraft Leases Total Aircraft Additions

2011 1 2 3

2012 6 • 6

2013 6 • 6

2014 8 • 8

2015 12 • 12

2016 13 • 13

2017 5 • 5

Total 51 2 53

In addition to the above, we hold an option, exercisable in 2011, to purchase one B737 aircraft in the fourth quarter of

2012.

As of December 31, 2010, our aircraft purchase commitments for the next five years and thereafter, in aggregate, are (in

millions): 2011•$50; 2012•$270; 2013•$280; 2014•$370; 2015•$520; and thereafter•$710. These amounts include

payment commitments, including payment of pre-delivery deposits and buyer-furnished equipment, for aircraft on firm

order. Aircraft purchase commitments include the forecasted impact of contractual price escalations. Our intention is to

finance the aircraft on order through either debt financing, lease financing, or a mix thereof. We have debt financing

commitments from a lender to finance a significant portion of the purchase price of two B737 aircraft scheduled for

delivery to us in 2011 or 2012. AirTran has no existing arrangements for the financing of B737s other than as described in

the immediately preceding sentence. In addition, BCC has the right to require us to lease up to three additional used

B717s for lease terms of up to 10 years per aircraft. If BCC requires us to lease any such used B717 aircraft, we have the

right to cancel a like number of B737 aircraft from our B737 order book with Boeing.

There are multiple variables including capital market conditions, asset valuations, and our own operating performance that

could affect the availability of satisfactory financing for our future B737 aircraft deliveries. While there was limited

availability of satisfactory aircraft financing in early 2009, it is our view that the aircraft financing market has improved.

While we cannot provide assurance that sufficient financing will be available, we expect to be able to obtain acceptable

financing for future deliveries. Our view is based upon our discussions with prospective lenders and lessors, the

consummation of aircraft financing transactions by other airlines, our own operating performance, and our recent ability

to refinance B737 aircraft.

Our B737 contract with Boeing requires us to make pre-delivery deposits to Boeing. Although we typically have financed

a significant portion of our pre-delivery deposit requirements with debt from banks or other financial institutions, we

currently have no such financing in place for future deliveries. In recent years, we have rescheduled new aircraft

deliveries to moderate our rate of growth and accordingly, we have stretched out our aircraft purchase obligations through

2017. We currently believe that our cash resources will be sufficient to satisfy our pre-delivery deposit obligations. Should

our existing cash resources be insufficient, we may seek to: obtain additional debt financing or equity capital; further

revise our aircraft delivery schedule; and/or amend the terms of our aircraft purchase agreement, including those

provisions relating to pre-delivery deposits.

75