Airtran 2010 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2010 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Market Risk-Sensitive Instruments and Positions

We are subject to certain market risks, including changes in interest rates and commodity prices (i.e., aircraft fuel). The

adverse effects of changes in these markets pose a potential loss as discussed below. The sensitivity analyses do not

consider the effects that such adverse changes may have on overall economic activity, nor do they consider additional

actions we may take to mitigate our exposure to such changes. Actual results may differ. See the Notes to the

Consolidated Financial Statements for a description of our financial accounting policies and additional information.

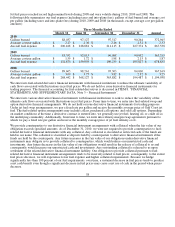

Interest Rates

We had approximately $623.8 million and $665.7 million of variable-rate debt as of December 31, 2010 and

December 31, 2009, respectively. We have mitigated our exposure on certain variable-rate debt by entering into interest-

rate swap agreements. During 2010, we entered into three interest-rate swap arrangements pertaining to $65.0 million

notional amount of outstanding debt. The notional amount of the outstanding debt related to interest-rate swaps at

December 31, 2010 and December 31, 2009 was $479.1 million and $447.0 million, respectively. These swaps expire

between 2016 and 2020. The interest-rate swaps effectively result in us paying a fixed rate of interest on a portion of our

floating-rate debt securities through the expiration of the swaps. As of December 31, 2010, the fair market value of our

interest-rate swaps was a liability of $27.6 million. If average interest rates increased by 100 basis points during 2011, as

compared to 2010, our projected 2011 interest expense would increase by approximately $1.4 million.

As of December 31, 2010 and 2009, the fair value of our debt was estimated to be $1.0 billion and $1.1 billion,

respectively, versus a carrying amount of $1.0 billion and $1.2 billion as of December 31, 2010 and 2009, respectively.

The fair value of our debt was estimated using quoted market prices where available. For long-term debt not actively

traded, the fair value was estimated using a discounted cash flow analysis based on our current borrowing rates for

instruments with similar terms. The fair values of our other financial instruments and borrowings under our revolving line

of credit facility approximate their respective carrying values. Given the current volatility in the credit markets, there is an

atypical element of uncertainty associated with valuing debt securities, including our debt securities. Market risk on our

fixed rate debt, estimated as the potential increase in fair value resulting from a hypothetical 100 basis point decrease in

interest rates, was approximately $10.1 million as of December 31, 2010.

Aviation Fuel

Our results of operations can be significantly impacted by changes in the price and availability of aircraft fuel. Aircraft

fuel expense for the years ended December 31, 2010, 2009, and 2008 represented 34.8 percent, 31.4 percent, and 45.5

percent of our operating expenses, respectively.

57