Airtran 2010 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2010 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Note 11 – Stock Option Awards and Restricted Stock Awards

Our 1994 Stock Option Plan and 1996 Stock Option Plan authorized up to 4 million and 5 million, incentive stock options

or non-qualified stock options, respectively, to be granted to our officers, directors, key employees, and consultants. No

new awards may be made under the 1994 Stock Option Plan or the 1996 Stock Option Plan. Our Fifth Amended and

Restated Long Term Incentive Plan (which we refer to as our Long-Term Incentive Plan or LTIP) was, as amended and

restated, adopted in 2009 and authorizes the grant of up to 13.5 million shares of our common stock, which may be

awarded in the form of options, restricted stock awards and other securities to our officers, directors, key employees, and

consultants. Awards for the issuance of up to 4,249,962 shares remain outstanding under such plans.

Vesting and the term of all options under the LTIP is determined by the Board of Directors and may vary by optionee;

however, the term may be no longer than ten years from the date of grant. As of December 31, 2010, an aggregate of 6.0

million shares of restricted stock, performance shares, and options to acquire common stock remained available for future

grant under the LTIP.

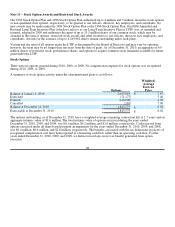

Stock Options

There were no options granted during 2010, 2009, or 2008. No compensation expense for stock options was recognized

during 2010, 2009, or 2008.

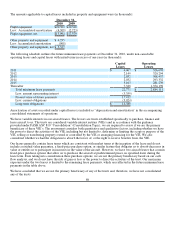

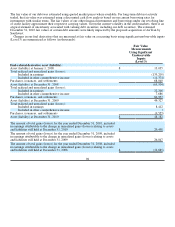

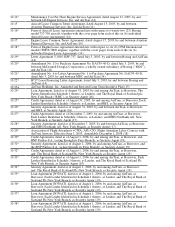

A summary of stock option activity under the aforementioned plans is as follows:

Options

Weighted-

Average

Exercise

Price

Balance at January 1, 2010 2,053,919 $ 7.67

Exercised (71,177) 5.46

Expired (148,000) 4.29

Cancelled (167) 7.00

Balance at December 31, 2010 1,843,575 $8.02

Exercisable at December 31, 2010 1,843,575 $8.02

The options outstanding, as of December 31, 2010, have a weighted-average remaining contractual life of 1.7 years and an

aggregate intrinsic value of $1.6 million. The total intrinsic value of options exercised during the years ended

December 31, 2010, 2009, and 2008, was $0.1 million, $0.2 million, and $1.0 million, respectively. Cash received from

options exercised under all share-based payment arrangements for the years ended December 31, 2010, 2009, and 2008,

was $0.4 million, $0.6 million, and $2.6 million, respectively. The benefits associated with the tax deductions in excess of

recognized compensation cost have been reported as a financing cash flow rather than an operating cash flow. For the

years ended December 31, 2010, 2009, and 2008, we did not record any excess tax benefit generated from option

exercises.

98