Airtran 2010 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2010 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The impact of an uncertain tax position taken or expected to be taken on an income tax return must be recognized in the

financial statements at the largest amount that is more-likely-than-not to be sustained upon audit by the relevant taxing

authority. An uncertain income tax position will not be recognized in the financial statements unless it is more likely than

not of being sustained. Interest associated with uncertain income tax positions is classified as interest expense and

penalties are classified as income tax expense. We have not recorded any material interest or penalties during any of the

years presented.

New Accounting Pronouncements

In October 2009, the Financial Accounting Standards Board (FASB) issued an Accounting Standards Update (ASU No.

2009-13) pertaining to multiple-deliverable revenue arrangements. The new guidance will affect accounting and reporting

for companies that enter into multiple-deliverable revenue arrangements with their customers when those arrangements

are within the scope of Accounting Standards Codification (ASC) 605-25 “Revenue Recognition - Multiple-Element

Arrangements”. The new guidance will eliminate the residual method of allocation and require that arrangement

consideration be allocated at the inception of the arrangement to all deliverables using the relative selling price method.

The new guidance will be effective prospectively for revenue arrangements entered into or materially modified in fiscal

years beginning on or after June 15, 2010. Because we will apply the guidance prospectively to agreements entered into

subsequent to January 1, 2011, it is not practical to estimate the impact of the new guidance on our consolidated

statements of financial position or results of operations.

In December 2009, the FASB issued ASU No. 2009-17, “Improvements to Financial Reporting by Enterprises Involved

with Variable Interest Entities”, which incorporates into the FASB Codification amendments to FASB Interpretation No.

46(R), “Consolidation of Variable Interest Entities”, made by Statement of Financial Accounting Standard No.

167, “Accounting for Variable Interest Entities”, to require that a comprehensive qualitative analysis be performed to

determine whether a holder of variable interests in a variable interest entity also has a controlling financial interest in that

entity. In addition, the amendments require that the same type of analysis be applied to entities that were previously

designated as qualified special-purpose entities. The amendments were effective as of January 1, 2010. The adoption of

ASU No. 2009-17 did not have a material impact on our consolidated financial position, results of operations, and cash

flows.

In January 2010, the FASB issued ASU 2010-06 “Improving Disclosures about Fair Value Measurements”. ASU 2010-06

requires additional disclosures about fair value measurements including transfers in and out of Levels 1 and 2 and more

disaggregation for the different types of financial instruments. This ASU became effective for annual and interim

reporting periods beginning after December 15, 2009 for most of the new disclosures and for periods beginning after

December 15, 2010 for the new Level 3 disclosures. Comparative disclosures are not required in the first year the

disclosures are required. We did not have any significant transfers in or out of Level 1 and Level 2 fair value

measurements during the years ended December 31, 2010 and 2009.

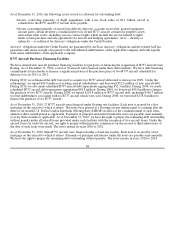

Note 2 – Commitments and Contingencies

Aircraft Related Commitments, Financing Arrangements and Transactions

We have contractual obligations to purchase 51 additional B737 aircraft from The Boeing Company (Boeing) between

2011 and 2017. In June and December 2010, we entered into amendments to our aircraft purchase agreements with

Boeing to defer delivery dates for 12 B737 aircraft originally scheduled for delivery between 2011 and 2014 to delivery

dates between 2015 and 2017. Simultaneously, Boeing Capital Corporation (BCC), a wholly-owned subsidiary of Boeing,

exercised a previously negotiated contractual right requiring us to lease two used B717 aircraft for a term of 10 years

commencing in 2011.

74