Airtran 2009 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2009 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90

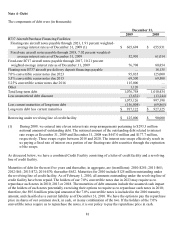

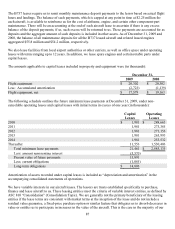

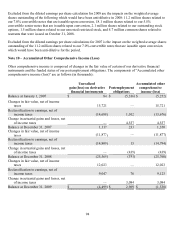

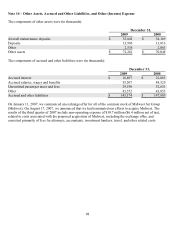

The reconciliation of our fuel derivatives that are measured at fair value on a recurring basis using significant

unobservable inputs (Level 3) for the period January 1, 2009 through December 31, 2009 is as follows (in

thousands):

Fair Value

Measurements

Using Significant

Unobservable

Inputs (Level 3)

Fuel-related derivative asset (liability):

Balance at January 1, 2009 $(65,504)

Total realized and unrealized gains (losses):

Included in earnings 22,208

Included in other comprehensive income 7,686

Purchases, issuances, and settlements 84,937

Balance at December 31, 2009 $ 49,327

The amount of total gains (losses) for the year ended December 31, 2009, included in

earnings attributable to the change in unrealized gains (losses) relating to assets and

liabilities still held at December 31, 2009 $ 26,047

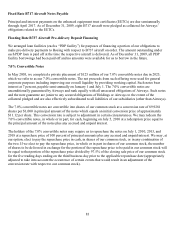

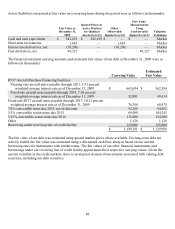

Note 7 – Common Stock

We have one class of common stock. Holders of shares of our common stock are entitled to one vote per share.

As of December 31, 2009, we had reserved 49,481,144 common shares for issuance for stock option exercises,

and conversion of convertible debt, and the vesting of restricted stock, of which 3,899,094 shares are reserved

for stock options that are vested and exercisable and restricted stock that have been granted but not vested, and

45,582,050 shares are reserved for issuance upon the conversion of convertible debt. Unvested restricted stock

awards are not included in the number of outstanding common shares.

In October 2009, we completed a public offering of 11.3 million shares of our common stock at a price of $5.08

per share, receiving net proceeds of approximately $54.8 million, after deducting discounts and commissions

paid to the underwriters and other expenses incurred with the offering.

In September 2009, we entered into an agreement whereby we issued 2.9 million shares of our common stock in

exchange for previously issued and outstanding warrants issued in connection with the Credit Facility, which

warrants were thereby cancelled.

In May 2008, we completed a public offering of 24.7 million shares of our common stock at a price of $3.20 per

share. We received net proceeds from the offering of approximately $74.7 million, after deducting discounts

and commissions paid to the underwriters and other expenses incurred with the offering.

Historically, we have not declared cash dividends on our common stock. In addition, our debt indentures and

our Credit Facility restrict our ability to pay cash dividends. In particular, under our Credit Facility, our ability

to pay dividends is restricted to a defined amount available for restricted payments, including dividends, which

amount is determined based on a variety of factors including 50% of our consolidated net income for the

applicable reference period and our proceeds from the sale of capital stock, including pursuant to the conversion

of indebtedness to our capital stock, all as defined. We intend to retain earnings to finance the development and