Airtran 2009 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2009 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132

|

|

98

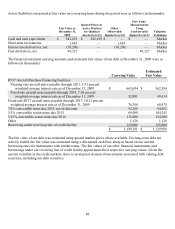

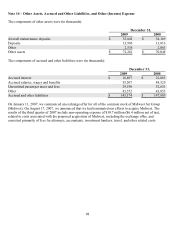

Note 14 – Other Assets, Accrued and Other Liabilities, and Other (Income) Expense

The components of other assets were (in thousands):

December 31,

2009 2008

Aircraft maintenance deposits $ 55,841 $ 54,169

Deposits 13,906 13,816

Other 2,534 2,063

Other assets $ 72,281 $ 70,048

The components of accrued and other liabilities were (in thousands):

December 31,

2009 2008

Accrued interest $ 16,897 $ 22,865

Accrued salaries, wages and benefits 55,507 48,520

Unremitted passenger taxes and fees 29,198 32,651

Other 43,572 43,853

Accrued and other liabilities $ 145,174 $ 147,889

On January 11, 2007, we commenced an exchange offer for all of the common stock of Midwest Air Group

(Midwest). On August 17, 2007, we announced that we had terminated our efforts to acquire Midwest. The

results of the third quarter of 2007 include non-operating expense of $10.7 million ($6.4 million net of tax),

related to costs associated with the proposed acquisition of Midwest, including the exchange offer, and

consisted primarily of fees for attorneys, accountants, investment bankers, travel, and other related costs.