Airtran 2009 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2009 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.43

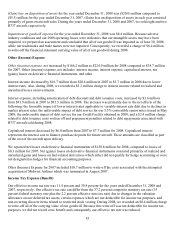

(Gain) loss on disposition of assets for the year ended December 31, 2008 was ($20.0) million compared to

($5.3) million for the year ended December 31, 2007. (Gain) loss on disposition of assets in each year consisted

primarily of gains on aircraft sales. During the years ended December 31, 2008 and 2007, we sold eight and two

B737 aircraft, respectively.

Impairment of goodwill expense for the year ended December 31, 2008 was $8.4 million. Because adverse

industry conditions and our 2008 operating losses were indicators that our intangible assets may have been

impaired, we prepared an assessment and concluded that all of our goodwill was impaired as of June 30, 2008,

while our trademarks and trade names were not impaired. Consequently, we recorded a charge of $8.4 million

to write-off the financial statement carrying value of all of our goodwill during 2008.

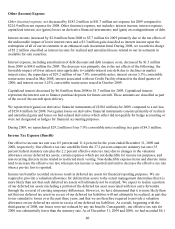

Other (Income) Expense

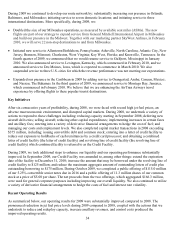

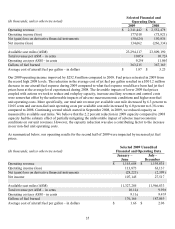

Other (income) expense, net increased by $166.2 million to $224.9 million for 2008 compared to $58.7 million

for 2007. Other (income) expense, net includes: interest income, interest expense, capitalized interest, net

(gains) losses on derivative financial instruments, and other.

Interest income decreased by $16.7 million from $20.4 million in 2007 to $3.7 million in 2008 due to lower

interest rates. Also, during 2008, we recorded a $5.2 million charge to interest income related to realized and

unrealized losses on investments.

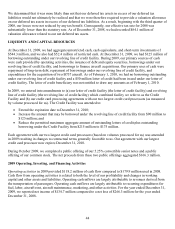

Interest expense, including amortization of debt discount and debt issuance costs, increased by $3.6 million

from $81.9 million in 2007 to $85.5 million in 2008. The increase was primarily due to the net effects of the

following: the favorable impact of lower interest rates applicable to variable-interest rate debt due to declines in

market interest rates; the unfavorable impact of debt service for our 5.5% convertible senior notes issued in May

2008; the unfavorable impact of debt service for our Credit Facility obtained in 2008; and a $2.4 million charge

related to debt issuance costs written off and prepayment penalties related to debt repayments associated with

B737 aircraft sold during 2008.

Capitalized interest decreased by $6.0 million from 2007 to $7.7 million for 2008. Capitalized interest

represents the interest cost to finance purchase deposits for future aircraft. These amounts are classified as part

of the cost of the aircraft upon delivery.

We reported net losses on derivative financial instruments of $150.8 million for 2008, compared to losses of

$0.3 million for 2007. Net (gains) losses on derivative financial instruments consisted primarily of realized and

unrealized gains and losses on fuel-related derivatives which either did not qualify for hedge accounting or were

not designated as hedges for financial accounting purposes.

Other (Income) Expense for 2007 included $10.7 million to write-off the costs associated with the attempted

acquisition of Midwest Airlines which was terminated in August 2007.

Income Tax Expense (Benefit)

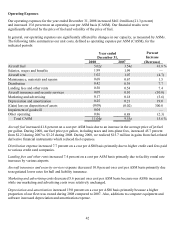

Our effective income tax rate was 11.4 percent and 39.8 percent for the years ended December 31, 2008 and

2007, respectively. Our effective tax rate can differ from the 37.2 percent composite statutory tax rate (35

percent federal statutory rate plus the 2.2 percent effective state tax rate) due to changes in the valuation

allowance on our deferred tax assets, certain expenses which are not deductible for income tax purposes, and

non-recurring discrete items related to restricted stock vesting. During 2008, we recorded an $8.4 million charge

to write-off all of the carrying value of our goodwill. Because this write-off was not deductible for income tax

purposes, we did not record a tax benefit and consequently our effective tax rate was reduced.